On-Chain Analysis : Ethereum (ETH) Shoots 10% as Non-Exchange Whale Holdings Hit 5-year high

Amid the strong broader market recovery today, the world’s second-largest cryptocurrency Ethereum (ETH) is up 10% today. As of press time, Ethereum is trading 9.48% up at $2,373 and a market cap of $277 billion.

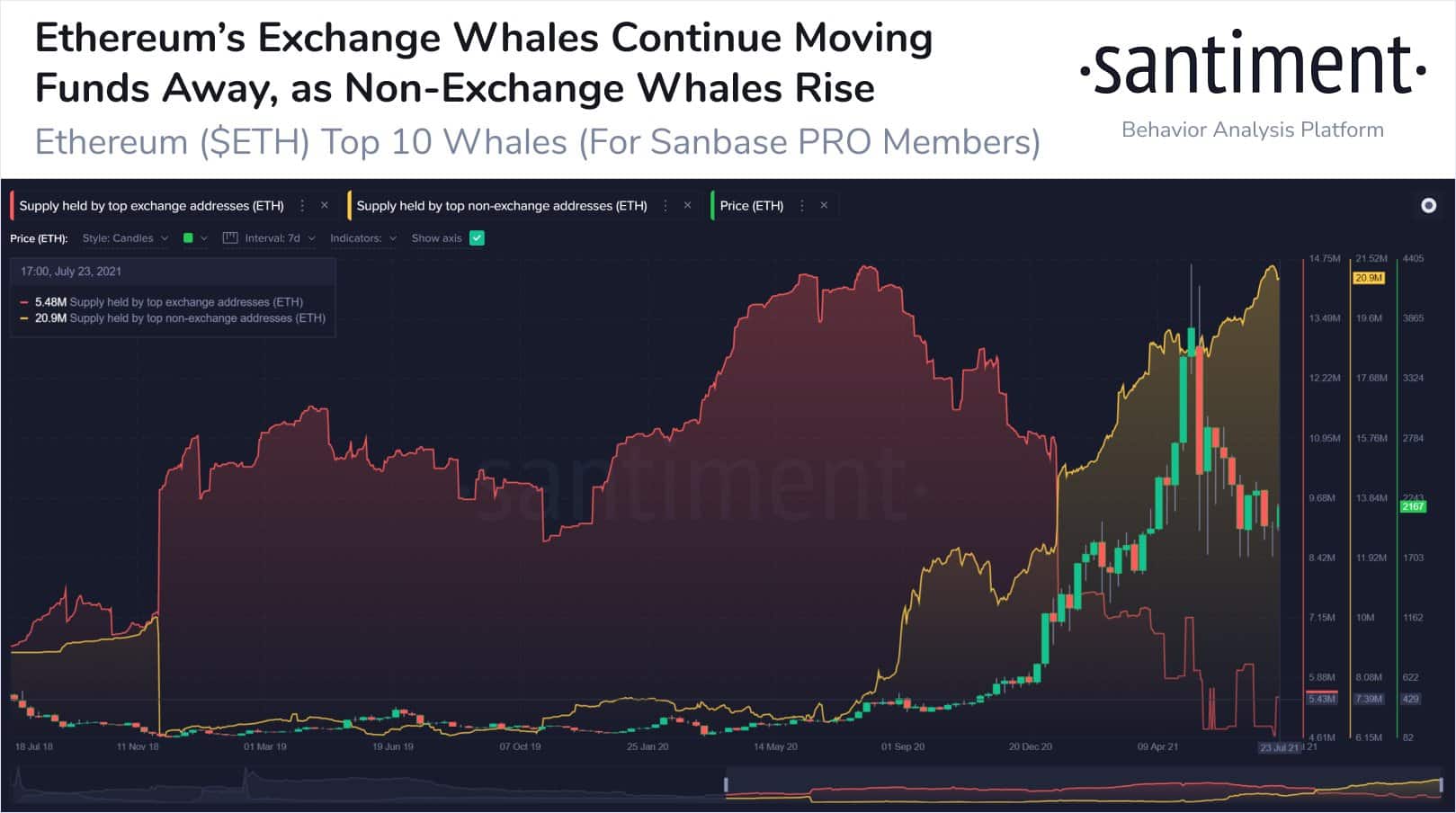

The price rally in ETH could be because of multiple factors. Strong rumors that e-commerce giant Amazon might soon integrate Ethereum payments along with Bitcoin by the end of this year. On the other hand, on-chain data shows that the supply held by Ethereum’s top ten non-exchange whale addresses has hit a 5-year high. On-chain data provider Santiment reported:

“Ethereum’s top 10 non-exchange whales are adding on to their holdings, as their 21.3M $ETH held this week established a new 5-year high. Meanwhile, top 10 exchange whales recently hit a low of 4.66M $ETH, the lowest since ETH’s 2015 inauguration”.

In another milestone, the total number of validator nodes on the Ethereum 2.0 blockchain has crossed 200,000. At the same time, a large number of Ether (ETH) are staked with deposit contracts on Ethereum 2.0. The pledged deposits in these contracts have crossed 6.4 million ETH with a total pledged value of $13.5 billion.

The number of Ethereum 2.0 validator nodes has exceeded 200,000, and the pledge deposit has reached 6,405,691 ETH. pic.twitter.com/pVMzCPSkKy

— Wu Blockchain (@WuBlockchain) July 26, 2021

Ethereum Exchange Supply Declining

While the ETH price has been trading under pressure for the most part of the last month, the supply at the exchange has also been on a constant decline. All exchanges are having a negative net position for Ethereum and the exchange outflows have shot up significantly. The net ETH outflows at the exchanges have reached the levels of September 2020.

ETH on exchanges took a real plunge last month. pic.twitter.com/RazSjJufHK

— Lex Moskovski (@mskvsk) July 25, 2021

If we look at Ethereum (ETH) price on the weekly chart, it has gained 23.46% in the last seven days. Besides, today’s price surge has been backed with a strong surge in the ETH trading volumes. If the ETH price manages to move past its 50-day moving average (DMA) of $2450, it will setting up itself for an upward journey.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Price Rebounds as Jane Street “10 am Dump” Pattern Stops Amid Lawsuit

- US OCC Proposes Rule to Implement GENIUS Act & Prohibits Stablecoin Yield

- ETHZilla Abandons Ethereum, Rebrands as Forum to Focus on RWA Tokenization

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale