Despite Ethereum (ETH) Price Crossing $1,500, Sentiment Remains Negative. Time to be Cautious?

The world’s second-largest cryptocurrency Ethereum has registered a sharp bounceback over the last week. The ETH price has surged all the way past $1,500 levels with its market cap reaching closer to $200 billion.

On the weekly chart, the ETH price has gained more than 40% leading to a strong rally in the altcoin space.

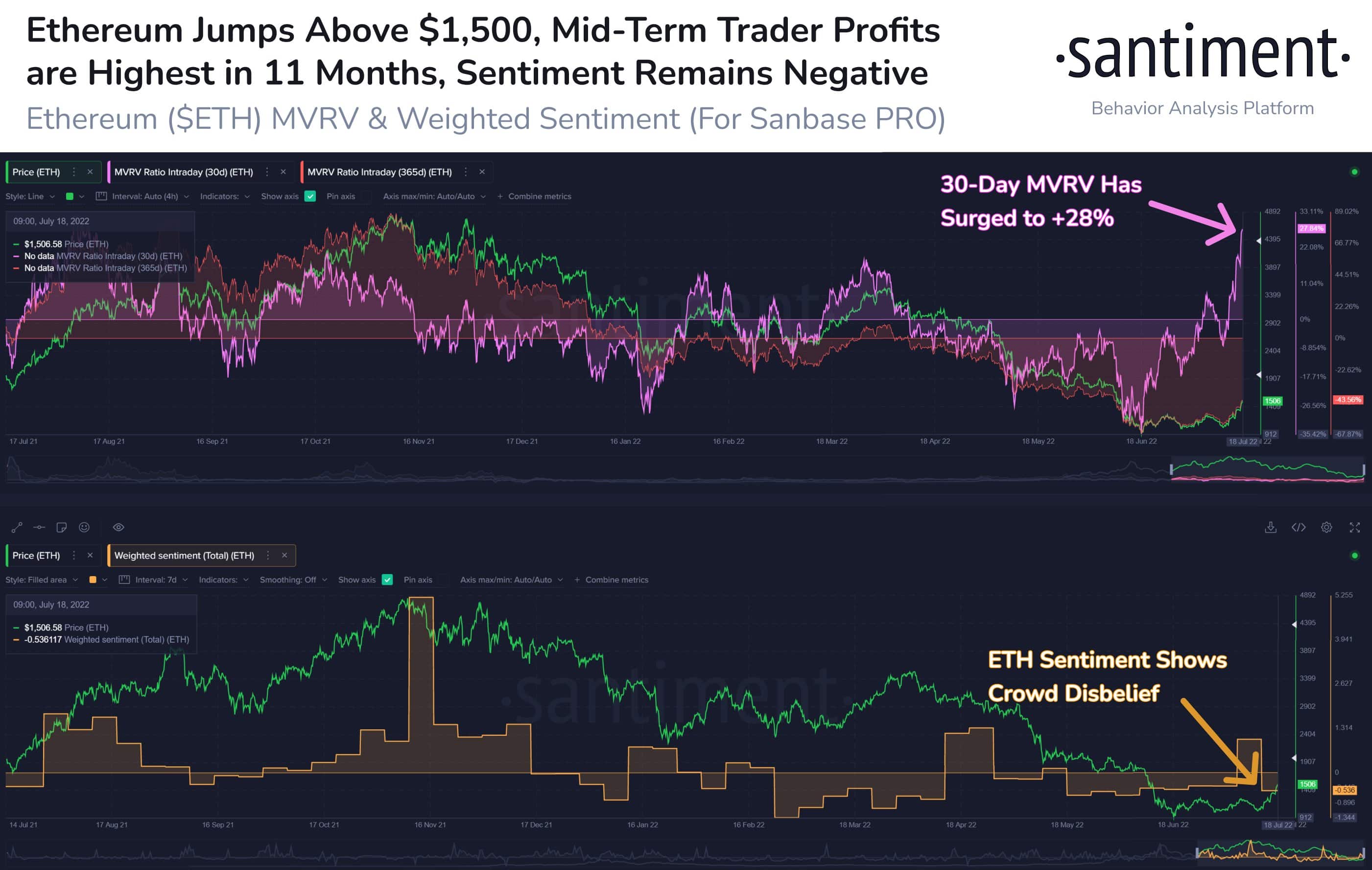

However, on-chain data provider Santiment notes that the overall sentiment around ETH remains negative with the crowd having little belief in this recovery. The data provider notes:

Ethereum’s return above $1,500 for the first time since June 12th appears to be happening as the crowd has little belief in this rebound. Despite this, the average $ETH return of 30-day traders has ballooned to +28%, the highest since August, 2021.

Is ETH Profit Booking on the Cards?

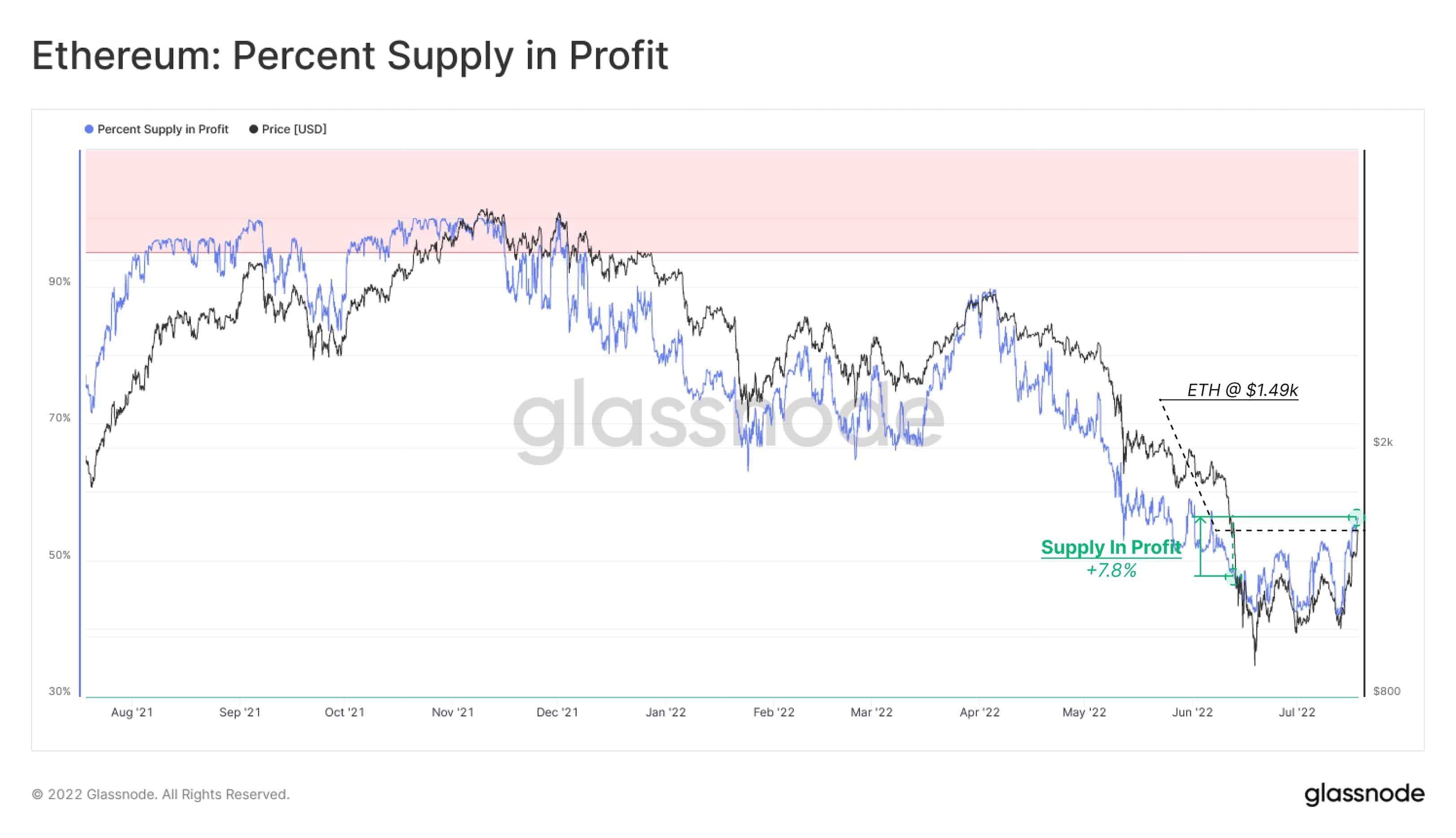

The recent price rally could see some profit booking, especially for short-term traders who recently purchased ETH for around $1,000. On the other hand, the percentage of ETH supply in profit has bounced by 15% over the last week. Thus, we can’t rule out the chances of profit booking.

As data provider Glassnode explains: “Over the last month, almost 7.8% of circulating supply of $ETH has transacted on-chain, and changed hands. The total $ETH supply in profit has now increased to 56%, after hitting lows of 41% prior to the current price rally”.

Taking a look at the ETH derivatives market, funding remains low across exchanges as of now. Market analyst Alex Kruger further explains: “Quarterly futures basis is flattish and close to zero. Perp open interest since $1200 is down in Binance & Bitfinex, flat in FTX, and up in OKEX”.

This shows that one can avoid building up any fresh positions at the current price considering that ETH has already given a pretty solid run-up. Also, as per CoinShares, ETH witnessed net outflows of $2.6 million last week after three weeks of consecutive inflows suggesting some profit booking.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

Buy $GGs

Buy $GGs