DeFi Becomes The Most Bullish Crypto Industry Development; Eclipses BTC Halving, CBDC Development – Survey

2020 has been quite eventful. The cryptocurrency battlefield is getting increasingly crowded and has been witnessing an increasing amount of attention like never before. Despite the economic shockwaves due to the ongoing COVID-19 pandemic, the cryptocurrency industry has emerged as an outperformer. While Bitcoin’s impressive rise throughout the year has been one of the most important news of this year, it is decentralized finance [DeFi] space that remains unbeaten.

Popular conversations takes a back seat

DeFi has managed to eclipse everything else that has been happening in the crypto ecosystem this year. Previous subject matters seem to have taken a back seat. This was according to the latest survey by Grayscale’s parent company, Digital Currency Group [DCG].

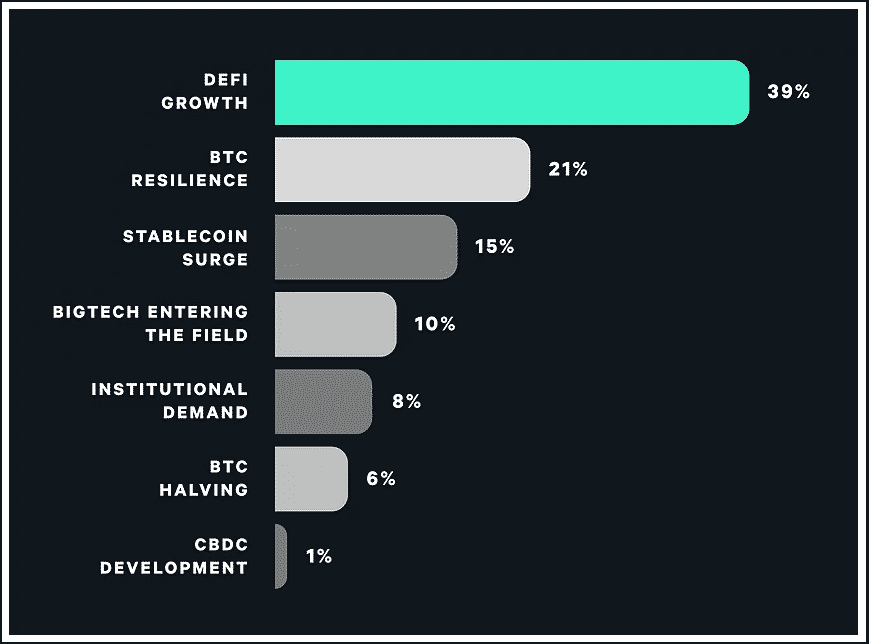

The platform reportedly polled the Founders and CEOs of more than its 150 portfolio companies on a wide range of topics and trends. In terms of DeFi, the survey’s respondents identified the rise of the DeFi sector as the “most bullish crypto development of 2020”. It was followed by ‘BTC resilience’ and ‘Stablecoin surge’. Additionally, ‘Big tech entering the field’ was in the fourth position.

Besides, since early 2020, the institutional demand for Bitcoin (BTC) has been consistently increasing. In the second quarter of this year, the appetite for BTC spiked substantially. However, all eyes were on DeFi. Hence, the topic of ‘institutional demand’ was pushed to fifth position. ‘Bitcoin Halving’ was heralded as the turning point for Bitcoin in the modern economy. But like everything else, conversations surrounding the block reward halving of the cryptocurrency faded. This was followed by the development of Central Bank Digital Currency. It is important to note that China leading the world leaders in terms of CBDC developments rose to prominence in the third quarter of 2019.

Not an ICO Bubble

Many in the community are of the opinion that the current DeFi craze’s resemblance is uncanny with the ICO boom three years back. But the report’s respondents’ do not believe so. Those interviewed were quick to contrast the DeFi movement with the ICO bubble of 2017, said that report citing ‘the talent and professionalism of today’s innovators’. Larry Sukernik, who leads venture investments at DCG, observed,

“The caliber of the founders is impressive; many left high-paying jobs to start companies in the DeFi space. They’re more commercial, productive, and ethical (than the 2017 crop)”

The report further stated,

“Our founders expressed that no matter the performance of DeFi token prices in the near-term—which have plunged recently—the protocol development and business growth of 2020 bodes well for the industry’s future.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs