Chainlink Price Slips Signaling Further Dip Ahead, Here’s Why

Highlights

- Chainlink price slipped more than 3% today, sparking market speculations.

- The broader crypto market also retreated today, but it seems other factors has contributed to LINK's volatility.

- Chainlink has unlocked 21 million LINK tokens from non-circulating supply contracts.

The Chainlink price has dropped more than 3% today, sparking speculations over the potential reasons behind the recent dip. Although the broader market has declined today, along with major cryptos like Bitcoin, Ethereum, Cardano, and others, it appears some other factors in play have triggered volatility in LINK price.

So, here we explore the potential reasons beyond market trends that may have caused the recent volatility in LINK price.

Chainlink Price Slips Amid Massive Token Unlock

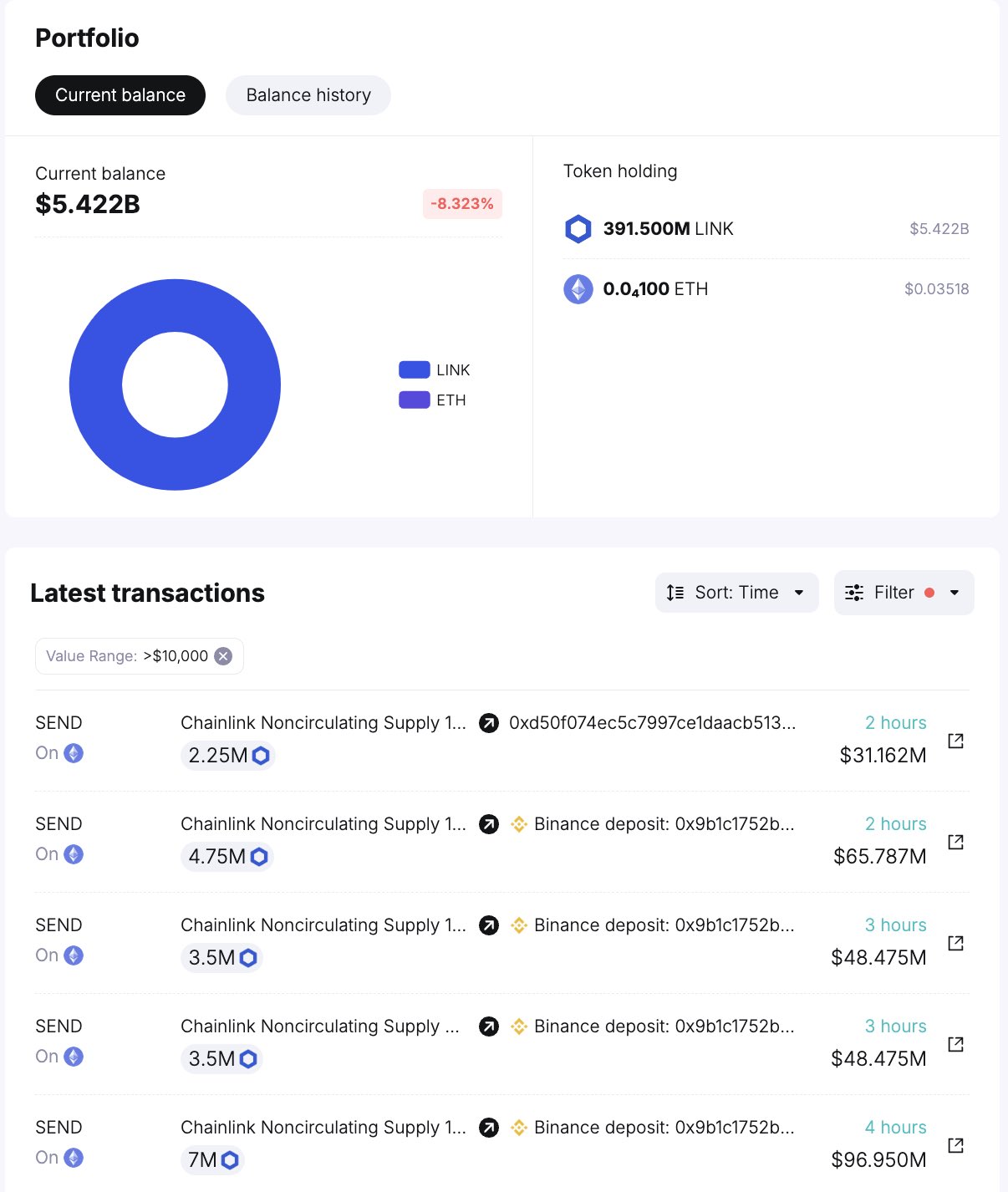

Chainlink’s price dip today follows a significant token unlock event. Notably, a recent report showed that Chainlink has unlocked 21 million LINK tokens, worth approximately $295 million, from non-circulating supply contracts.

According to Spot On Chain, the unlock has introduced a substantial number of tokens into the market, raising concerns about increased supply and its potential impact on prices. This development could signal further declines in LINK’s price in the near future.

Meanwhile, token unlocks generally increase the circulating supply of a cryptocurrency, which can put downward pressure on its price. This influx of new tokens can dilute existing holdings, making each token less valuable.

On the other hand, token burns, which reduce the overall supply, tend to have the opposite effect by potentially increasing the value of the remaining tokens.

Notably, today’s unlock involved the transfer of 18.25 million LINK, worth $264 million, to Binance, and another 2.25 million LINK, valued at $31.3 million, to a Multisig wallet identified as 0xD50f. This large-scale movement of tokens has likely contributed to the selling pressure on LINK.

In addition, Spot On Chain’s report highlights that Chainlink has unlocked a total of 127 million LINKs since August 2022. Besides, 107.7 million of those tokens were sent to Binance at an average price of around $9.89 per LINK.

Currently, 391.5 million LINK, worth $5.4 billion, remains locked across 24 contracts. However, despite these unlocks, LINK’s price has generally remained stable post-unlock, but today’s market response suggests renewed concerns.

Also Read: US Bitcoin ETF Records $545M Outflow, BTC Dip To $60K Imminent?

What’s Next?

The recent unlock of LINK tokens has not only added to the circulating supply but also sparked a wave of speculation among investors and analysts about the future price trajectory of Chainlink. The substantial increase in available tokens often leads to heightened selling pressure as investors anticipate a potential decline in value.

Although today’s decline in LINK’s price aligns with broader market trends, the specific timing of the token unlock exacerbates its impact. The added supply from the unlock might overshadow any positive market sentiments or technical developments in the short term, keeping downward pressure on the price.

While Chainlink’s price has typically managed to stabilize following previous token unlocks, the market’s current reaction underscores the importance of monitoring such events. As of writing, LINK price was down 3.23% and exchanged hands at $13.80.

In addition, its trading volume soared 22% to $320.884 million, while the crypto touched a high of $14.58 in the last 24 hours. However, despite the recent price dip, Chainlink Open Interest (OI) soared 1.74% to $179.02 million.

Also Read: PEPE Coin (PEPE) Price Bounces From Crucial Support Levels, A Do or Die Ahead

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs