BTC Price Prediction: $25k Support Can Save Bulls, But There’s A Catch

Bitcoin is on the verge of triggering another downfall after wobbling during the mid-week climb to $26,800. The largest crypto market cap, turned green this week, although briefly following extremely oversold conditions in the previous week. As expected, BTC price positively impacted major altcoins like Ethereum, which climbed to $1,700 before rolling back to $1,650 on Friday.

BTC Price At A Crossroads – Going To $30k or $20k?

Although hovering at $26,000 at the time of writing, BTC price is in a precarious position where short traders believe it is poised for another dip to $23,500 for the conservative ones and $20,000 for those stubbornly bearish.

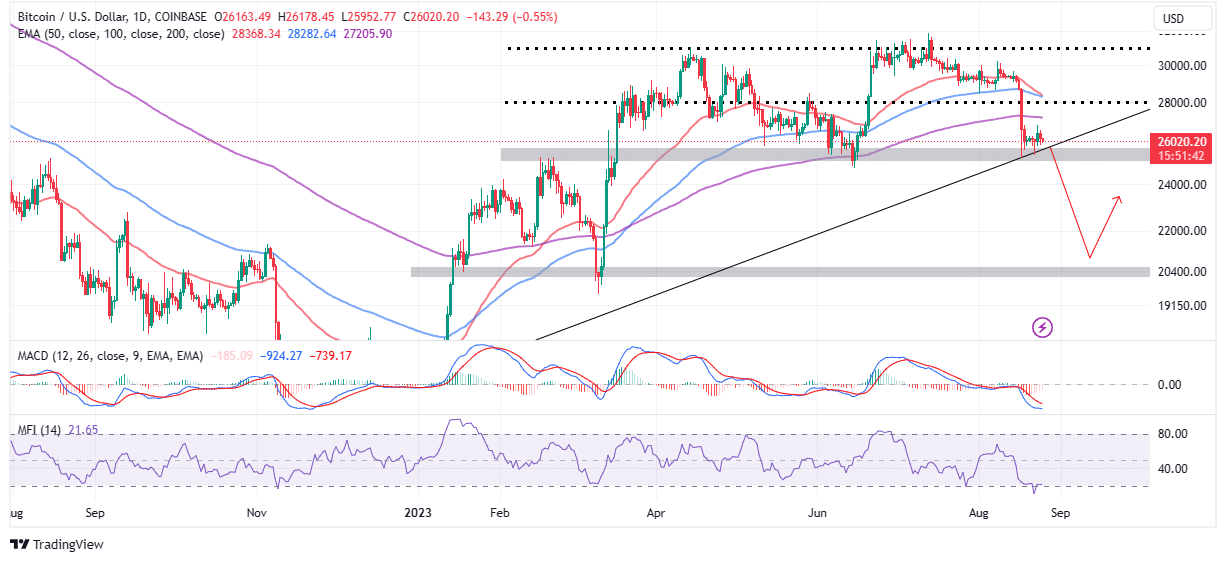

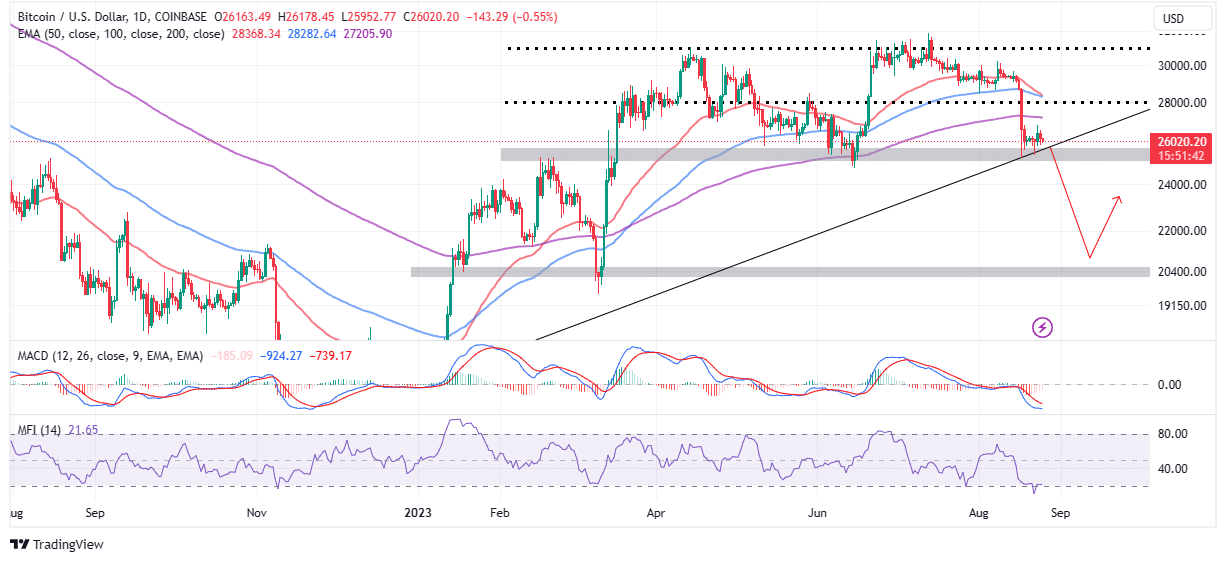

The technical outlook on the daily chart affirms the bearish stance, starting with the Moving Average Convergence Divergence (MACD) indicator’s sell signal. As long as this momentum indicator holds the downtrend in place below the mean line (0.00) the path with the least resistance will remain downward.

An opposite outcome would be considered as the blue MACD line flips above the red signal line. Such a move would encourage more buyers to seek exposure to BTC following the drop to $25,000, in turn, contributing to the momentum for gains targeting $30,000.

The Money Flow Index (MFI) reveals that sellers have the upper hand. This indicator measures the amount of money flowing into and out of Bitcoin markets. Since the outflow volume significantly overwhelms the inflow volume, declines are likely to carry on.

Despite this worrisome technical situation, a rebound can be anticipated at $25,000 – a support reinforced by a multi-month ascending trendline, dating back to January. Crypto analyst @CryptoFaibik shares the same sentiment based on his post on X that “$25k needs to hold to save the bulls.”

$BTC #Bitcoin 25k need to Hold to save the Bulls. pic.twitter.com/DOFhmsLqNn

— Captain Faibik (@CryptoFaibik) August 25, 2023

