Ethereum Foundation Sells ETH Amid Spot Ether ETF Debut

Highlights

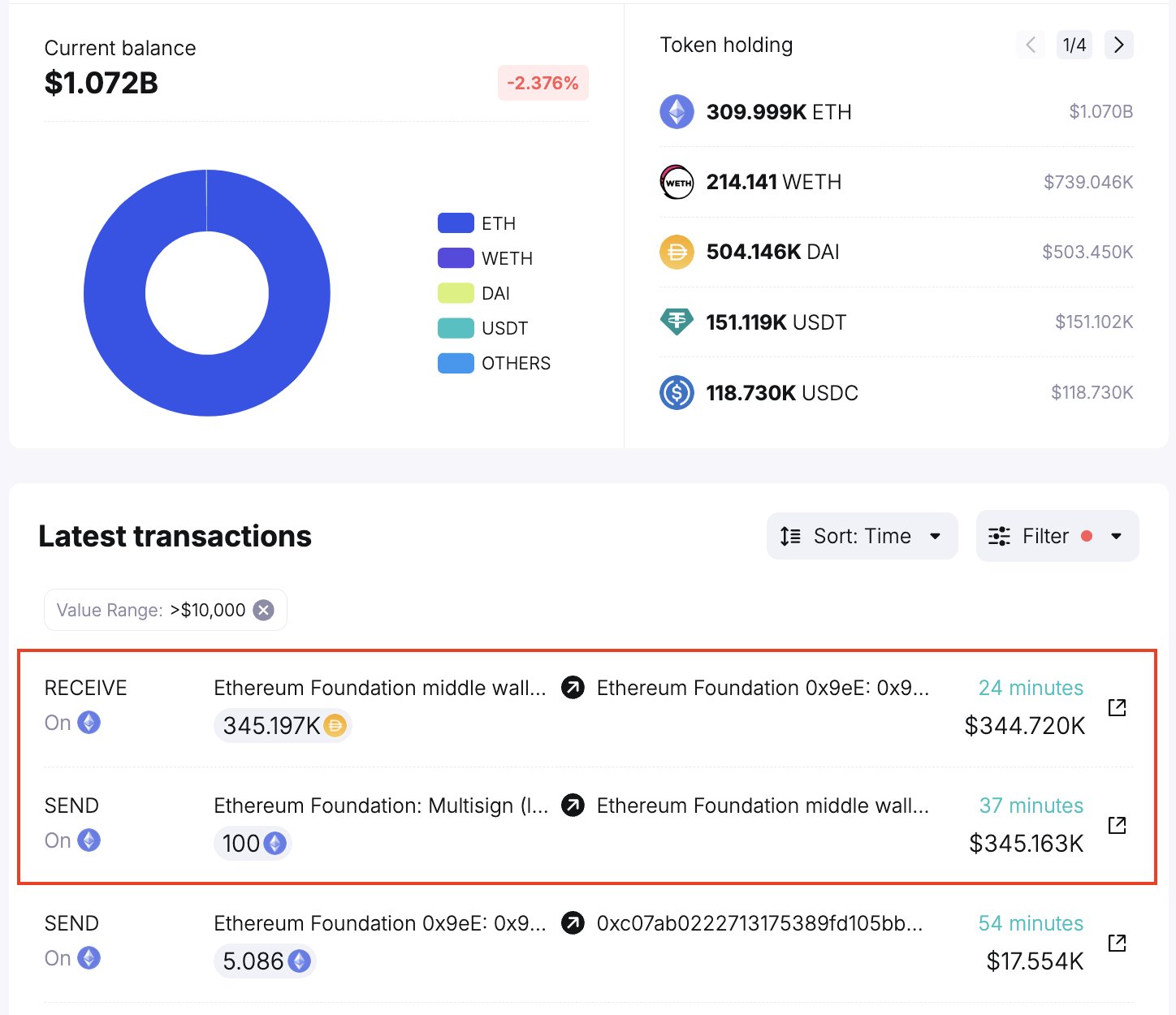

- Ethereum Foundation sold 100 ETH for 345,179 DAI.

- Ethereum Foundation offloading Ethereum ahead spot Ethereum ETF launch raises skepticism.

- ETH price trades higher at $3,505.

Ethereum Foundation has just sold 100 ETH, according to a transaction on Tuesday. The move raises eyebrows in the crypto community as the foundation sold the crypto asset just before the spot Ethereum ETF listing and trading today. Traders didn’t respond immediately to the selloff by the foundation.

Ethereum Foundation Wallets Offloading ETH

It’s a huge week for Ethereum and ETH with the spot Ether ETFs set to go live today. However, Ethereum Foundation-linked wallets are selling the crypto asset ahead of ETF launch.

In a significant development on July 23, Ethereum Foundation sold 100 ETH for 345,179 DAI. Notably, the transaction came just before the start of spot Ethereum ETFs trading today. Traders look out for further cues as institutions continue to send ETH to crypto exchanges or other wallets.

As per on-chain data platform Spot On Chain, Ethereum Foundation has sold 2,366 ETH for 6.9 million DAI stablecoin this year. The last Ether selloff by the foundation was noted on July 2. Investors panicked due to offloading by foundation-linked wallets, but overall sentiment remain positive.

In addition, the wallet address “0xdb3” linked to Ethereum Foundation or Ether ICO moved 3,200 ETH worth $11.2 million to Kraken. Grayscale also transferred $1 billion in Ethereum to Coinbase ahead spot Ethereum ETF debut.

Also Read: OKX To Delist XRP, SHIB, ADA, & 27 Crypto In BTC and ETH Pairs

US SEC Issues Effectiveness Notice For Ether ETFs

U.S. SEC has issued the S-1 application effectiveness notice for all spot Ethereum ETFs. Issuers including BlackRock’s iShares, Fidelity, Franklin Templeton, Bitwise, VanEck, 21Shares, Invesco Galaxy, and Grayscale are set to start trading today.

Grayscale Ethereum Trust (ETHE) and BlackRock ETF (ETHA) are witness massive trading activity in pre-market hours, as per Yahoo Finance.

ETH price jumped 0.50% in the past 24 hours, with the price currently trading at $3,505. The 24-hour low and high are $3,425.80 and $3,539.53, respectively. Furthermore, the trading volume has increased by 40% in the last 24 hours, indicating a rise in interest among traders.

Futures trading also records buying, with a 4% increase in ETH futures open interest in the lat 24 hours. The total Ethereum OI rises to $15.33 billion, as per CoinGlass.

Also Read: Terra Sets Preliminary Date For LUNA, LUNC, USTC Recovery

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- Ripple CEO Hints Crypto Bill Is Near Deal, Sets April as Approval Timeline

- Wall Street Giant Signals XRP Price ‘Long Winter’ After Cutting Target By 65%

- Shark Tank Kevin O’Leary Warns Bitcoin Crash as Quantum Computing Threats Turns Institutions Cautious

- Japan’s SBI Clears XRP Rumors, Says $4B Stake Is in Ripple Labs Not Tokens

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling