Cathie Wood: Investment Community “Underestimating Bitcoin”; Ark Buys ARKB Units

Cathie Wood’s asset management firm Ark Invest further offloaded holdings in ProShares Bitcoin Strategy ETF (BITO) to buy units in its newly launched Ark 21Shares spot Bitcoin ETF (ARKB). The move has offered Ark Invest an advantage over competitors due to its active portfolio management strategy and availability to investors globally.

Cathie Wood’s Ark Invest Buys ARKB Spot Bitcoin ETF Shares

On January 23, Cathie Wood’s Ark Invest sold 585,915 shares of ProShares Bitcoin Strategy ETF (BITO) valued at approximately $12 million to purchase 360,830 Ark 21Shares Bitcoin ETF (ARKB) units worth $14.5 million.

Cathie Wood purged ProShares Bitcoin Strategy ETF again from ARK Next Generation Internet ETF (ARKW) as part of the strategy to increase holdings in Ark 21Shares spot Bitcoin ETF.

On January 22, ARKW also sold 648,091 BITO units to buy 523,541 ARKB units. It seems Ark Invest will continue to buy its ARKB spot Bitcoin ETF units until the target buying value is reached.

CoinGape earlier reported that ARKW purchased 1.04 billion ARKB units worth $43 million last week after ARKB spot Bitcoin ETF started trading on Wall Street.

ProShares Bitcoin Strategy ETF (BITO) price closed 2.42% lower at $18.92 on Tuesday. Whereas, Ark 21Shares Bitcoin ETF (ARKB) price closed 1.90% lower at $41.73. As per Ark Invest data until Jan 24, ARKB has Bitcoin worth $480.86 million.

Also Read: CryptoQuant CEO Unveils Potential Reasons Behind Bitcoin Price Dip

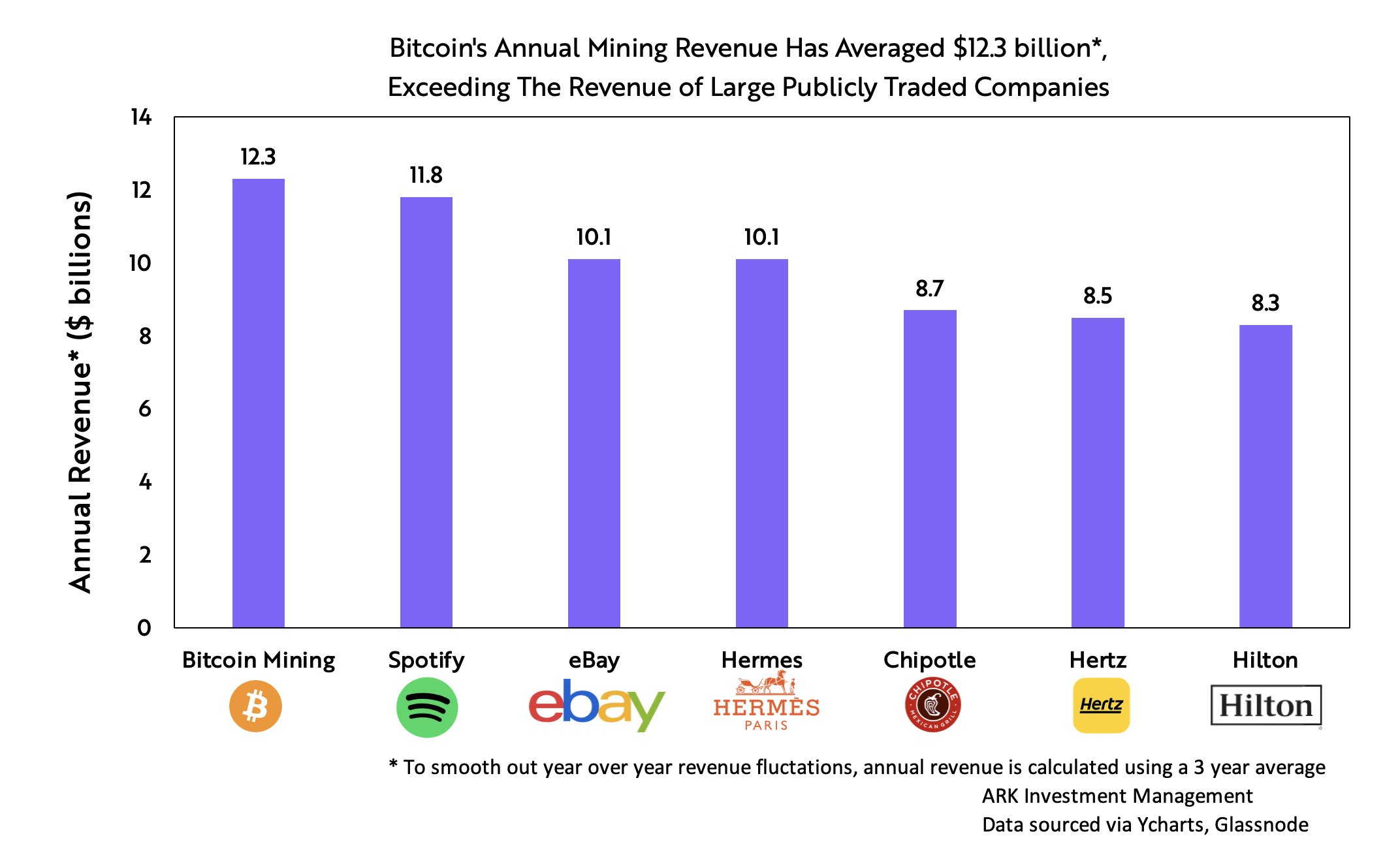

Reacting to Ark Investment director of digital assets Yassine Elmandjra’s data on Bitcoin mining, Cathie Wood said “Many in the investment community are underestimating Bitcoin.”

Bitcoin mining generates more annual revenue than some largest publicly traded companies. It includes Spotify, eBay, Hermes, Chipotle, Hertz, and Hilton.

Bitcoin miners’ total revenue has reached almost $60 billion from $10 billion in 2019. With TradFi’s entry into Bitcoin market, upcoming halving event and easing macro conditions, it will be interesting to witness the changes at the end of 2024.

Also Read: US SEC May Win Against Ripple In XRP Sales Discovery Requests

- Vitalik Buterin Offloads $3.67M in ETH Amid Ethereum Price Decline

- Crypto Market Crash: Here’s Why Bitcoin, ETH, XRP, SOL, ADA Are Falling Sharply

- Missouri Joins Bitcoin Reserve Push as U.S. States Race to Accumulate BTC

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible