Can US FOMC Hinder Bitcoin Price Rally To $100K?

Highlights

- The crypto market anticipates a short-term volatility after US FOMC, despite speculations over 25 bps rate cut rises.

- Fed Chair Jerome Powell's speech is likely to impact the ongoing Bitcoin price rally.

- Despite short-term concerns, the market experts anticipates a robust rally for BTC in the coming days.

The crypto market now eagerly awaits the US FOMC and Fed Chair Jerome Powell’s speech as optimism soars after Donald Trump’s presidential win. The investors are betting towards a 25 bps Fed rate cut later today, with many anticipating these developments to send Bitcoin price to $100K soon. However, despite that, some have issued warnings over the event’s potential to spark volatile trading in the market.

So, here we explore the potential factors that could impact the BTC rally in the coming days.

Will US FOMC Trigger Volatility In The Crypto Market?

The market participants are bracing for the upcoming US FOMC which is expected to shed light on the current economic health of the US. Besides, the rate-cut decision is also likely to impact the market sentiment, with many expecting a 0.25% point decrease by the US central bank. According to the CME FedWatch Tool, there is a 99% chance of a 25 bps point cut by the central bank, with another similar announcement expected in December.

However, despite this positive expectation, some are staying on the sideline seeking further clarity on the market trends. For context, many crypto market experts anticipate potential volatility after the Fed Chair Jerome Powell’s speech.

For context, in a recent post, crypto market expert and Bitcoin Maxi AlphaBTC remained cautiously optimistic, while expecting a quarter-point cut by the Fed. He noted that Jerome Powell’s note will play a key role in shaping the market sentiment ahead. A hawkish tone could signal recession fears, while a dovish stance might help the “TrumpRally” to continue.

Besides, Powell’s view on the newly elected US President Donald Trump will be also watched closely, especially as Trump has criticized the central bank several times before. On the other hand, Elon Musk’s D.O.G.E. initiative is likely to target the US Fed in the coming days, sparking market optimism. It has also fueled discussions over a robust Dogecoin price rally in the coming days.

Bitcoin Price Rally To $100K Imminent?

Although the market anticipates short-term volatility following the US FOMC and Fed Chair Jerome Powell’s speech, many crypto experts are optimistic about a swift rebound ahead. A flurry of analysts have shared a bullish outlook on BTC price, anticipating a clear crypto regulation under Trump’s presidency.

As of writing, Bitcoin price was up 1.5% to $ 74,828, after touching a ATH of $76,460.15 in the last 24 hours. Besides, BTC Futures Open Interest rose nearly 4% since yesterday, hinting at a bullish sentiment hovering in the market.

In addition, the anticipation over Bitcoin Strategic Reserve in the US has sparked market optimism. With Wyoming Senator Cynthia Lummis recently reiterating her stance on making BTC a strategic reserve, which Trump also committed earlier during his presidential campaign, the expectations are high over a potential rally.

Meanwhile, a recent report from Matrixport also hints towards a potential BTC rally to $100K. The report suggested that with the potential exit of the US SEC Gary Gensler and Bitcoin US Strategic Reserve, the crypto is poised to hit $100K soon.

Can BTC Face Selling Pressure Ahead?

The US FOMC is likely to spark some volatility in the market, which may weigh on the ongoing Bitcoin price rally. Besides, recent developments indicate that many investors are shifting their focus from the flagship crypto to altcoins like Ethereum, sparking concerns in the market. This growing interest in the top altcoins appears to have weighed on some traders’ sentiments.

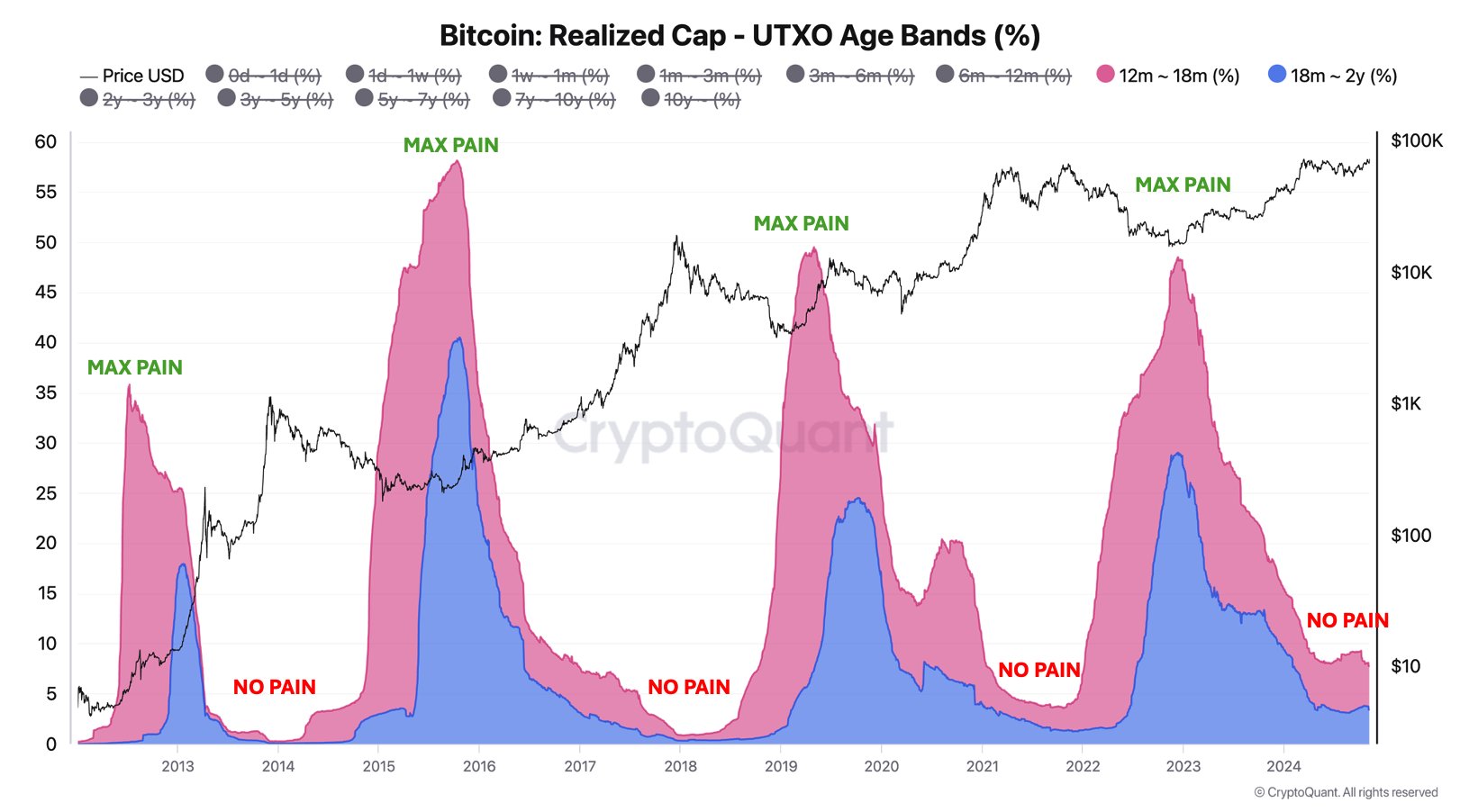

In addition, in a recent X post, CryptoQuant Founder and CEO Ki Young Ju also suggested a potential BTC selling in the coming days. He noted that new investors might take the ongoing rally as a profit-booking opportunity, which might hinder a robust rally in the crypto’s price. Ki Young Ju stated:

New investors often hold $BTC through bear markets, enduring losses.

After about two years, it changes hands when pain eases. That time is now.

It could go up +30-40% from here, but not like the +368% we saw from $16K. Time to consider gradual selling, not all-in buying, imo.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs