Cardano Founder Charles Hoskinson Says 2025 Is ‘Crypto’s Year,’ Here’s Why

Highlights

- Cardano founder Charles Hoskinson has asserted that 2025 is crypto's year.

- He believes that this upcoming bull market will be huge because of the strength the market showed amid the liquidation event earlier this week.

- Fundamentals support Hoskinson's bullish outlook for the crypto market.

Cardano founder Charles Hoskinson has provided optimism for the crypto community amid the recent market crash. Hoskinson asserted that 2025 is crypto’s year despite this setback and explained why he holds such a belief.

Cardano Founder Explains Why 2025 Is Crypto’s Year

In an X post, Charles Hoskinson asserted that 2025 is crypto’s year. This came as the crypto founder gave an idea of how big the upcoming bull market will be for crypto.

The Cardano founder noted that the market had just absorbed a downturn that was larger than FTX and Luna’s collapse and has already nearly recovered. He also alluded to the liquidations recorded earlier in the week with $710 billion in losses and 740,000 traders liquidated in 24 hours.

Indeed, billions of dollars were wiped from the crypto market between Sunday and Monday earlier this week as traders offloaded their coins following Donald Trump’s tariffs on Canada, Mexico, and China.

However, as Hoskinson indicated, the crypto market showed strength in how it quickly reversed following the agreement between the US, Canada, and Mexico to halt these tariffs for one month.

The Bitcoin price, which had dropped to as low as $91,000 amid the crash, quickly rebounded and reclaimed $100,000 following the pause on these tariffs. Altcoins also showed strength with the Cardano price, which is one of the cryptos that recorded major gains following the market rebound.

Some Bullish Fundamentals For The Crypto Market

Several bullish fundamentals support the Cardano founder’s claim that this upcoming bull market will be huge for crypto. For instance, Donald Trump’s Crypto Czar, David Sacks, assured that he and his team are evaluating the possibility of creating a Bitcoin reserve.

The crypto market will also gain regulatory clarity as the US Securities and Exchange Commission (SEC) has set up a crypto task force. The task force will focus on clarifying the application of federal securities laws to the digital asset industry.

Ripple’s CEO Brad Garlinghouse also recently commented how Sacks and his team committing to passing legislation for crypto clarity is 100% a big deal. It is worth mentioning that Senator Bill Hagerty introduced the GENIUS bill yesterday, which is aimed at regulating stablecoins in the US.

From A Technical Perspective

From a technical perspective, crypto analysts have backed the Cardano founder’s claims as they predicted that the Bitcoin price and, ultimately, altcoins would rally higher.

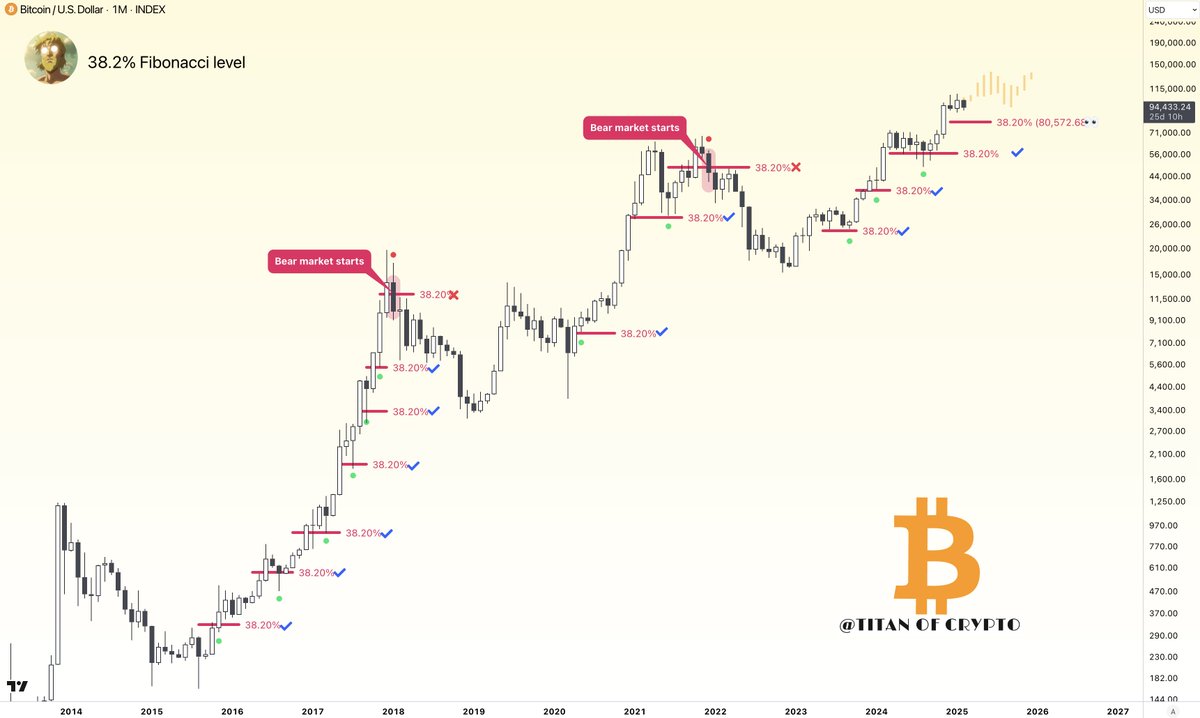

Crypto analysts like Titan of Crypto have predicted that the Bitcoin price could rally to as high as $160,000 this year. Titan of Crypto recently asserted that the Bitcoin bull market is still intact. He further remarked that as long as BTC holds a monthly close above the 38.2% Fibonacci retracement level, the bullish trend remains valid.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin & Gold Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs