ETH Price At Decisive Critical Point, 30% Sell-Off On The Offing?

Ethereum, like its top ten peers, is struggling with charting its way out of the August sell-off that saw ETH price plunge to $1,580. The second-largest crypto holds above slightly higher support at $1,630 following a failed recovery attempt above $1,700 last week.

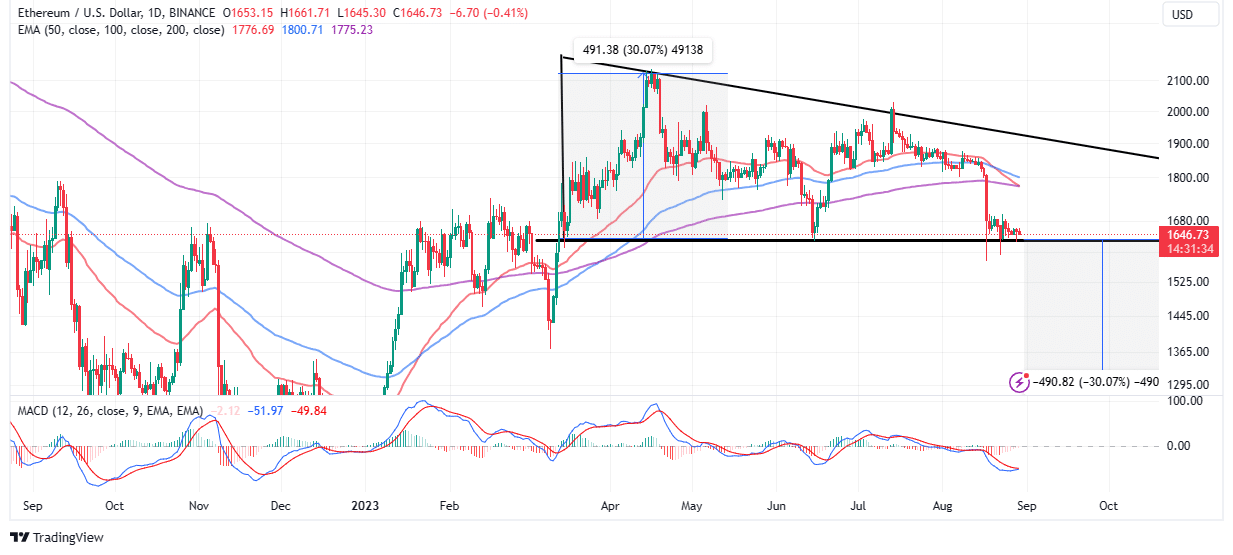

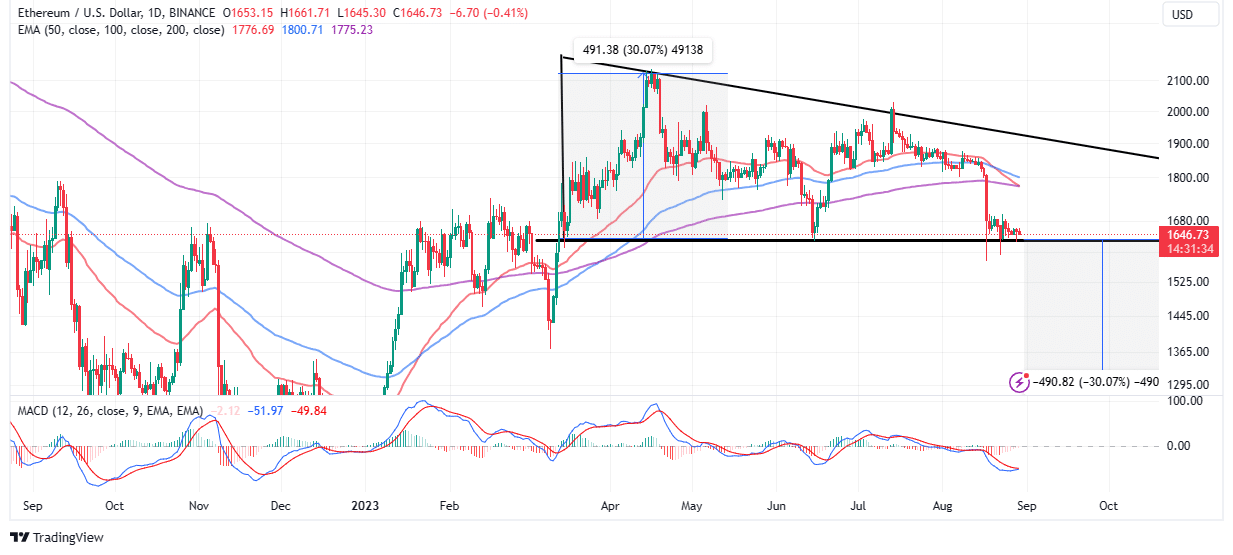

Up a mere 0.2% on Tuesday, Ether trades at $1,646 amid a building bearish trend, with the possibility of validating an extended downtrend to $1,140, considering the presence of a descending triangle pattern.

ETH Price Sits At Breakout Zone

Ethereum has generally sustained a downtrend since the last bull run to $4,878 in November 2021. Within this crypto winter, there have been moments when ETH price has pushed to reverse the trend like the rally in January and April 2023. The latter hit $2,125 as investors embraced the Shapella upgrade, which marked the completion of the transition to a proof-of-stake mechanism.

Although bulls gathered rallied behind ETH in June, resulting in an upswing to $2,000, a lack of momentum saw the smart contracts token trim gains back to support between $1,600 and$1,630.

The technical picture on the daily chart presents a disquieting situation, where ETH price could tumble 30% below the breakout point at $1,630 to $1,140.

A descending triangle pattern as seen on the daily chart could further jeopardize Ethereum’s recovery, paving the way for the downtrend to stretch to $1,140 before ETH price aligns with the expected uptrend into the bull market.

Traders must, however, wait for the pattern’s confirmation before going all-in with their short positions in ETH. It would be prudent to trigger the sell orders once the support at the triangle’s x-axis around $1,630 breaks.

Profit booking may start as Ethereum drops through potential support areas at $1,400 and $1,200. However, the triangle pattern projects a 30% drop from the axis to $1,140 which represents the height of the pattern extrapolated below the breakout point.

An incoming death cross on the same daily chart could complicate the situation further for bulls, holding Ether from starting the move to $2,000 and focusing on sweeping the floor for liquidity at the $1,140 support.

A death cross forms with a short-term moving average like the 50-day EMA (red) in Ethereum’s case flipping below a longer-term moving average such as the 200-day EMA (blue).

The path with the least resistance will most likely remain downward due to the death cross as well as the prevailing ETH price position below all three moving averages, including the 100-day EMA.

Despite the bearish outlook, markets are not set in stone and an opposite reaction to support at $1,630 could disregard the triangle pattern breakout and allow for an immediate rebound above $1,700 while bringing the coveted $2,000 level within reach.

That said, it is essential to trade carefully keeping in mind a possible buy signal from the Moving Average Convergence Divergence (MACD) indicator. If the MACD line in blue completes the flip above the signal line in red, ETH price could soon be on the recovery path eyeing $2,000.

Related Articles

- DOGE Price Still Vulnerable To Declines Unless Dogecoin Soars Past Crucial Level

- DCG Agrees to Settle Claims of Bankrupt Lender Genesis, Good News for Gemini?

- Big Week For Crypto: Potential Grayscale Decision And Bitcoin ETF Approval By US SEC

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs