China Injects $19 Billion to Bailout Evergrande, Here’s How Crypto Market Can Benefit

The Chinese Real Estate giant Evergrande has defaulted on its debt payment and the fear of the company’s payment default has led to a collectible slump in the financial market world over. Many believe the crypto market’s downturn over the past week was also influenced by the same as investors rushed to liquidate their crypto funds. However, the Chinese Central Bank has injected 120 billion Yuan nearly $19 billion into the banking system in hopes of bailing out Evergrande.

China's central bank injects 120 billion yuan ($18.6 billion) into the banking system after concern over a debt crisis at Evergrande roiled global markets https://t.co/U75QYOkie6

— Bloomberg Economics (@economics) September 22, 2021

Amid the new insurgence of stimulus in the banking system by the Chinese Central Bank, several Western banking giants including HSBC and Blackrock bought the largest shares of Evergrande debt.

BlackRock, HSBC among largest buyers of Evergrande debt: Morningstar https://t.co/iThgVinK0s pic.twitter.com/U0ril8arTW

— Reuters (@Reuters) September 22, 2021

Evergrande’s default could prove costly for China and many pundits have predicted the country would try everything to stop Evergrande from failing and their predictions seem to be coming true. Now with Evergrande looking at a possible bailout, the crypto market could see a trend reversal from bearish to bullish.

Sorry to be the guy who asks the awkward question but… when can we expect to see China bailout Evergrande and pump the market?

— The Wolf Of All Streets (@scottmelker) September 20, 2021

China’s Evergrande Bailout Plan Could Help Crypto Market

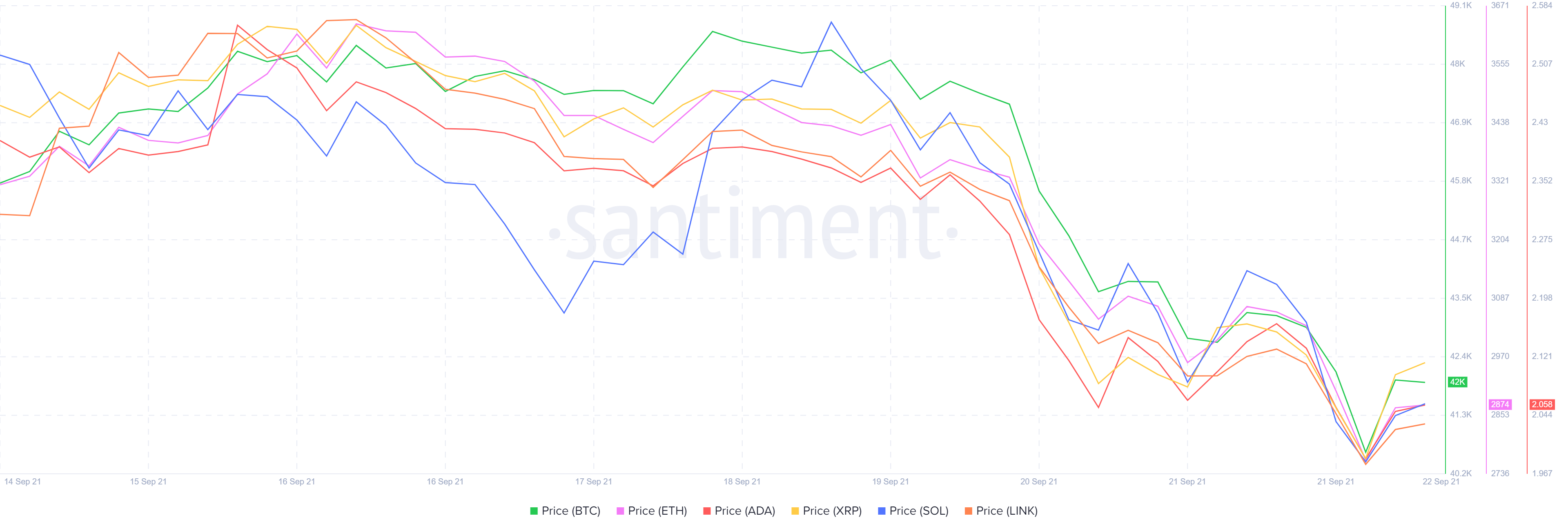

The crypto market saw its market cap dip below $2 trillion for the first time in two months and major cryptocurrencies lost 20%-30% of their market cap over the past week. While September is historically proven to be a bearish month with negative returns in the past, the Evergrande crisis worked as a catalyst that took out most of the gains from the last two months.

Bitcoin ($BTC) briefly dropped below $40K before recovering above the key support, Ethereum ($ETH) is trading below the $3,000 mark and many other crypto assets also lost more than 2o% of their market cap in September. Here’s how much top crypto assets have lost their market since September 6th,

However, China starting to influx stimulus into the banking system and the end of September can bring back the bulls to the crypto market again. Historical data shows that the final quarter of the year has proven to be bullish for the crypto market, thus the start of October could help the market resurge to its bullish ways as it did in August.

3 Last two bull runs saw sell offs in July following massive runs, both also saw sell offs in September, exactly as we are seeing in 2021. In both previous runs #bitcoin went on for a parabolic yearly finish. history doesn't repeat, but it sure does rhyme. pic.twitter.com/07wN03cWPd

— Lark Davis (@TheCryptoLark) September 22, 2021

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Michael Saylor’s Strategy Moves $83M in Bitcoin as $9B Paper Losses Raises Pressure

- Stripe Eyes PayPal Acquisition Amid Stablecoin Expansion

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card