BitMEX Open Interest On Bitcoin Futures Reaches All-Time Lows, Is A Long Squeeze On The Horizon?

- Bitcoin open interest (OI) hits all-time low signaling a prevalence in a spot induced bull market.

- Is a long squeeze on the horizon for BTC?

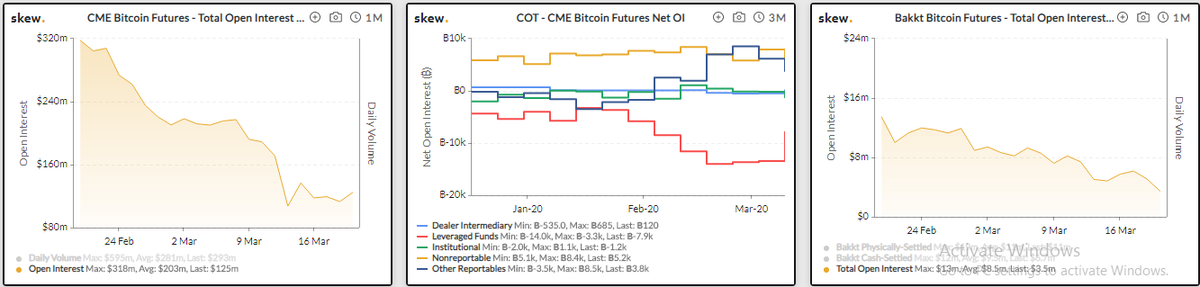

Bitcoin (BTC) is finally on an uptrend after a fortnight of terror, trading above the $6,200 USD mark for the past 24 hours. According to data collected from Skew Markets, the current bullish run may be on the verge of experiencing a long squeeze as the markets experience one of the lowest open interest volumes ever.

Bitcoin soars over 45% from yearly lows

BTC/USD witnessed one of its best days yet since the massive selloff on Mar. 12 which saw the price of the top crypto tank to the $3,600 USD level. Currently trading at an average of $6,610 USD across top exchanges, this represents over 69% growth since hitting a year low last week and an impressive 49% so far during the week.

BTC set an intraday high of $6,972 USD on Coinbase taunting a possible breach to the $7,000 key resistance level. However, it seems the current bullish momentum is heavily fueled by the spot market as open interest on BitMEX, CME and Bakkt derivatives hit a record low.

Bitmex OI at All time low of 58k.

We're seeing a spot driven rally on $BTC pic.twitter.com/YJDHYIxnve

— Mohit Sorout ? (@singhsoro) March 20, 2020

This may seem a positive move for BTC in the short term, as HODLers stock up on the coin for the cheap but is the momentum really stable?

Does a long squeeze ensue?

BitMEX set a historic low in its open interest on Bitcoin as the number dipped to 85,000 BTC contracts, approx. $385 million USD. CME options and Bakkt options were facing a similar case as the market signals a move from the derivative markets to spot BTC markets. CME recorded a low of $125 million on its BTC Futures with Bakkt options hitting a low of $3.5 million.

Could this signal an upcoming long squeeze as the bears await to open the shorts on the derivative markets? Well, on the daily charts, BTC indicators signal a possible continuation of the bullish momentum as the relative strength index (RSI) oscillates in a bullish trajectory.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs