Ethereum (ETH) Surges Past $2550 As Average Gas Fee Drops to Three-Month Low

The world’s second-largest cryptocurrency Ethereum (ETH) is all set for another rally as it surpasses $2550 levels hitting its new all-time high and just short of $300 billion in valuations. At press time, Ethereum (ETH) is trading at a price of $2551 with a market cap of $295 billion.

Dropping under $2200 levels last Friday, the ETH price has regained its lost ground gaining more than 10% under a week. This happens as some of the on-chain Ethereum fundamentals align with the price recovery.

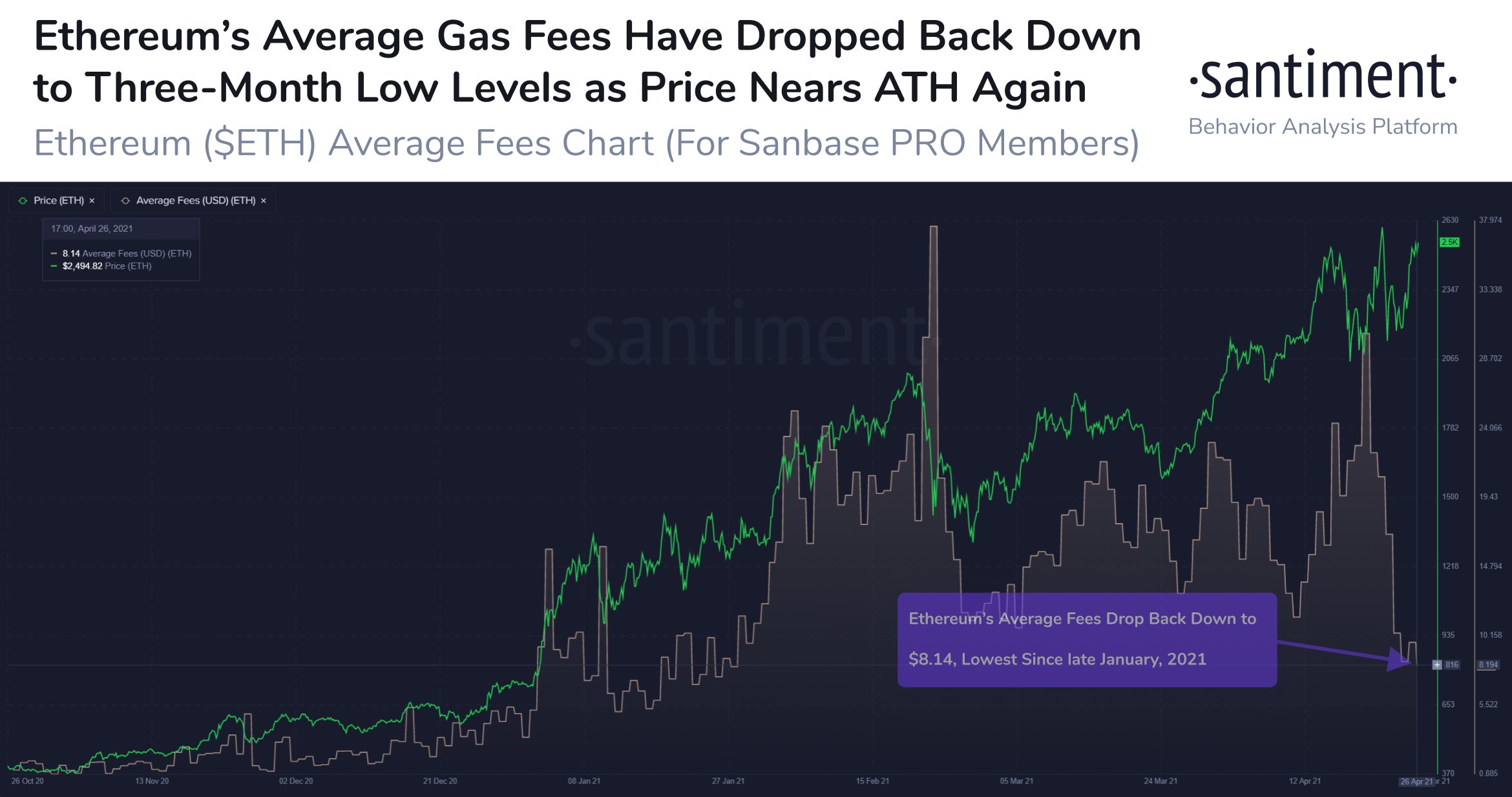

As per on-chain data provider Santiment, the Ethereum gas fee has now dropped to its three-month low. This is encouraging from the perspective of higher investor participation as more investors shall be moving their coins. As Santiment reports:

“Ethereum average gas fees are back at sub-$10 levels, and $8.14 is the lowest average cost in three months. This is obviously encouraging, with $ETH holders being able to confidently move their holdings without fear of such heavy incurred costs”.

What’s Actually Behind the Falling ETH Gas Fee?

As per the latest report from Glassnode, the primary reason behind Ethereum’s dropping gas fee is the surge in the gas limit from 12.5M to 15.0M by miners. This has effectively facilitated more transactions per block.

The on-chain data provider mentions that the falling gas fee has ultimately benefitted traders on Ethereum-based DeFi protocols and DEX platforms like Uniswap. With the reduced gas fee, the transaction count on Uniswap has surged to an all-time high of 213k trades per day this week.

This comes as Uniswap trading volumes peaked out at $1.8 billion last week. On the other hand, the total value staked with Ethereum 2.0 Deposit Contracts has hit a new record high moving past $10 billion.

The total value in the ETH 2.0 Deposit Contract just went above $10 billion with 3,994,722 $ETH deposited pic.twitter.com/rdtFTxG14C

— Bloqport Insights (@Bloqbot) April 27, 2021

Besides, Ethereum also continues to be on the institutional radar with the CI Global Asset Management firm announcing the world’s first Ethereum-based mutual fund CI Ethereum Fund on Monday, April 26.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- WhiteBIT Coin ($WBT) Officially Listed on Kraken Exchange, Highlighting Its Growing Recognition

- Top Real World Asset (RWA) Issuers of 2026 – Best Picks Reviewed

- KuCoin Hit With VARA Alert for Unlicensed Crypto Services

- U.S. Jobs Report Today: Bitcoin and Crypto Prices Brace for Volatility Amid Labor Market Slowdown

- Crypto Market Crash Alert: Institutions Trap Retail Ahead of BTC, ETH, XRP Options Expiry & Nonfarm Payrolls

- Gold Price Prediction as US-Iran War Hits the Second Week

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

Buy $GGs

Buy $GGs