Ethereum Records $4.7 B in Daily Volume at Binance While Rising ETH Fees Raises Concerns

Ethereum’s surge above $1,000 to record a new yearly high of $1,153 helped the second-largest cryptocurrency by market cap to record new highs including a market cap over $100 billion for the first time since the last bull run. ETH in its current bullish rally also flipped bitcoin for the highest daily spot trading volume on Binance for a brief period of time with $4.7 Billion volume.

Ethereum just briefly flipped Bitcoin on Binance by daily volume at $4.7 billion.

— Joseph Young (@iamjosephyoung) January 4, 2021

The record session for ETH has brought the altcoin even closer to its previous all-time-high recorded in January of 2018. One more rally of the same intensity could push the second-largest crypto to a new ATH. Ethereum is only 30% down from its ATH of $1,432, the price could soar further as the date for the Ether Futures launch by CME nears.

ETH Continues to Soar Against BTC

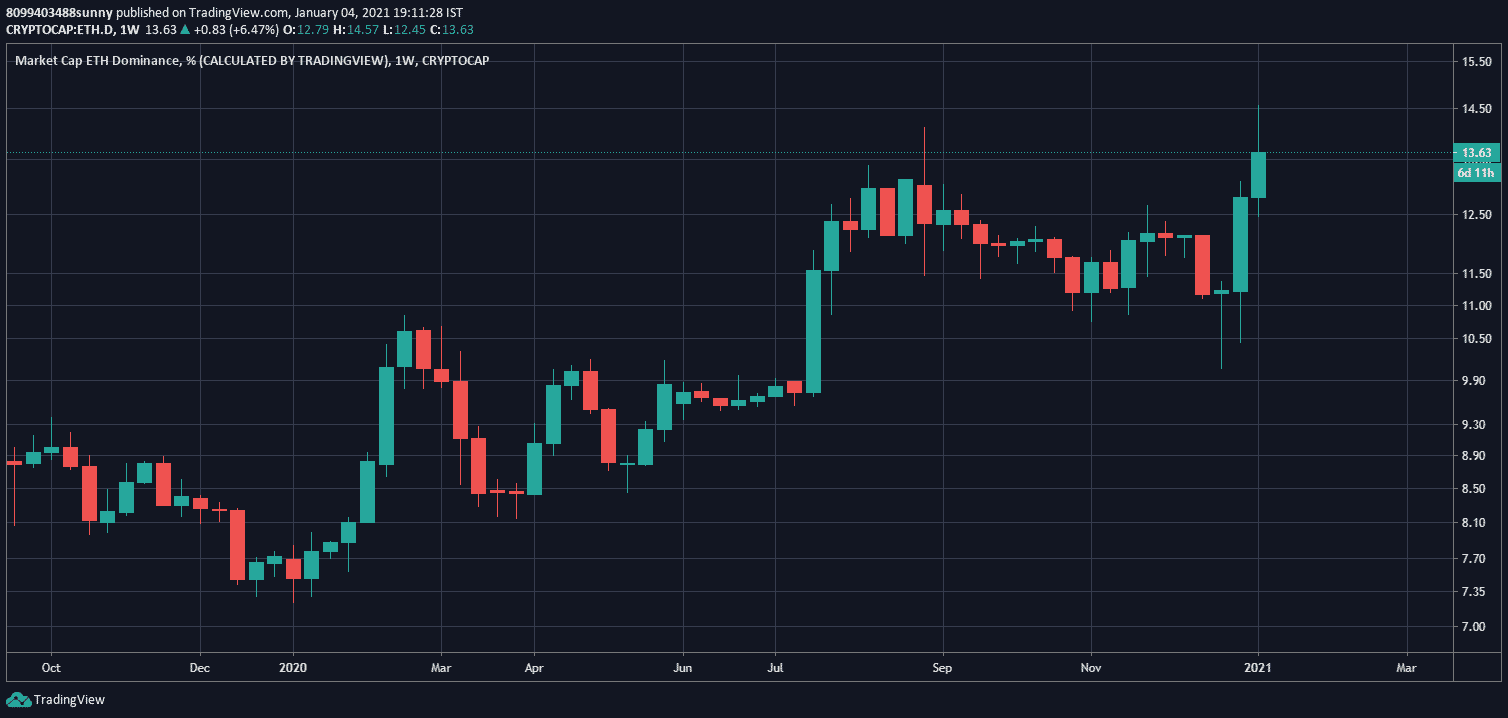

Bitcoin might have topped most of the headlines owing to its mammoth rally surging over $34,000 to create a new ATH., however ethereum is the real winner when it comes to year-to-date returns. The second largest cryptocurrency broke a crucial resistance against bitcoin last week at 0.0263 which has surged to 0.0320 by now. The market dominance of Ether is also on the rise in the past week rising over 13.63.

On the other hand, bitcoin dominance is trying to breach 73% and has been rejected on several occasions which might work in favor of altcoins as a declining market dominance of bitcoin often indicate towards a probable alt season.

BOOM here comes the Altseason, as per prediction in tweet above ???? ! $BTC dominance got rejected at 73% & made a bearish doji candle on weekly chart ! $ETH on the BTC pair bounced hard from supports and is attempting to breakout out of the Bull Flag ! #Altseason is here???? pic.twitter.com/TdlaONNTPG

— Syed Hussaini ???????????? (@Safi_hussaini91) January 4, 2021

Ethereum’s Rising Gas Fee Could Halt Its Progress?

When everything seems going in favor of ETH, the ghosts of exponential gas fee has come back to haunt the cryptocurrency again. The average gas fee as the demand for the cryptocurrency rose, ranged from $7 to $155 making it impossible for small traders to get their transaction verified. The same problem has haunted Ethereum throughout last year, where in certain exceptional cases a few traders had to pay thousands of dollars for their transaction approval.

OMG!! Ethereum transactions are more than $7 a pop. How will people be able to afford a cup of coffee in the third world?? pic.twitter.com/Tm16wLfv3x

— Mati Greenspan (tweets ≠ financial advice) (@MatiGreenspan) January 4, 2021

The launch of ETH 2.0 promises to take care of the long pertaining issue, however the launch of the new PoS based network would take at-least another two years and till then the developers must come with a temporary solution to avoid unnecessary congestion especially at these times when the demand for ETH is skyrocketing.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs