Crypto Market Liquidations Top $1 Billion Again With Ethereum Leading, Buy The Dip Opportunity Ahead

Highlights

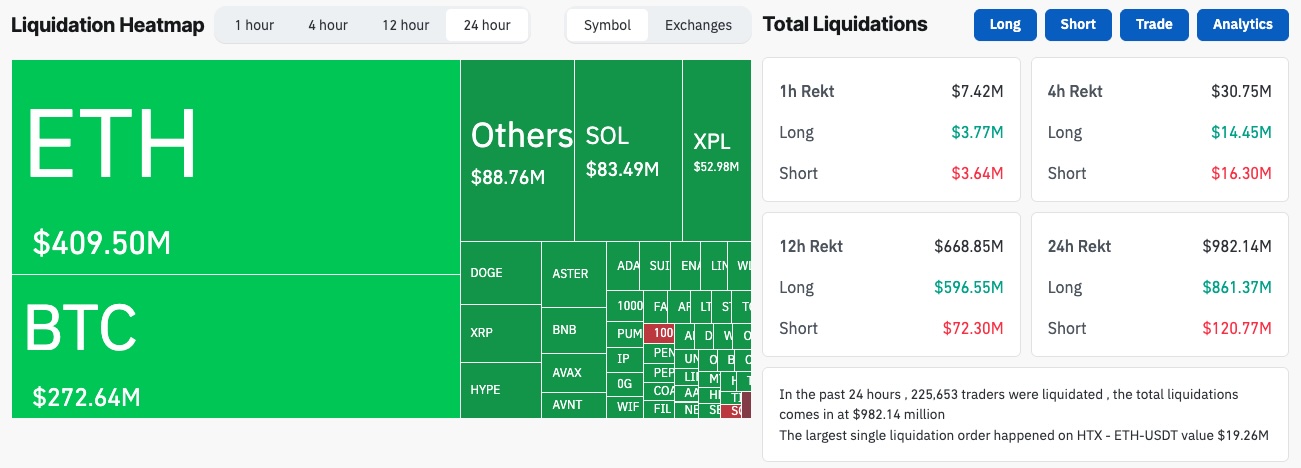

- Ethereum accounted for $409 million in liquidations, while Bitcoin saw $272 million in the last 24 hours.

- Spot Ether ETFs recording over $250 million in outflows, despite the launch of first staking ETF.

- Analysts highlight buy-the-dip opportunities, noting that Ethereum is in the final leg of correction.

Crypto market liquidations crossed $1 billion for the second time this week, with Ethereum (ETH) once again leading the downturn. The sell-off pushed ETH below $3,850, triggering a sharp wipeout of leveraged long positions. Despite the 20% ETH price drop from its peak, analysts point to potential buy-the-dip opportunities.

Crypto Market Liquidations Soar $1.1 Billion, Ethereum Leads Altcoin Crash

A massive crypto selloff has once again triggered strong liquidations, shooting past $1.1 billion for the second time this week. The cryptocurrency market faced heavy turbulence over the past 24 hours, with 233,337 traders liquidated and total liquidations reaching $1.06 billion, ahead of the massive $23 billion crypto options expiry.

The largest single liquidation occurred on Hyperliquid, where an ETH-USD order worth $29.12 million was closed, as per data from Coinglass. Ethereum’s contribution to the overall crypto market liquidations, in the last 24 hours, is a massive $409 million. Bitcoin (BTC) stands second at the moment with $272 million in long liquidations.

On the other hand, the outflows from spot Ether ETFs have skyrocketed to more than $250 million, with Fidelity’s FETH leading the most outflows at $158 million. This shows that institutional sentiment around ETH has been waning quickly. Interestingly, the launch of the first Ether staking ETF, hasn’t much helped in changing the market sentiment.

Should Investors Buy ETH Price Dips?

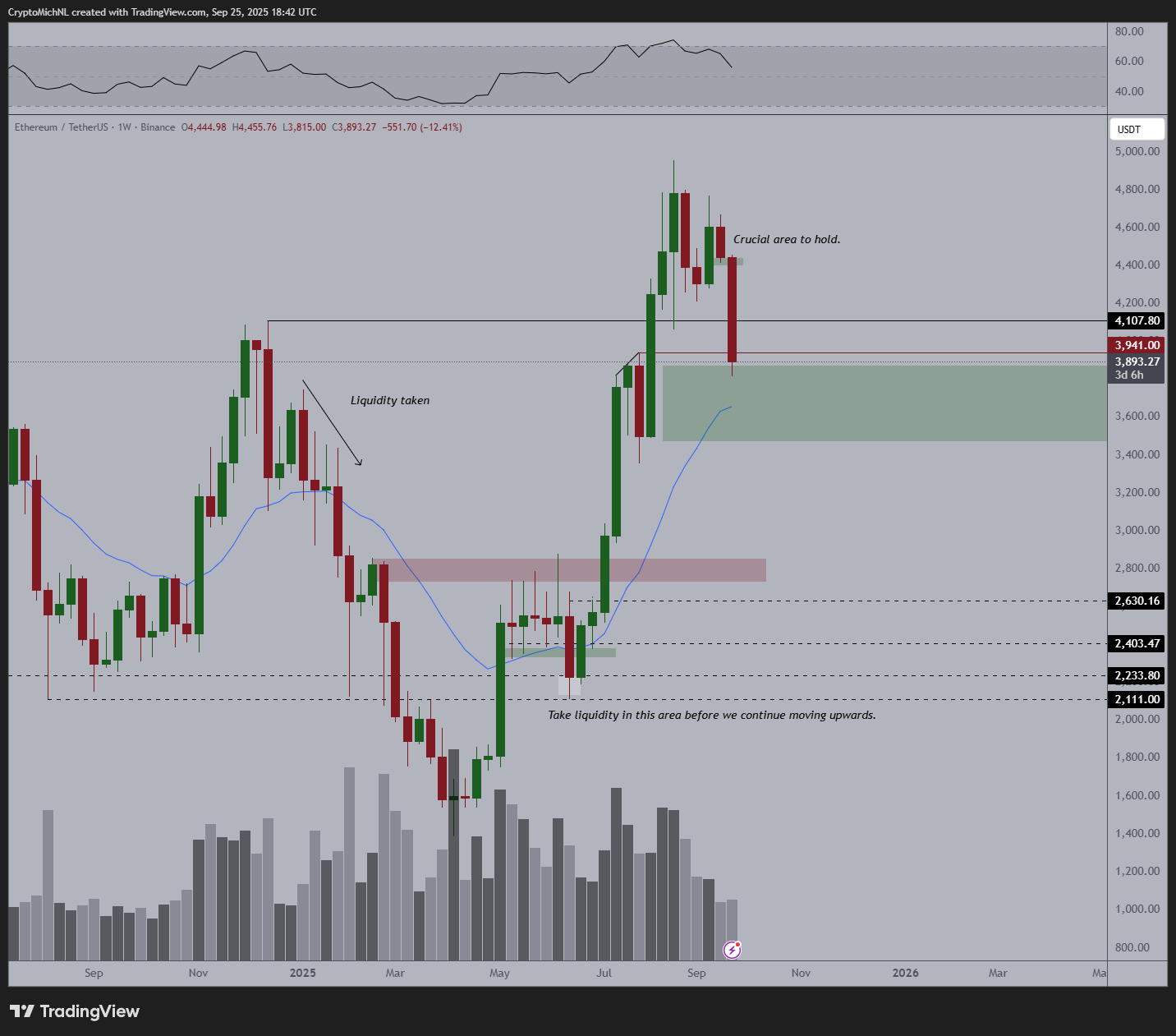

Crypto analyst Ted Pillows outlined critical support and resistance levels for Ethereum (ETH) as the market faces heightened volatility. According to Pillows, ETH is holding support near $3,822, its recent low. A breakdown below this level could push the price further toward $3,700–$3,750. With the ETH price crashing under $4,000 support, Peter Schiff issued a warning to investors. However, others see this as a buy-the-dip opportunity.

On the upside, Pillows noted that the resistance lies between $3,960 and $4,000. The analyst noted that ETH is now “entering the buy zone”.

$ETH is now entering the buy zone.

I hope you didn't FOMO at the top. pic.twitter.com/2ChzR2vnRh

— Ted (@TedPillows) September 25, 2025

Crypto analyst Michael van de Poppe highlighted Ethereum’s (ETH) technical setup. He pointed out a significant gap with the 20-day exponential moving average (EMA) and the weekly 20-EMA closing in. Van de Poppe said these signals suggest the market may be nearing the bottom of its current correction. He added that the conditions present a potential buying opportunity for investors.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs