Bitcoin Whale Alert: $3.5 Billion Accumulated, Price Climbs Back Above $27,000

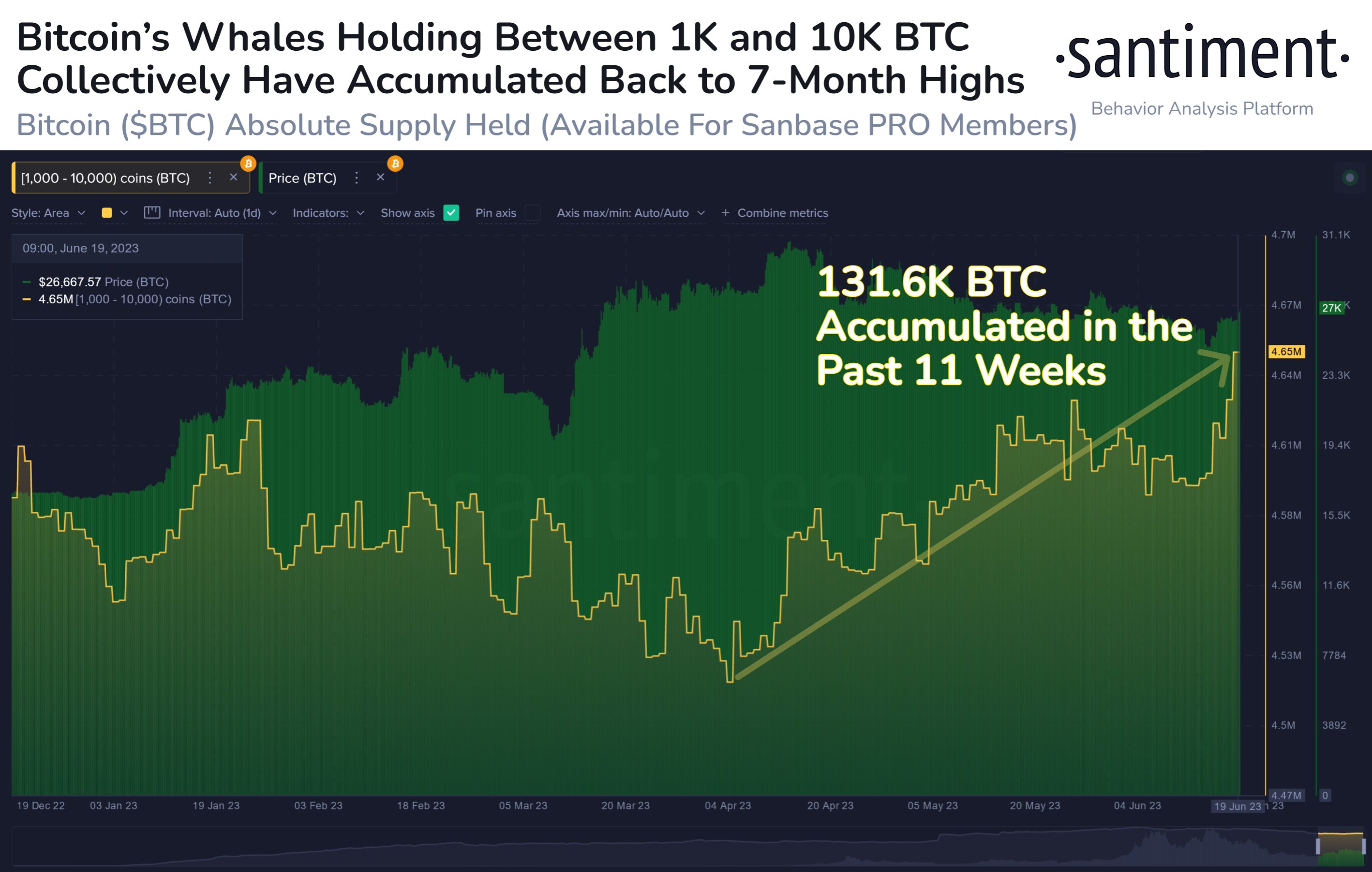

Bitcoin’s market has been witnessing the activity of large holders who have been actively accumulating more Bitcoin over the past two months. While the BTC’s price appeared to dwindle in recent times, wallets holding substantial amounts of Bitcoin, known a Bitcoin whales, have amassed a combined total of $3.5 billion since early April.

Bitcoin Whale Accumulation Amidst Price Volatility

According to Santiment, a market intelligence platform, Bitcoin whales have been actively accumulating more Bitcoin amidst the price decline witnessed in recent months. Wallets holding between 1,000 and 10,000 BTC have collectively acquired a staggering $3.5 billion worth of the cryptocurrency since the first week of April.

Whale accumulation typically indicates a positive outlook, as these investors tend to have a long-term perspective and may anticipate future price appreciation.

Santiment also shared its latest insight highlighting the rise in BTC whale transactions and the contrasting responses to Blackrock and SEC lawsuits.

Bitcoin Price Action

American multinational investment giant BlackRock filing for a spot Bitcoin Exchange Traded Fund (ETF) application with the United States Securities and Exchange Commission (SEC) raised the bullish momentum for Bitcoin.

As of today, Bitcoin is trading at $26,869.12, showcasing relatively stable consolidation above the $27,000 level. The cryptocurrency’s 24-hour low of $26,338.54 and high of $27,147.47 highlight a narrow trading range.

CoinGape covered how Bitcoin price has recovered mid-June after crashing down following lawsuits and regulatory uncertainity. Looking back over the past few months, the cryptocurrency reached a recent high of $30,404 on April 14, 2023, but also experienced a significant dip to $20,187 on March 11.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs