Chainlink (LINK) Price Up 24%; On-Chain Data Indicates Bullish Sentiment Ahead

Chainlink (LINK) is up nearly 24% in a week, with the current price trading at $15.65. According to data from on-chain analytics firm Santiment, the increase in active addresses activity is the reason behind this rally in the LINK price. Since February 24, the start of the Russia-Ukraine war, every rise in the active addresses had pushed the price to shoot higher.

Active Address Price Divergence Data Indicates Bullish Sentiment

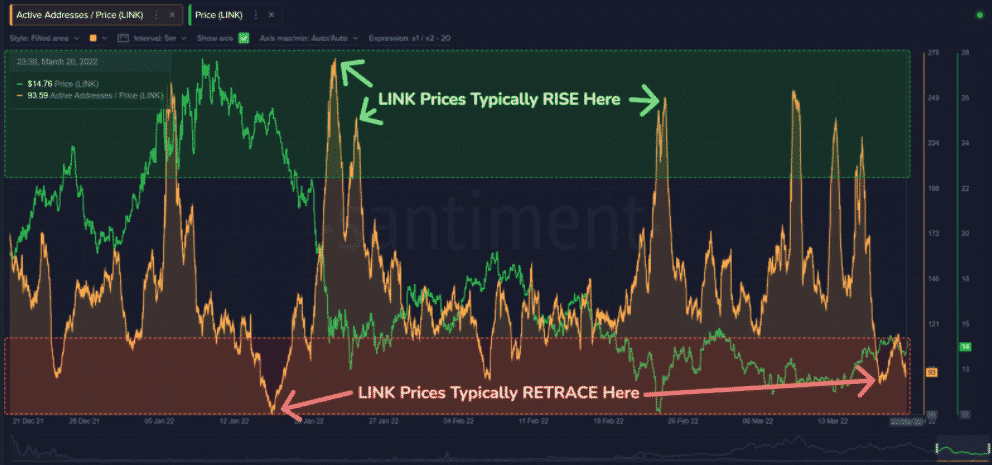

Santiment reports in a tweet on Monday that the active address to price divergence chart shows points of bullish price movements. Typically, the LINK price has rallied after the active address to price divergence moves in the green zone, as depicted in the chart. The Santiment data also reveals the retracement levels where the price movements have generally reversed.

“#Chainlink is +24% since bottoming out on #war news back on February 24th. Upticks have been driven by spikes in $LINK address activity, where pushes in active address/price divergence into the green zone have worked as excellent #bullish validators.“

In January, the Chainlink active address to price dipped massively, bottoming out near the level of 68, which resulted in the LINK price plummeting rapidly.

Also, in March, the Chainlink active address to price has moved in the green zone, forming numerous spikes, resulting in the LINK price moving higher. Thus, the current data validates bullish sentiment, pushing the price to move higher from here.

LINK Price Movement Expectations

As per the current Santiment active address price divergence data, the price is expected to move higher in the next couple of days. At the time of press, the LINK price has rallied nearly 7% in the last 24 hours, with the price trading near $15.65.

The price action paints a bullish movement in the upside channel, looking to cross the resistant level at $15.80. If the LINK price breaks the March 2nd resistance level, it could move significantly higher.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs