BlackRock Bitcoin ETF Ranks Among Top ETFs In 2025 Despite Crypto Downturn

Highlights

- The BlackRock Bitcoin ETF has attracted huge inflows despite its negative price so far this year.

- This shows that investors are embracing long-term Bitcoin position and ignoring the short-term fluctuation in its price.

- New large investors are changing the cost basis of Bitcoin with fresh capital.

The BlackRock Bitcoin ETF (IBIT) has emerged as one of the top exchange-traded funds (ETF) of 2025 despite negative price returns. IBIT attracted more than $25 billion in net inflows this year even as Bitcoin struggled.

Why IBIT is Attracting Inflows Despite Losses

The fund ranked sixth on the annual ETF flow leaderboard, according to data highlighted by Bloomberg ETF analyst, Eric Balchunas. However, it was the only ETF in the top rankings that posted a negative return for the year.

The contrast between flows and price suggests that the way investors view Bitcoin is changing. According to Balchunas, most investors are paying excessive attention to short-term performance.

He believes that continuous inflows should be the real focus. This explains recent accumulations like the one implemented by Michael Saylor’s Strategy, which purchased additional Bitcoin this week.

Despite gold registering returns of more than 60% in the year, the Bitcoin ETF still raised more capital compared to gold-backed funds such as GLD. The change in investor behavior is indicated by this contrast.

Have Bitcoin ETFs become Long-term Holdings?

Bitcoin exposure is no longer considered a momentum trade. This movement can be noticed even as some conventional firms are becoming cautions. For instance, Vanguard referred to Bitcoin as a toy even though it has authorized the trading of ETF on its platform.

Still, many investors appear willing to hold through volatility. BlackRock’s role also matters. Its brand and distribution power lower barriers for traditional investors entering crypto markets. Furthermore, the flows suggest Bitcoin ETFs are entering a new phase.

Demand now appears less sensitive to short-term price swings. Sustained ETF inflows provide structural support independent of daily market sentiment. Balchunas summed it up simply. If IBIT can draw $25 billion in a bad year, good years could be far stronger.

Why Are New Whales Buying Bitcoin Now?

This ETF resilience aligns with deeper structural changes inside the Bitcoin market itself.

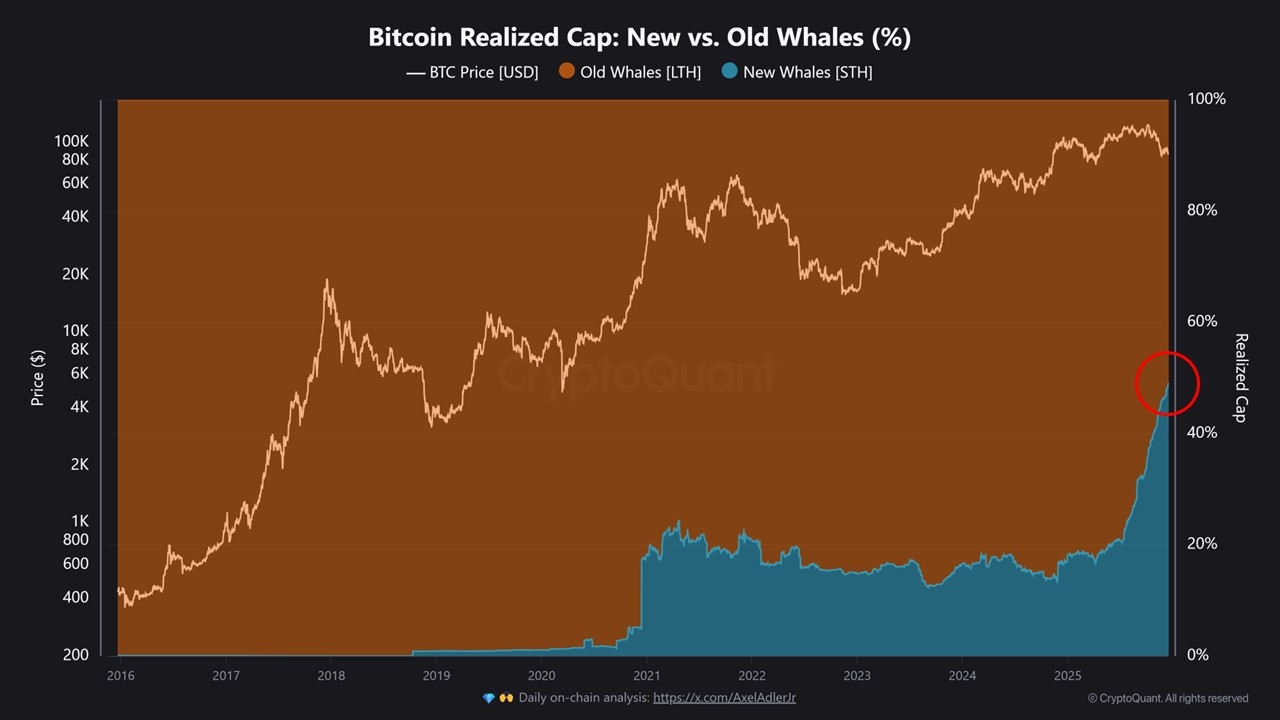

Onchain data shows that new large investors are now shaping Bitcoin’s cost base. According to CryptoQuant data, “new whales” now account for nearly 50% of Bitcoin’s realized capital.

This is a drastic change from previous cycles when long term holders took control of capital deployment. Realized capital chart follows money entering into the system, not only the coin owners.

The data shows that new capital is being added to Bitcoin at a higher price even when there are pullbacks. In the last period when BTC price dropped, the portion of realized funds among new whales only grew.

This suggests a re-anchoring phase and not a panic selling. Investors are now focusing longer time frames and are not pursuing short-term rallies.

- Robert Kiyosaki Reveals Why He Bought Bitcoin at $67K?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?