BTC Price Rebound Awaits This Condition

The Bitcoin Dominance has according to @CryptoFaibik fallen to a level that is hindering the resumption of the uptrend. Currently at 49.25%, the BTC dominance is down almost 5.5% from 52.1% at the beginning of July.

A drop in Bitcoin dominance implies that investors are focusing on the altcoins more and less on BTC. A spike in the metric would mean that the largest crypto has the momentum and liquidity to climb higher.

$BTC could Bounce Back if its Dominance Rebounds.#Crypto #Bitcoin #BTC pic.twitter.com/Q9nlJa2XfI

— Captain Faibik (@CryptoFaibik) August 25, 2023

Bitcoin Supply On Exchanges Dips to Pre-2017 Levels

Bitcoin’s supply on exchanges has continued to fall despite the crypto winter. Investors prefer to hold their cryptos away from exchanges when they do not intend to sell in the short term. Low supply on exchanges is seen as a positive factor characterized by reduced potential selling pressure and a possible breakout.

👋 Just 5.8% of #Bitcoin is currently sitting on exchanges, which is officially the lowest level #crypto's top market cap asset has seen since December 17, 2017. We are also continuing to see reasonable amounts of $BTC whale transactions (57.4K per week). https://t.co/c0vfjFEvvG pic.twitter.com/nNnz2JDJyb

— Santiment (@santimentfeed) August 24, 2023

Another factor investors can tap to comfortably keep their positions in BTC intact is the discussion among traders “referring to the current market conditions as a bear market.”

According to Santiment, “when traders show FUD, the probability of price rises increases considerably.” Therefore, no matter where BTC breaks down to, a bull market is imminent, especially with the halving approaching in about eight months.

Related Articles

- PEPE Coin Developers Selling Huge? PEPE Price Tanks by 20%

- XRP Price Prediction: Profitable Traders Are Considering This Key Level

- Breaking: FTX Claims Agent Kroll’s Cybersecurity Breach Compromised Claimants Data

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?