Bitcoin Price Slumps Post Release Of U.S. Jobs Data, Is $35k Next?

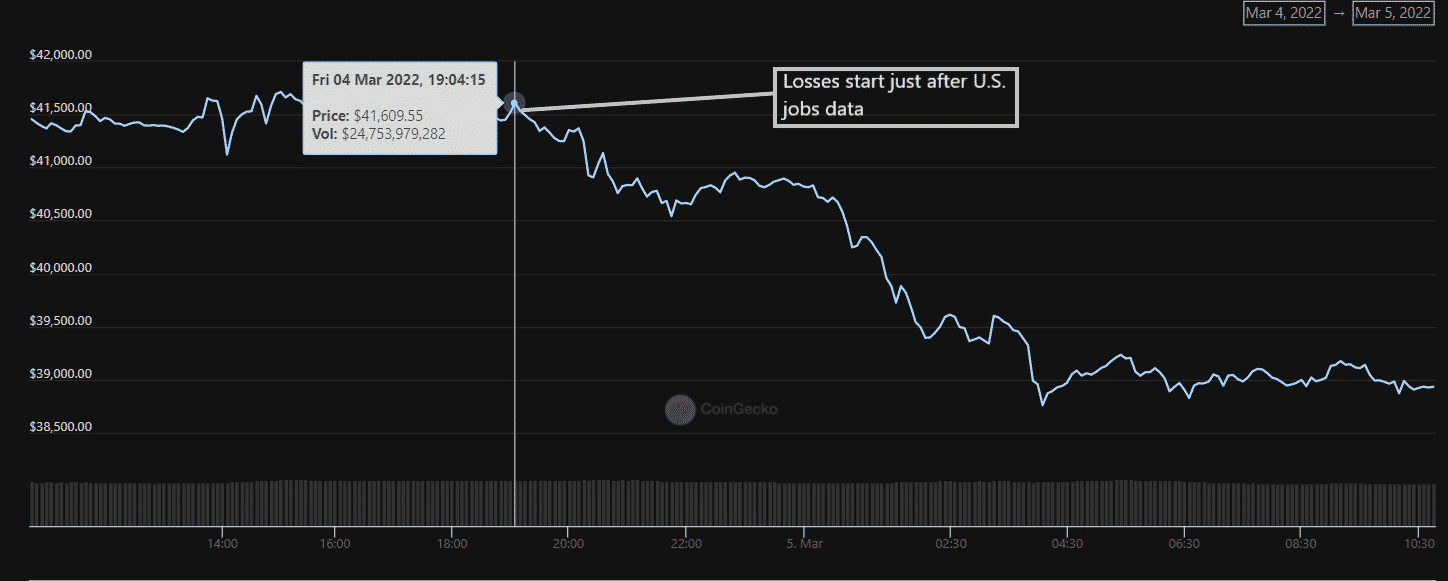

Bitcoin price dropped 8% to $38,000, erasing much of its recent rally. The latest sell-off was triggered by data showing strength in the U.S. jobs market, which furthers the case for a Federal Reserve rate hike this month.

Fed hikes paint bearish picture for Bitcoin

Although Bitcoin was already on a mild downtrend over the past few days, the currency accelerated its losses right after strong U.S. jobs data. Employment grew at its highest pace in seven months in February, Yahoo Finance reports. The reading further ties into recent comments from Fed Chair Jerome Powell that the job market was heating up, and that the Fed will likely hike rates by at least 25 basis points in March.

An interest rate hike will reduce liquidity in the market, curbing the amount of cash that can be invested in Bitcoin.

Inflation and employment are the two main factors considered by the Fed in adjusting rates. With U.S. consumer prices at a 40-year high, a hike seems likely when the Fed meets on March 15th and 16th. Hawkish comments from Powell also dismissed recent speculation that the Russia-Ukraine conflict would make the Fed pause its plans for hiking.

Broader financial markets wilted after the data, as the prospect of Fed hikes added to uncertainty caused by the Russia-Ukraine conflict. Concerns over Russia capturing Europe’s largest nuclear reactor in Ukraine had also rattled sentiment.

Despite decoupling from the stock market for nearly a week, Bitcoin sank in line with U.S. equities on Friday. The Bitcoin fear and greed index sank back into extreme fear after nearly a week in neutral.

Is $35k next for Bitcoin price?

Traders were now looking at $35,000 as the next support level. A breach would put Bitcoin exactly where it was about two weeks ago, when heightened fears of the Russia-Ukraine conflict had spurred a risk-off sentiment. While the token had since then rallied off a one-month low, going as far as $44,000, a pullback in trading by major whale accounts had stalled gains.

$44,000 was also the last ceiling faced by Bitcoin in February. The currency is trading down 18% this year.

We’re now back in the $35,000 – $39,000 territory and not a lot of major good news to kick start a rally. So we might be going back to $35,000 support line.

-crypto investor @StevenAitchison says.

- Crypto Regulation: Hyperliquid Launches Policy Group to Push DeFi Integration in U.S. Markets

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks