Circle’s USDC Redemptions Reaches $2.5 Billion In 24Hrs, Exchange Inflow $7B

Stablecoin issuer Circle’s USD Coin (USDC) redemptions reach over $2.5 billion in the last 24 hours. Investors move away from USDC stablecoin as Silicon Valley Bank (SVB), one of the six banking partners that managed 25% of reserves, was closed by a U.S. regulator and transferred to the U.S. FDIC to protect depositors.

Also Read: Venture Capital Firms Agree To Support Silicon Valley Bank Again

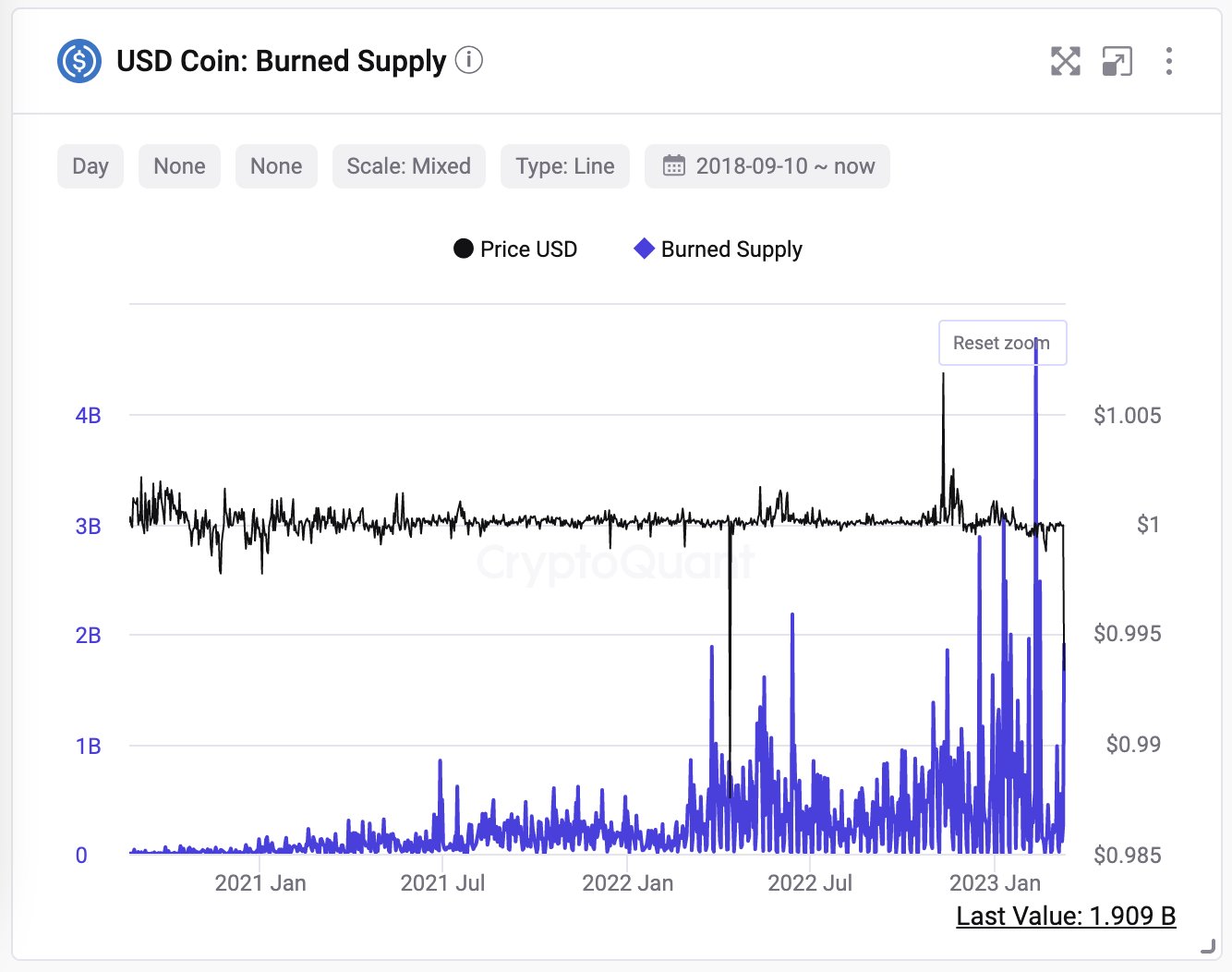

Ki Young Ju, CEO of CryptoQuant, in a series of tweets on March 11 reveals that Circle has burned almost $2.5 billion USDC in the last 24 hours. The total burn after the SVB closure could have reached above $3 billion. He claims it is not a significant amount of money if compared with the historical data.

“Value dropping to zero means major shareholders are selling. No on-chain proof of USDC bank run found for now.”

CryptoQuant data reveals that Circle’s USD redemptions reached over $4.5 billion on February 10 when problems started in the crypto market due to Operation Choke Point 2.0 by Biden Administration to strangle the crypto industry by cutting ties with the banking sector.

Moreover, Ki Young Ju believes the USDC situation is completely different from the TerraUSD (UST) collapse. The Luna Foundation Guard sent billions in BTC to crypto exchanges for issuing Terra (LUNA) to maintain the peg, risking its crash by market makers.

Also Read: Binance Switches To Multiple Stablecoins, Discontinues Auto-Conversion Policy

USDC is the only regulated stablecoin backed by cash reserves backed by traditional financial institutions on public blockchains. Circle’s failure will hamper the plans to launch global financial businesses on public blockchains by U.S. financial institutions.

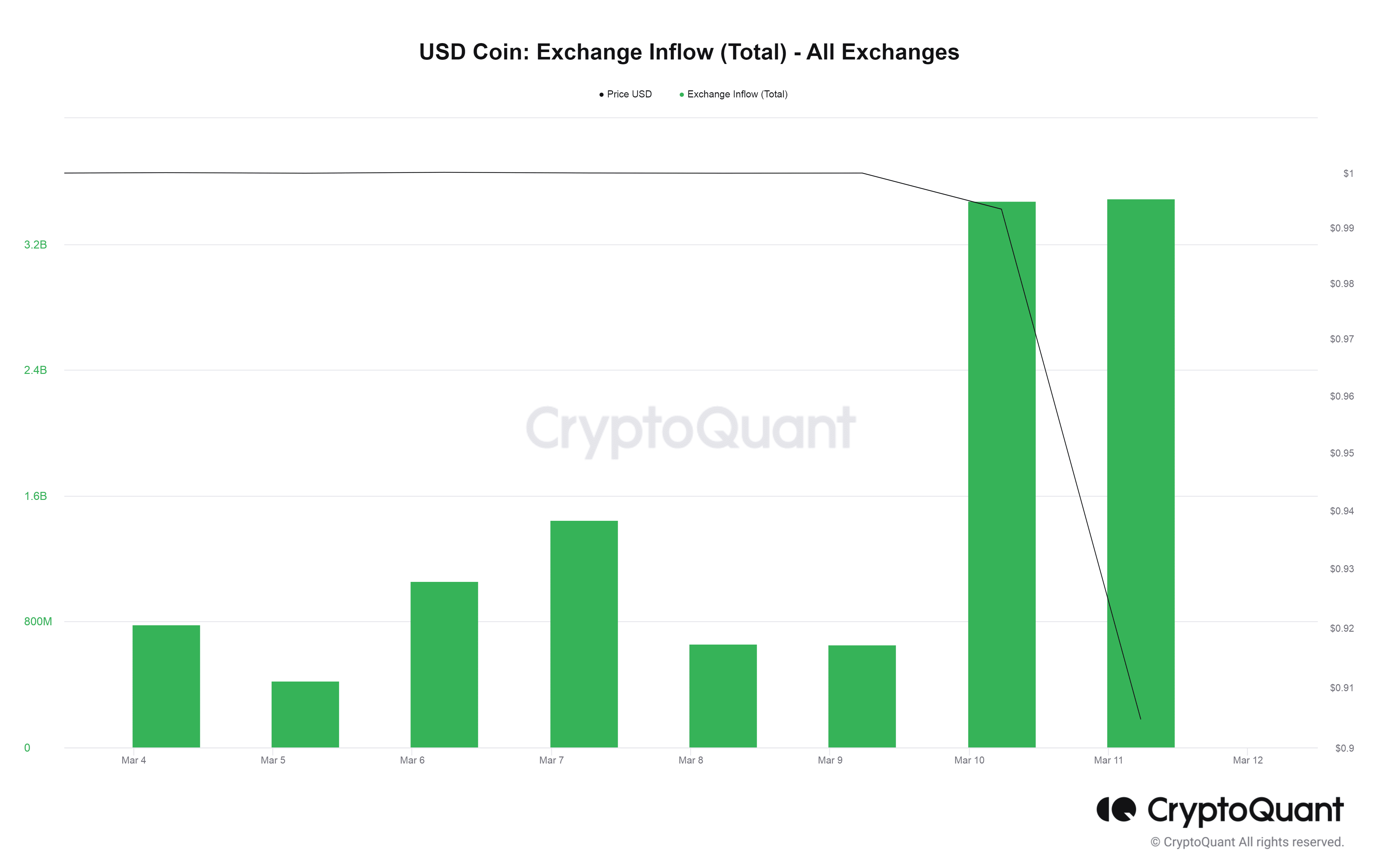

On-chain data also reveals that exchange inflow has reached over $7 billion in two days. Meanwhile, exchange outflow has also reached nearly $6 billion in two days. The USDC remains depegged at $0.91.

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand