Crypto Crash Or Bull Run? FED Hikes Interest Rates Again

On Wednesday, July 26, the US Federal Reserve announced a 25 basis points rate hike on the expected lines. Soon after, Bitcoin and the broader crypto market turned green with the BTC price moving closer to $30,000.

As of press time, BTC is trading 0.7% up at a price of $29,464 with a market cap of $572 billion. On the other hand, all of the top altcoins have also been in the green. Ether (ETH), XRP, and Binance Coin (BNB) are up by 1.5%. Solana (SOL) remains the biggest gainer in the top ten crypto-list with over 7% gains. Cardano (ADA) and Polygon (MATIC) are up by over 3% each.

With the recent rate hike, the US Interest rates have touched a new 22-year high. On-chain data provider Santiment explains: the Federal Open Market Committee (FOMC) has recently raised US rates to their highest level since 2001, with another 25 bps increase. How the crypto markets will respond could depend on social reactions. Early signs suggest a “sell the rumor, buy the news” approach, with positive price movements anticipated.

Bitcoin Grabs Attention Amid Fed Rate Hike

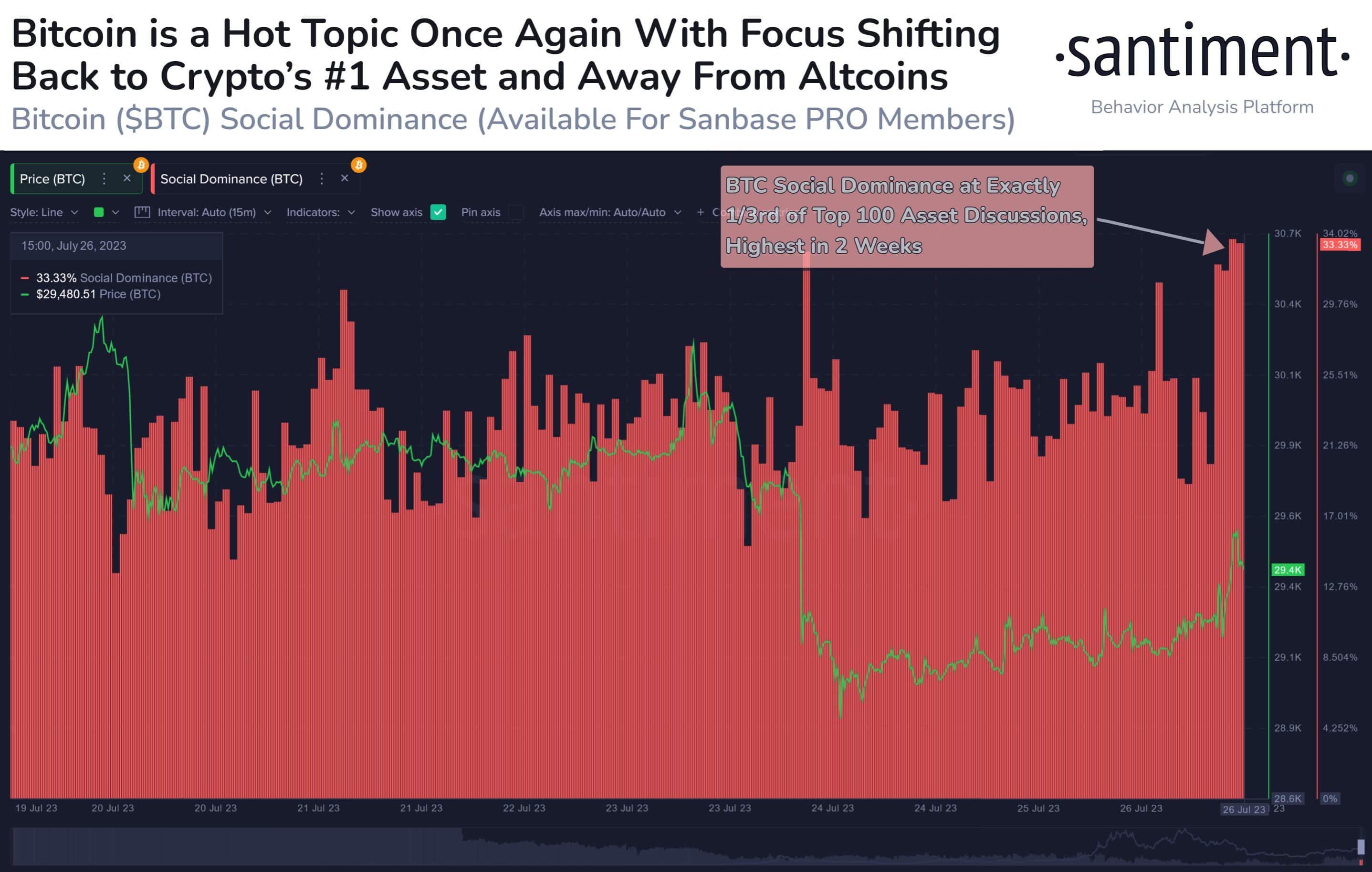

As the Fed announces a rate hike, Bitcoin once again takes away the limelight from altcoins. After the Federal Open Market Committee (FOMC) raised rates and Bitcoin approached $30k, there has been a significant increase in discussions about Bitcoin compared to other top 100 assets. This heightened social dominance usually indicates fear, which could raise the chances of a price increase, reports Santiment.

Another major bullish indicator is that the Bitcoin supply at the exchanges has dropped to a 5-year low . Despite the current selling pressure, a lot of Bitcoin holders have been moving their coins into self-custody.

Additionally, Fed Chairman Jerome Powell also hinted at another possible rate hike in the month of September 2023. Thus, this can lead to investors moving towards Bitcoin instead of altcoins over the next two months.

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible