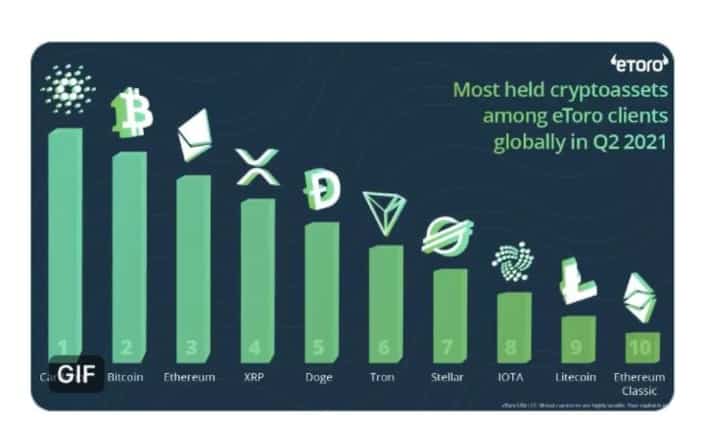

Cardano (ADA) beats Bitcoin (BTC) & Ethereum (ETH); becomes most HOLD’d crypto

The rapidly rising altcoin, Cardano (ADA) which saw a 67 percent hike during Q1, has now acquired the position of the most held crypto asset by investors of eToro US in Q2. Where top cryptocurrency Bitcoin’s steady speed of a 42 percent rise in demand could not beat Cardano for the top spot.

Check out the most HODL'd cryptoassets on eToro in Q2 2021: pic.twitter.com/uC2rsFRSn0

— eToro US (@eToroUS) July 6, 2021

BTC, ETH, & DOGE – need to catch up

Cardano has been on a bullish surge in the wake of Grayscale Digital Large Cap Fund which also indicates its growing institutional demand. Ethereum, which is claimed to be the most reliable altcoin by the ETH community could not even secure the first runner-up position, despite gaining 225 percent till now in 2021 and gained popularity with the impressive 79 percent increase in investors holding the asset. Whereas, the controversial meme coin and Elon Musk’s favorite, Dogecoin came in second and became the second most held coin.

The eToro crypto market analyst revealed their platform has seen a surge in demand for coins which is less costly per unit where holders can buy a whole coin rather than a fraction.

“Rather than focus solely on Bitcoin and Ether, where many investors can only own a fraction of a coin, we are seeing increasing demand for lower-priced coins,” said Simon Peters, a crypto market analyst at eToro.

Cheaper & Better – TRX & ETC gain popularity

Smaller coins like Tron (TRX) and Ethereum Classic (ETC) have shown a quarterly increase. Where TRX presented a 163 percent increase in users holding the assets worldwide in Q2, ETC having a 151 percent hike compared to Q1.

eToro US pointed out that the attitude of people towards crypto has been turning more and more optimistic and new investors are seeking harvesting trust and confidence towards crypto in 2021. This has led to an increase in the number of crypto assets held during the last quarter. Comprehensively, 2021 is turning out to be the year of innovative technology and decentralized markets.

“Cryptoassets have had an exciting year, with big milestones achieved in terms of price movements and increased institutional investment signaling more adoption by the traditional financial services ecosystem,” said Simon Peters

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs