Crypto Crash: BTC, ETH, XRP, SOL, DOGE Prices Slip, Here’s Why

Highlights

- The crypto market has witnessed volatile trading over the past few days.

- Major cryptos like Bitcoin, ETH, SOL, XRP, and others, have retreated, contributing to the broader market dip.

- The recent economic indicators seem to have weighed on the market sentiment.

The crypto market has gone through a bumpy road lately, with all the major cryptos like Bitcoin, ETH, SOL, XRP, DOGE, SHIB, and other prices declining over the past few days. Meanwhile, the recent market crash indicates the ongoing bearish sentiment hovering over the market while dampening investors’ confidence.

Although there is a flurry of macroeconomic and other related concerns, let’s explore some of the potential reasons behind crypto prices’ dip today.

Why Is The Crypto Market Falling Today?

The broader crypto market has gone through tumultuous trading so far over the past few weeks, over the soaring concerns of inflation, the Fed’s stance with their policy rates, and other related concerns. So, here we explore the potential reasons why the crypto market is witnessing a downturn momentum today.

Bitcoin ETF Outflows Trigger Crypto Market Dip

The cryptocurrency market witnessed a downturn today, driven by ongoing outflows from the U.S. Spot Bitcoin ETF. According to Farside Investors data, Bitcoin ETFs have experienced outflows for three days this week, contrasting with two days of inflows.

Over the last two days, the U.S. Spot Bitcoin ETFs registered a significant outflow of $96 million, heightening investor apprehensions. However, this comes after a promising start to the week, with a substantial inflow of $217 million into the investment instrument, which has also fueled optimism in the crypto market.

Meanwhile, the predominant factor behind the outflow pressure appears to be the persistent exodus from Grayscale GBTC, with over $146 million exiting in the past two days alone. These consecutive outflows from Bitcoin ETFs and the ongoing Grayscale exodus have contributed to the prevailing negative sentiment in the crypto sector.

Inflation Concerns

Today’s crypto market dip is attributed to heightened inflation concerns following recent economic data. For context, the University of Michigan’s consumer sentiment index plummeted from 77.2 in April to 67.4 in May, marking a six-month low and missing expectations.

In addition, inflation expectations for the year ahead surged to 3.5%, reaching a six-month high, while the five-year outlook rose to 3.1%. Meanwhile, Federal Reserve officials’ cautious remarks further fueled investor anxiety.

As CoinGape Media reported earlier, Fed’s Lorie Logan highlighted significant upward inflation risks, advocating for policy flexibility and ruling out immediate rate cuts. Simultaneously, Fed Governor Bowman emphasized the need for sustained policy stability.

These developments have left investors apprehensive about the economic outlook, prompting a downturn in the crypto market as they seek clarity amid uncertain financial conditions.

Also Read: Dogecoin (DOGE) Price Eyes ‘Golden Cross’, A Mega Rally ahead?

Anticipation of Next Week’s Economic Data

Investors are bracing for next week’s economic data release, causing a pause in the crypto market today. With recent bleak economic indicators impacting sentiments, anticipation looms over the U.S. Producer Price Index (PPI) and Core PPI data set to be unveiled on Tuesday, May 14, alongside Fed Chair Jerome Powell’s address.

Following this, the focus shifts to the U.S. Consumer Price Index (CPI) data and Core CPI data, as well as U.S. retail sales data, scheduled for release on Wednesday, May 15. Notably, these pivotal economic figures hold significant weight for crypto market investors, offering insights into the current economic landscape and inflationary pressures.

Meanwhile, as anticipation builds, market participants are exercising caution, leading to a temporary downturn in the crypto market as they await crucial indicators to navigate future investment strategies.

A Closer Look Into The Market Trends

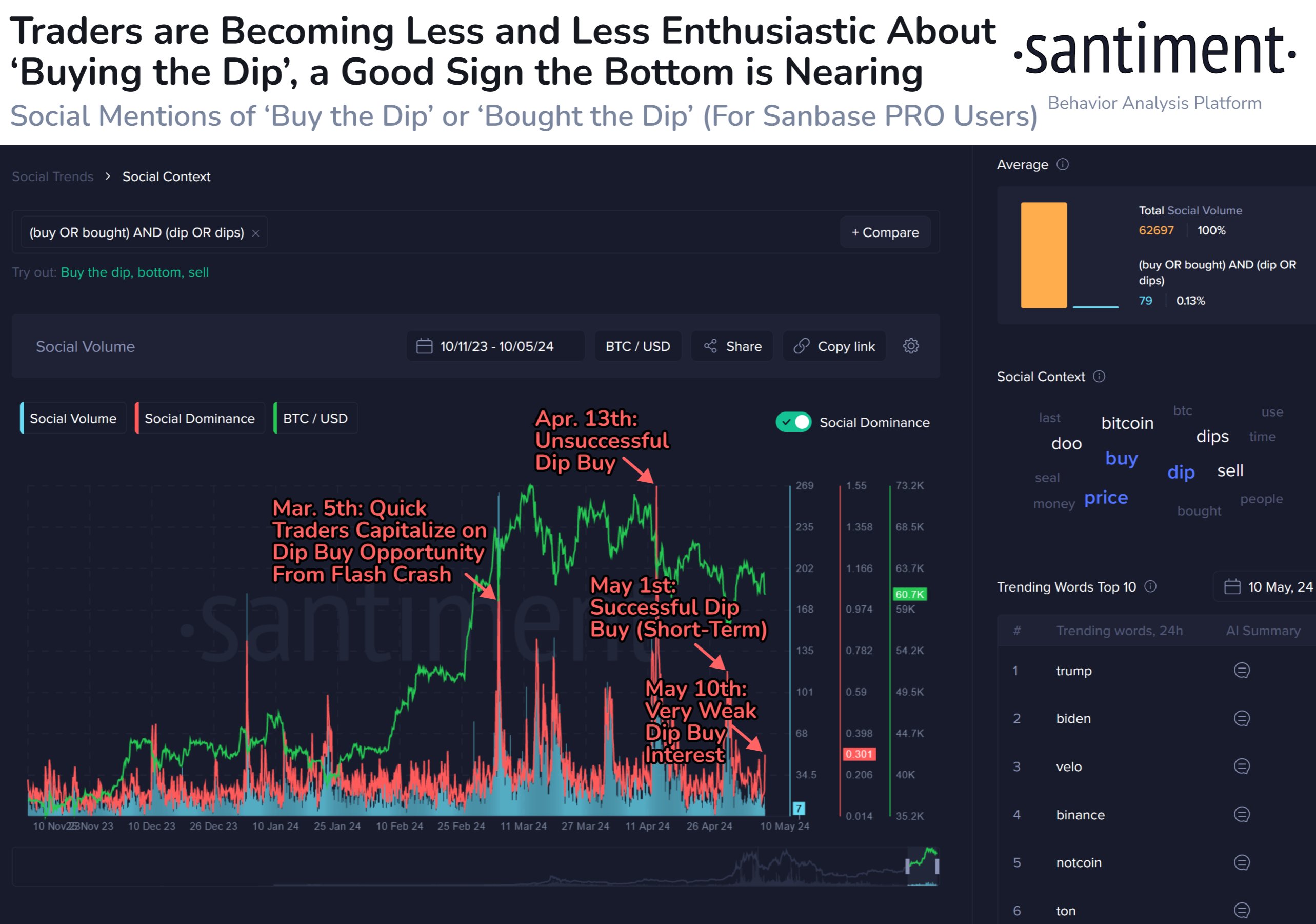

The recent discussions over the crypto market dip have been further intensified by the latest report of Santiment. In a recent X post, Santiment said that this downward trend coincided with a concerning lack of enthusiasm among traders to capitalize on the dip through the “buy the dip” strategy.

Meanwhile, the report suggests that the prevailing sentiment among traders indicates a lack of confidence, signaling that the cryptocurrency’s price may be nearing a bottom. This hesitancy to buy during the dip reflects a broader sentiment of uncertainty among investors, contributing to the downward pressure on prices across the market.

On the other hand, CoinGlass reported a significant surge in crypto liquidations, with 58,000 traders facing liquidation, totaling $156.53 million in the last 24 hours. Notably, the largest single liquidation occurred on Binance, involving the BTCUSDT pair, with a value of $3.56 million.

Crypto Prices & Performance

The global crypto market fell 3.42% to $2.26 trillion as of writing, indicating the bearish sentiment hovering in the market. At the same time, the Bitcoin price slipped 3.26% and traded at $61,033.64, while the Ethereum price plunged 4.00% to $2,922.99.

Similarly, the Solana price noted a slump of 5.65% to $145.72, while the XRP price plummeted 2.31% to $0.5058. The scenario in the meme coin sector was also bearish amid the broader market retreat. The leading meme coin, Dogecoin price fell 5.15% to $0.1445, while the Shiba Inu price decreased by 3.80% to $0.00002262.

Also Read: PEPE Investors Accumulate 650 Bln Pepe Coin, More Steam Left?

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Michael Saylor’s Strategy Moves $83M in Bitcoin as $9B Paper Losses Raises Pressure

- Stripe Eyes PayPal Acquisition Amid Stablecoin Expansion

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card