Chainlink (LINK) On-chain Data Signals Bull Run Ahead

Chainlink (LINK) has established a formidable support range between $6.63 and $6.88, attracting nearly 29,000 addresses that acquired a total of 295 million LINK within this span. This strong backing, coupled with aggressive accumulation by large LINK whales, bodes well for the cryptocurrency’s outlook.

Chainlink Shows Robust Support

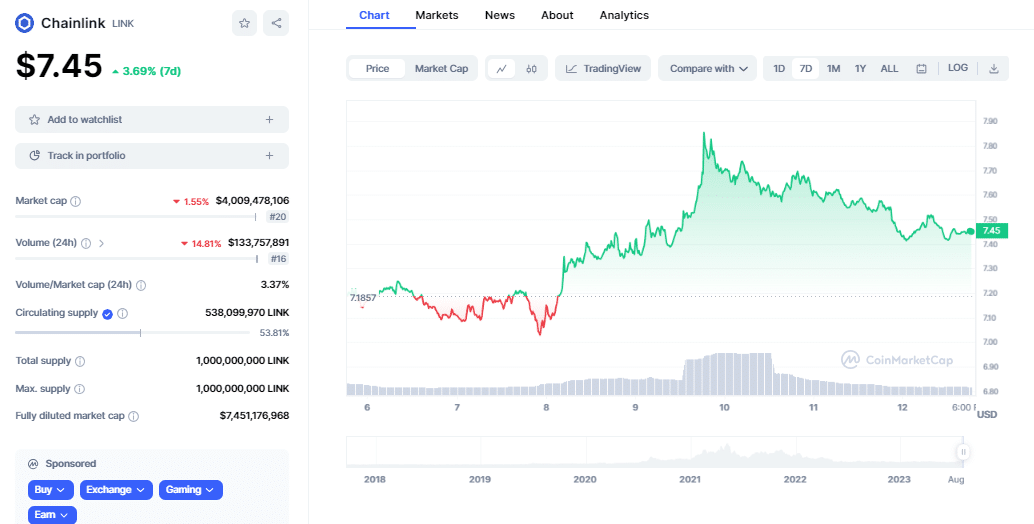

The on-chain data reveals that as long as Chainlink maintains its position above this support level, a strong bullish sentiment prevails. This sentiment is further reinforced by the absence of significant resistance barriers on the immediate horizon. LINK is trading at $7.45, at the time of reporting, with more than a 4% increase in the last 7 days.

Notably, prominent LINK whales have been actively increasing their holdings. Over the past two weeks alone, these whales have acquired around 13 million $LINK, totaling approximately $91 million.

While this accumulation pattern is promising for LINK holders, traders anticipating a breakout might need to exercise patience. Recent on-chain data indicates a decline in network activity over the past three weeks, including a decrease in the number of large transactions.

However, experts highlight that a sudden spike in large transactions could potentially signal an impending breakout. As the crypto landscape continues to evolve, Chainlink remains resolute in its position. Current on-chain metrics mirror the absence of significant resistance barriers, fostering a favorable atmosphere for both investors and traders.

Also Read: CFTC Charges Florida, Louisiana And Arkansas Residents For Crypto Fraud

Chainlink’s CCIP Tech May Have a Role To Play

To develop a decentralized credit score system, Lendvest has stated that it will incorporate Chainlink’s cross-chain interoperability protocol (CCIP). To “maintain the highest standard of security and reliability,” Lendvest, a data marketplace for DeFi borrowing and lending information, will launch its credit score system in partnership with Chainlink due to Chainlink’s demonstrated track record of delivering secure Oracle solutions. And these developments have a good role to play in whales flocking toward the LINK token.

Also Read: Dogecoin, Shiba Inu, ApeCoin, PEPE Finally Decoupling From Bitcoin?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs