DeFi Derivatives Volume At All Time High , Over $70 M USD Contributed To Ethereum Mcap

- Decentralized Finance (DeFi) derivatives record all-time high volume of 400,000 ETH in the past 24 hours.

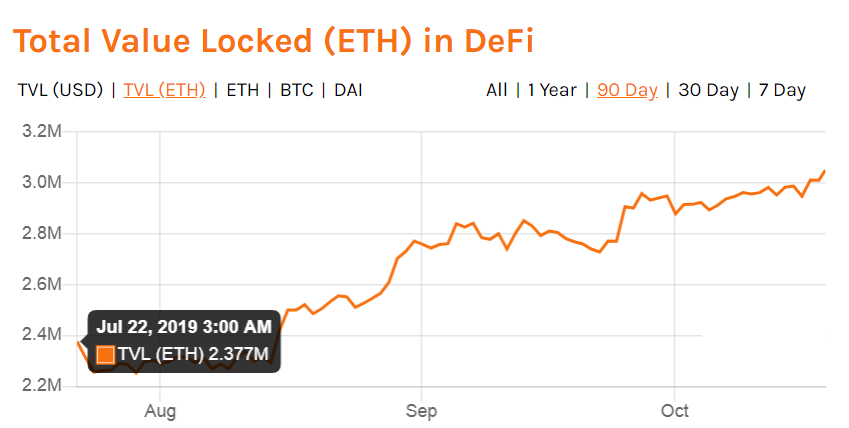

- DeFi applications contributed a record high of 3 million ETH on Ethereum blockchain.

According to data by DeFi Pulse, the TVL of crypto derivatives soared by 7000% during the year to record a daily trading volume of $70 million USD, as of October 18. Notwithstanding, the total value locked in lending platforms stands at $421 million USD, representing over 120% increase in volumes in the past year.

The total value locked (TVL) for decentralized finance derivatives reaches all-time high in both USD and Ethereum valuation.

DeFi derivatives at all-time high volumes

According to DeFi Pulse, over 400,000 ETH is locked in DeFi derivatives following a massive pump in the past 30 days. As of September 20, the total volume locked in the exotic assets stood at almost 250,000 ETH and volume has since exploded by 61% since then to record its highest TVL to date. In dollar terms, DeFi derivatives also surpassed their all-time high volume – breaking the $70 million USD barrier – with $71.8 million locked.

However, the impressive soaring volume is heavily influenced by Synthetix, a crypto based synthetic asset, which holds 96.6% of the total DeFi derivatives volume. The platform provides on-chain exposure to real world currencies, commodities, futures, options and cryptocurrencies. Nexus Mutual and Augur, a distant second and third respectively, locked a total of $1.8 million (2.5%) and 575,000 USD (0.7%) of the total value of derivatives locked.

DeFi applications transact over 3 million ETH

In the past 90 days, lending DeFi apps have been on the rise as total value locked in ETH soared above the 3 million mark. On Oct. 12, Coingape reported DeFi applications contributed close to 2.3 million ETH in the last quarter with Maker and Nest leading the standings.

Of the total 3 million ETH, Maker, the creator of DAI stablecoin, contributed over half of the total volume with 51.48% dominance despite the slight 0.3% drop in the past 24 hours. Compound, a blockchain based lending platform using digital assets as collateral, is second with 665,000 ETH locked. InstaDapp and dYdX, both lending apps, completed the top five list of DeFi apps with largest volumes in the past 90 days – 176,000 and 142,000 ETH respectively.

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card