Donald Trump Calls For A 100 Bps Fed Rate Cut Ahead June FOMC Meeting

Highlights

- Trump urged "too late" Jerome Powell to cut rates by 1% from the current benchmark 4.25% to 4.5% interest rate.

- The president alluded to the fact that Europe has cut rates 10 times this year while the Fed is yet to make any.

- He asked the Fed to cut rates and approved them to raise it again if inflation comes back.

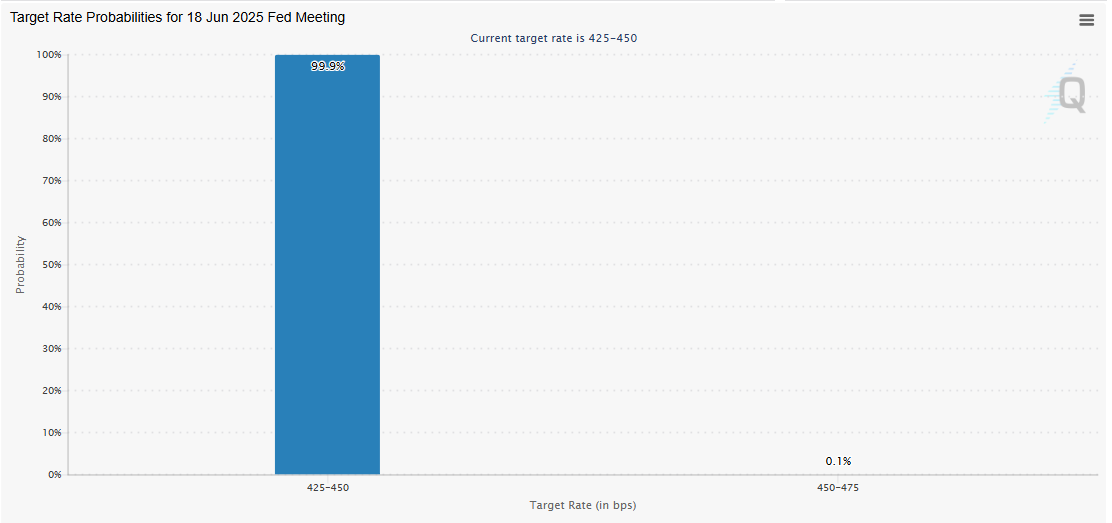

- CME FedWatch data shows there is a 99% chance that interest rates will remain unchanged following the June FOMC meeting.

Donald Trump continues to pressure the US Federal Reserve to cut interest rates despite Jerome Powell and the committee’s hesitance. This time, the president has called for a “rocket fuel” 100 basis points (Bps) Fed rate cut ahead of the FOMC meeting later this month. However, the Fed is adopting a cautious stance toward cuts with a keen eye on US inflation data.

President Trump Pushes For A 100 Bps Fed Rate Cut

In a Truth Social post, the US president urged the Federal Reserve to go for a full point cut, which he described as what would be a “rocket fuel” for the economy. He made this statement while also criticizing Fed Chair Jerome Powell as being too late and a “disaster.”

Trump noted that the European Central Bank (ECB) has made 10 rate cuts while the FOMC has yet to make any. As CoinGape reported, the latest ECB rate cut came on June 5, with Europe cutting interest rates by 25 bps to 2%.

In another Truth Social post, Trump again pushed for a Fed rate cut. He stated that if Powell cut, the US would greatly reduce interest rates, long and short, on debt that is coming due.

He noted that Joe Biden went mostly short-term. However, the president believes that there is “virtually no inflation” anymore. Trump even went as far as calling for a deal with the Fed, asking them to raise the rate to counter if inflation should come back.

In the meantime, he believes the logical thing to do is to cut rates, stating that it is “very simple.” Trump also declared that Powell and the FOMC’s reluctance is costing the country a fortune, as borrowing costs should be much lower.

The president’s latest call for a Fed rate cut comes just less than two weeks before the FOMC meeting, scheduled for 17 and 18. CME FedWatch data shows that there is a 99.9% chance that the Fed will keep interest rates steady between the current range of 425 and 450 Bps.

Fed Adopts A Cautious Approach

The May FOMC meeting minutes showed that the FOMC is in no hurry to cut interest rates. Instead, they are choosing to wait and see how the Trump tariffs impact the economy.

Policymakers at the Federal Reserve are steeling their resolve to keep interest rates unchanged after the release of the Labor Department’s monthly economic report. Per the report, unemployment steadied at 4.2%, but discontent over the Fed’s refusal to cut rates continues to rise.

Another reason behind the Fed’s hesitation to cut interest rates revolves around inflation levels not dropping to the 2% target. There are fears that early rate cuts may trigger inflation ,and subsequent hikes will damage overall market confidence.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

Buy $GGs

Buy $GGs