Bitwise Files S-1 for Avalanche ETF With SEC Following Delaware Registration

Highlights

- Bitwise files S-1 with SEC for Avalanche ETF after Delaware registration.

- VanEck and Grayscale Avalanche ETF proposals filed before now show rising institutional demand.

- Coinbase Custody secures Avalanche assets while ETFs provide direct AVAX exposure.

Bitwise has followed VanEck and Grayscale in submitting an Avalanche (AVAX) ETF filing to the U.S. SEC. This push highlights increased institutional regulation of AVAX exposure.

Bitwise Avalanche ETF Seeks Direct Exposure with Coinbase Custody

The SEC filing follows the trust’s registration in Delaware, where it was organized as a statutory trust. The proposed Bitwise Avalanche ETF will provide direct exposure to Avalanche by holding the token in custody.

Shares are expected to list on a U.S. exchange under a ticker symbol that will be disclosed later. Net asset value will track the CME CF Avalanche–Dollar Reference Rate, published daily by CF Benchmarks.

Coinbase Custody Trust Company will act as custodian for Avalanche assets held by the trust. Coinbase Custody, regulated under New York banking law, will safeguard tokens in segregated accounts with cold storage protection.

Instead of derivatives, the ETF will hold Avalanche directly. The shares will be issued and redeemed in blocks of 10,000 shares also known as baskets. These will be settled either in cash, or in Avalanche. The key benefit of this structure is that investors can access the exposure without any management of wallets and private keys.

It supports proof-of-stake consensus, scalable smart contracts, governance, staking and subnet creation. A recent AVAX price forecast indicates that the token could rally by almost 99% from current price levels to trade at $55.

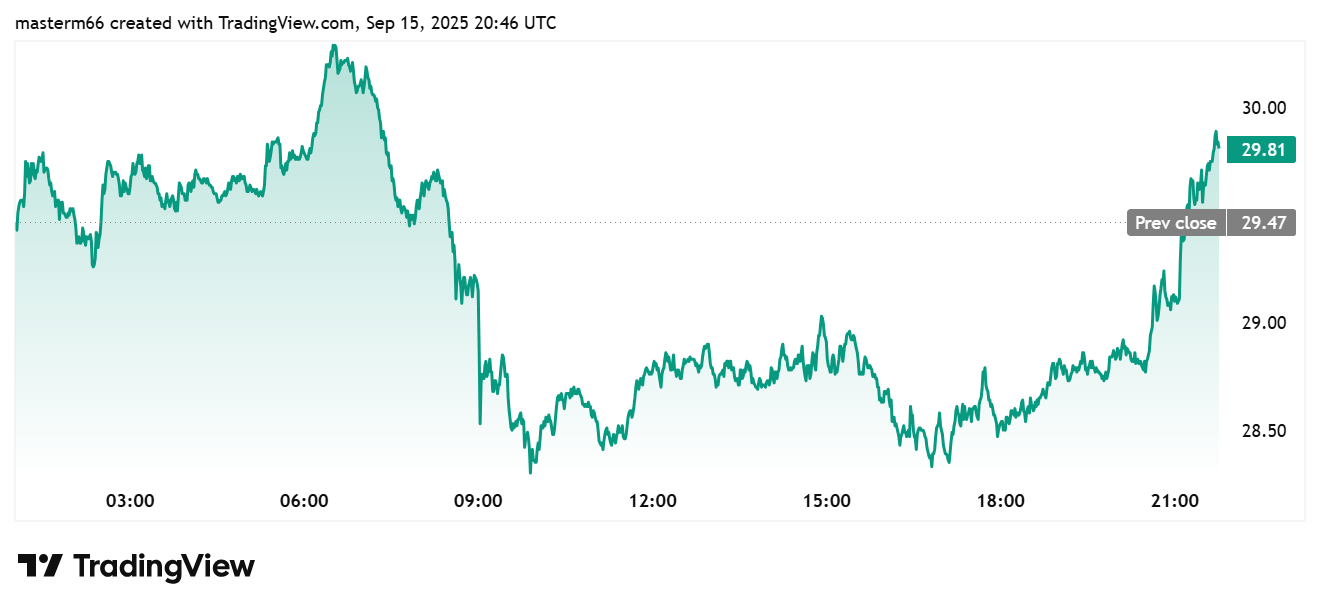

TradingView data shows that AVAX price is $29.83, up 1.29% over 24 hours. It remains 57.44% below its all-time high, underscoring the risks and volatility that ETFs would pass on to investors.

VanEck and Grayscale Pursue Separate Spot Avalanche ETF Approvals

Bitwise is not the only asset manager pursuing an Avalanche ETF. VanEck filed an S-1 for its own spot AVAX ETF in March 2025. Nasdaq submitted a proposed rule change in April 2025 to allow its listing. No final approval or decision has yet been announced.

The filing is still active and show growing institutional demand for AVAX exposure through regulated vehicles. Recent Avalanche treasury accumulation also highlights how market dynamics are reinforcing this demand, signaling broader confidence in the token.

Grayscale also filed on August 22, 2025, to convert its Avalanche Trust into a spot AVAX ETF. The application proposes trading on Nasdaq, with Coinbase Custody as custodian and BNY Mellon as administrator.

The SEC initially extended its review to July 15, 2025, though no decision was published by that deadline. The applications also represent a further push to expand crypto funds beyond Bitcoin and Ethereum, the two leading cryptocurrencies.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs