DeFi Rockets, NFTs Plummet as Ethereum Bulls Set Sight on $2,000

The decentralized finance (DeFi) sector is shining bright with notable gains in lending and borrowing protocols while NFTs have experienced a downturn in performance. Recent market movements have shown a surge in popularity for Defi, coinciding with a notable rally in the Ethereum market as it sets its sights on the coveted $2000 milestone.

Decoupling Visible In Crypto Market

As reported by a Defi Researcher on Twitter, there is a decoupling between DeFi and NFTs highlighting the divergent trends within the crypto market. Over past 07 days, DeFi Tokens are on the Rise

- Ethereum-based lending protocol Compound (COMP) has surged by 80% and Pendle ($PENDLE) has seen a remarkable increase of 66%, especially after Binance announcement of its listing in Innovation Zone and Launchpool.

- Decentralized stablecoin minter Maker ($MKR) has enjoyed a solid rise of 32% while DPI, the DeFi Pulse Index, has shown a growth of 12.6%. MKR’s weekly gains of over 30% have occurred amid increased revenue on the protocol and reports of whale accumulation.

At the same time, NFT tokens are facing decline.

- Beanz has witnessed a significant drop of 69% and Azuki has seen a decline of 58%.

- Moonbirds has experienced a dip of 24% and Bored Ape Yacht Club (BAYC) has faced a decrease of 23%.

Also Read: Why NFT Market Tanked Sharply After The Azuki Incident

Ethereum Bullish, Defi On Rise

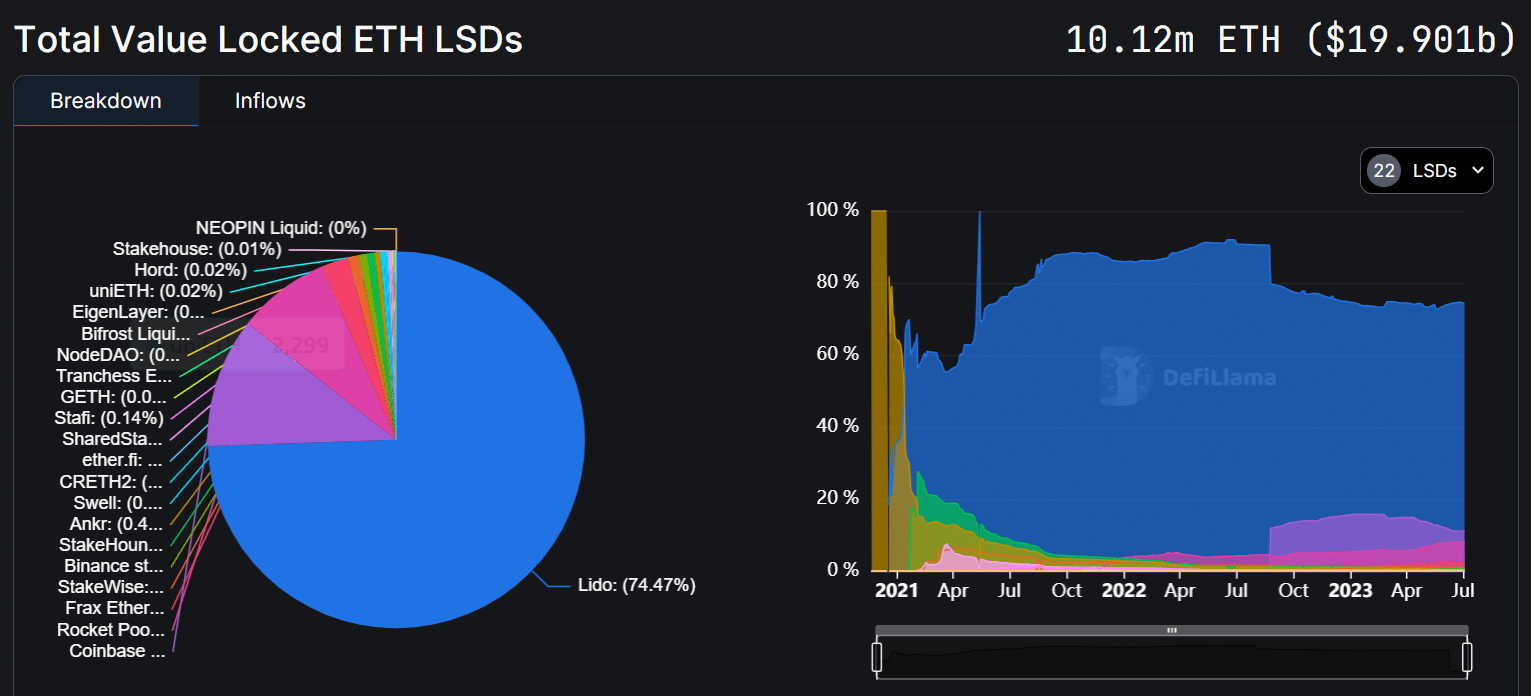

Defilama shows that as of July 3, 2023, more than ten million ethereum (ETH) is locked in liquid staking defi platforms. At the time of reporting, approximately 10.12 m ETH is locked, with a value of $19.901 billion using today’s exchange rates.

Dr. Nick, a prominent DAO builder, believed that the cyclical nature of the cryptocurrency market will reset once DeFi starts performing well again in beginning of June. He suggests that the recent “vapour bubble” has burst, leading the market to recalibrate towards a more sustainable level focused on utility.

CoinGape reported Ethereum’s price prediction- The fear of missing out (FOMO) could suddenly be the driving force for Ethereum price targeting the ultimate move to $3,000 and subsequently climbing to the all-time high of $4,878. Read More..

Also Read Some Shiba Inu Updates On CoinGape..

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- XRP Seller Susquehanna Confirms Long-Term Commitment to Bitcoin ETF and GBTC

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards