Ethereum (ETH) Breaks Past $2300 Resistance, Long-Term Outlook Bullish

On Sunday, July 4, the world’s second-largest cryptocurrency Ethereum (ETH) is showing strong momentum northwards. The Ethereum (ETH) price has moved past its crucial resistance of $2300 for the first time in the last 16 days.

With this, ETH’s weekly gains have moved to nearly 20% as the crypto struggled under $2000 for quite some while. However, ETH’s move above $2350 levels has been short-lived and Ethereum is showing partial retracement. At press time, the ETH price is 1.78% up trading at $2257 with a market cap of $262 billion.

The recent price surge could be due to the excitement around the London hardfork scheduled ahead this month. This upcoming Ethereum network upgrade will bring the implementation for EIP-1559. It will implement a “base fee” model to significantly reduce the ETH gas fee. As a result, the EIP-1559 holds major significance for investors, however, it has opposed by the miners recently.

Ethereum 2.0 Staking and Purpose Ether ETF

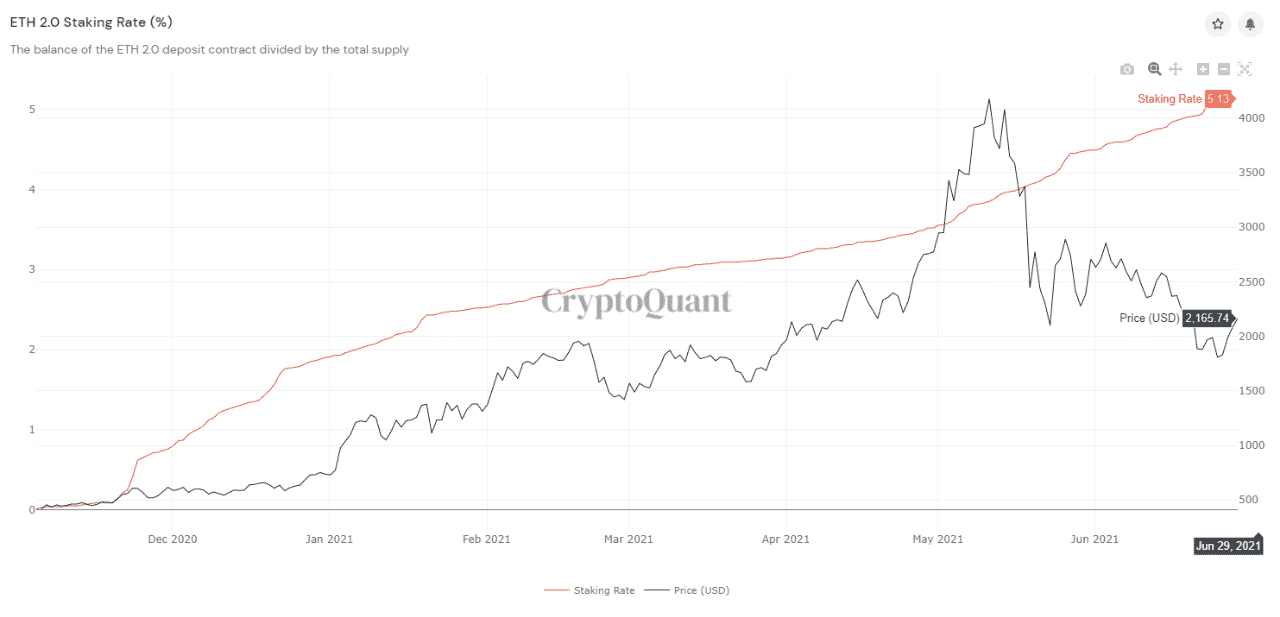

Long-term ETH holders and whales have been continuously accumulating Ethereum as per on-chain data. As per data on CryptoQuant, the Ethereum staking rate has recently crossed 5% with a large number of long-term deposits in Ethereum 2.0 deposit contracts. The data provider writes:

“Paired with sideways movement in the ETH reserves (all exchanges) and decreasing net flows, it looks like ranging will go on for a while, still, but the long-term outlook remains positive despite prices oscillating at critical levels”.

Two weeks back on June 23, 2021, the Ethereum 2.0 blockchain registered the largest single-day staking inflow of 134.112K ETH coins. At the same time, the ETH supply at the exchanges has been on a decline which is a bullish indicator.

Ethereum (ETH) accumulation by institutional players seems to be going pretty strong. Canada’s Purpose Ether ETF has now accumulated more than 60,000 ETH coins in less than three months of its launch. The total holdings of the PurPose Ethereum ETF are now worth $155 Million.

Last week SkyBridge Capital founder Anthony Scaramucci announced that his firm will soon launch an Ethereum fund as SkyBridge now shifts its focus to alternate crypto funds apart from Bitcoin. The company is also willing to bring an Ethereum ETF subject to regulatory approval.

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- XRP Seller Susquehanna Confirms Long-Term Commitment to Bitcoin ETF and GBTC

- Vitalik Buterin Offloads $3.67M in ETH Amid Ethereum Price Decline

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards