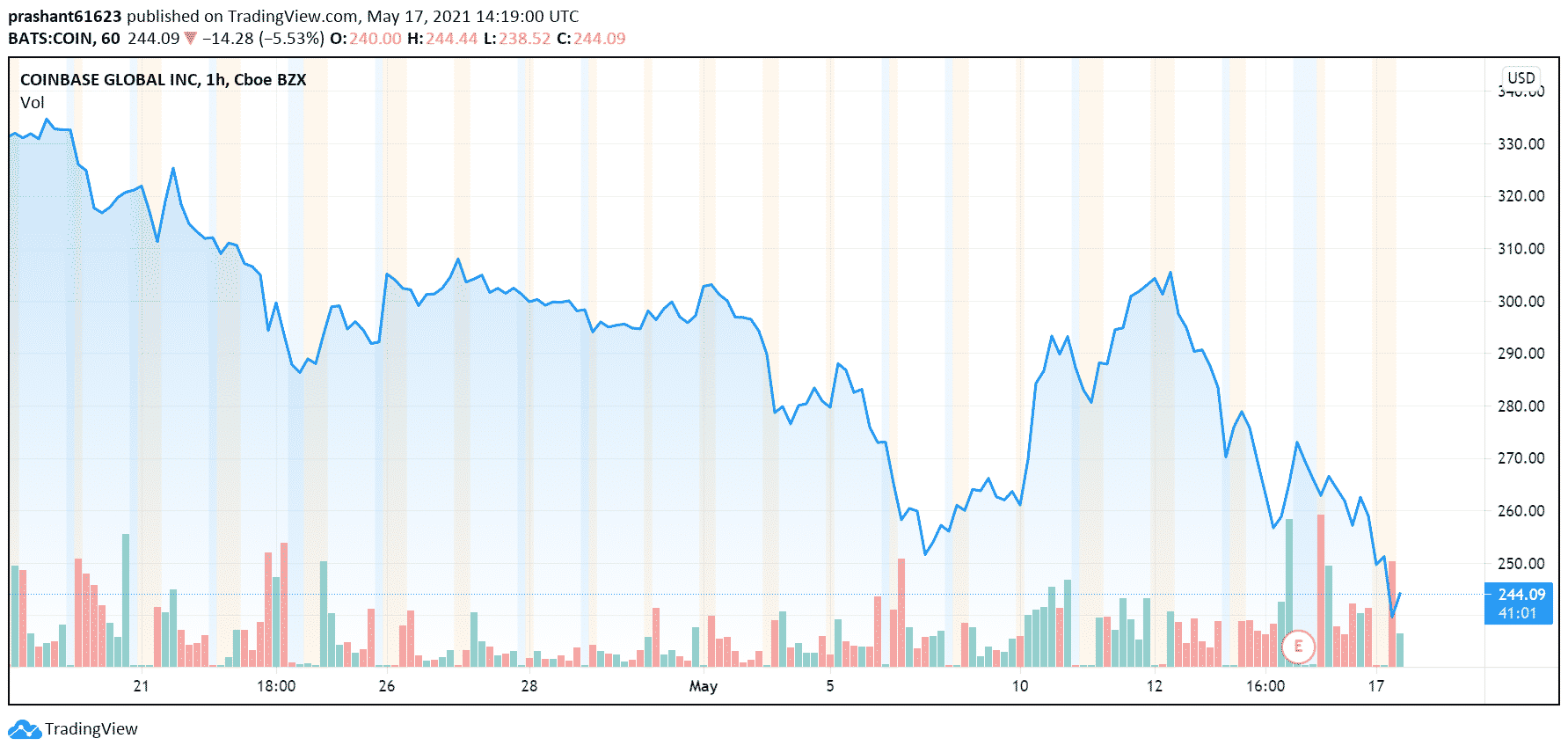

Coinbase($COIN) Share Price Falls Below Reference Amid Crypto Market Sell Off

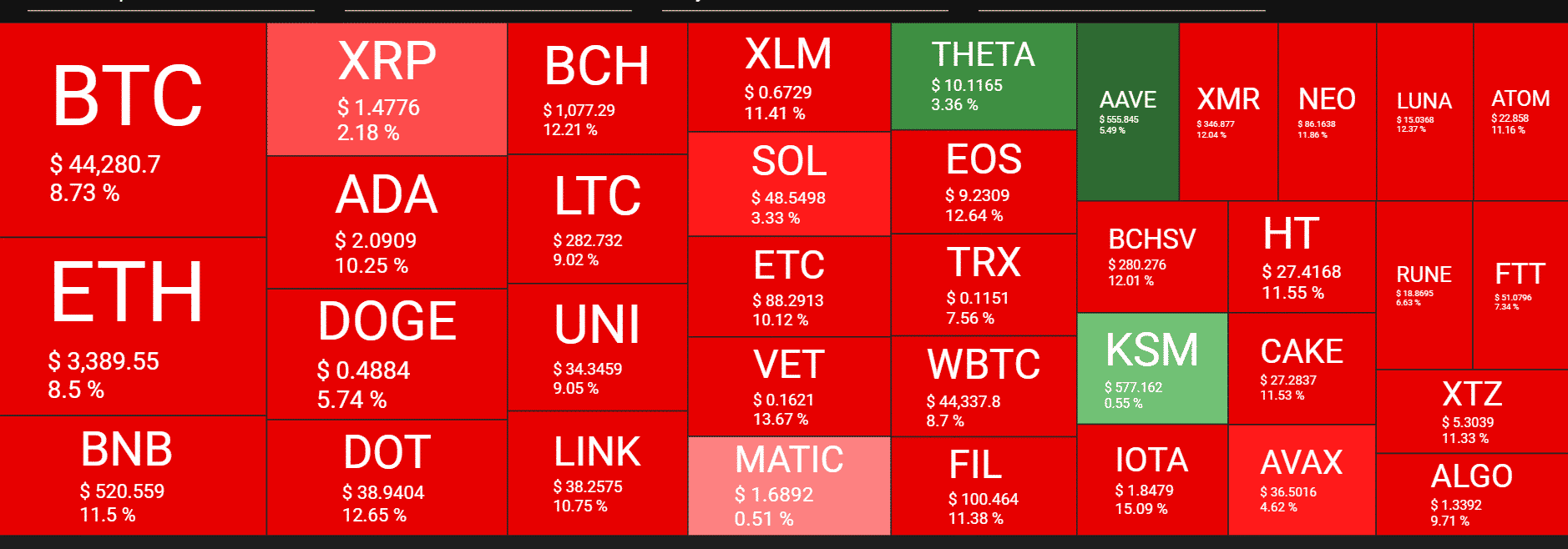

Coinbase ($COIN), the New York-based crypto exchange that went public last month has fallen below the reference price of $250 for the first time since listing. $COIN was trading just under $244 at the time of writing after registering a 5.3% decline since the opening today. The price fall comes amid a red crypto day in Twitter where the majority of the digital assets have fallen to the tune of 5%-10%.

*COINBASE FALLS 5.3% TO $244.60, BELOW REFERENCE PRICE OF $250

— *Walter Bloomberg (@DeItaone) May 17, 2021

Coinbase made its public debut on Nasdaq after a phenomenal first-quarter performance and became one of the highest valued companies to ever go public on the platform. At the time of listing $COIN shares opened at $381 despite a reference price of $250. The listing was also delayed due to an ongoing investigation by the CFTC as a result instead of March, the crypto exchange went public in April after clearance from the SEC.

Crypto Market in Red After Elon vs Bitcoin Twitter Faceoff

The Elon Musk crypto Twitter face-off against Bitcoin proponents over his multiple vague allegations took a “salty” turn when Musk threatened to go all-in Dogecoin and then responded to several tweets including a known “crypto scammer” indicating that looking at the push back he has received from Bitcoin proponents Tesla might sell their Bitcoin holdings. This led to a sharp decline in Bitcoin price which fell to a 3-month low just above $42,000. Many even started speculating that Tesla might have indeed sold their BTC holdings looking at Musk’s unnecessary aggression and threatening tone. However, he later clarified that Tesla hasn’t sold any of their Bitcoin.

To clarify speculation, Tesla has not sold any Bitcoin

— Elon Musk (@elonmusk) May 17, 2021

Most of the altcoins also followed the bearish trend as the majority of altcoins fell between 5%-10% barring a few. While FUDs in the crypto market is nothing new, but if someone of Musk’s stature decides to give fuel several debunked and tested FUDs it created a whole different scenario.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs