Fed Announcement Triggers Biggest Trading Day For Gold & Silver; Will Bitcoin (Btc) Follow?

The much-awaited Federal Open Market Committee (FOMC) meeting took place yesterday, and inflation hedges such as the gold and silver market responded optimistically to the announcements.

FED meeting noted that the authorities will not be making any changes to the interest rates and doubling the rate of its bond tapering. As a result, crypto turned green overnight, and the traditional Gold and Silver experienced the biggest trading volume day.

The VanEck Junior Gold Miners ETF (GDXJ), which tracks the MVIS Global Junior Gold Miners Index, saw the largest volume all year, with 18 million shares traded.

HUGE VOLUME! In Gold and Silver stocks.

Might be the largest volume day of the year.

Big reversal day on volume.$GDXJ pic.twitter.com/V3EZknQAHr

— Peter ⚒ Spina | Gold & Silver Maximalist (@goldseek) December 15, 2021

Will Bitcoin follow Gold & Silver?

With Gold and Silver seeing a dead cat bounce post fed announcement, the crypto market could see similar price action. Especially, since crypto already turned green and the global crypto market cap reached $2.26T, at a 2.93 percent increase over the last day.

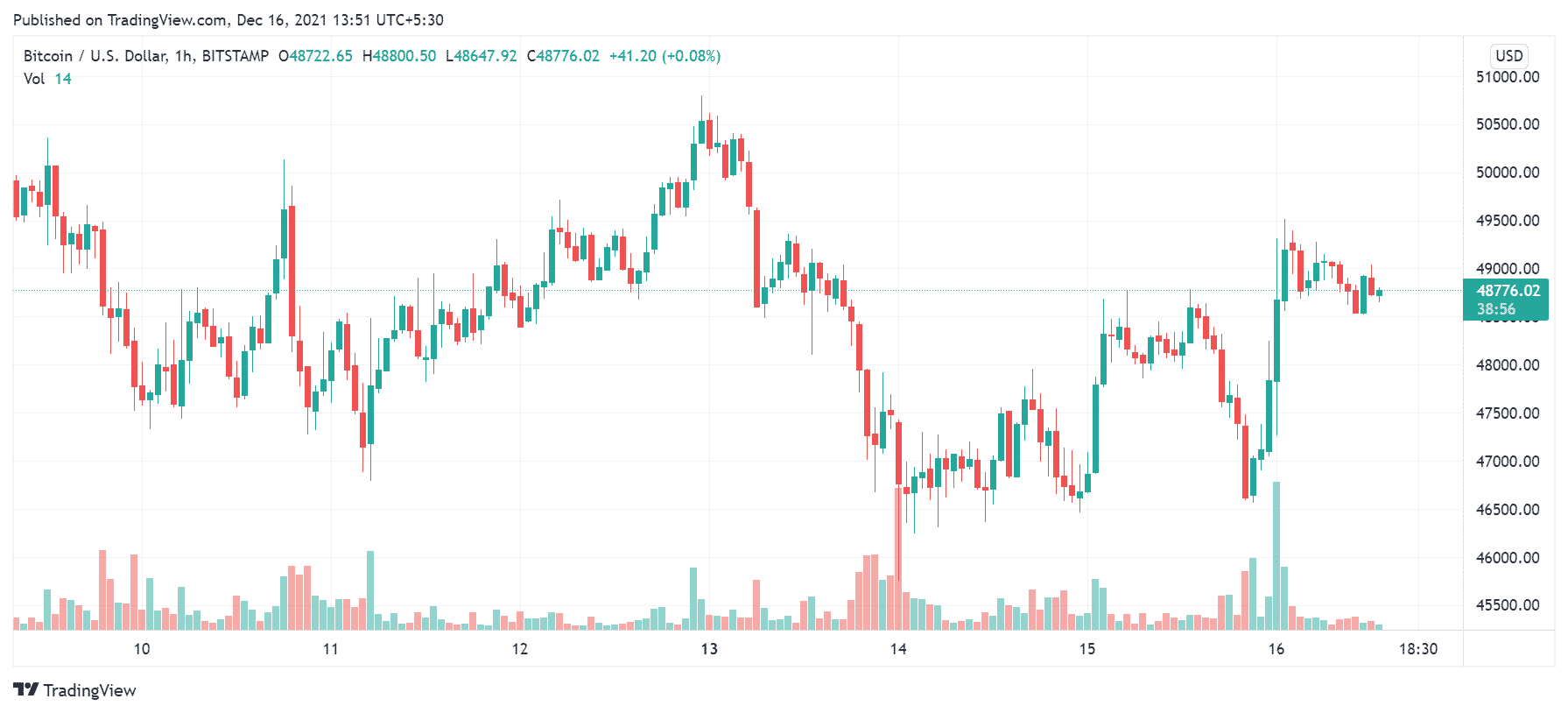

The top cryptocurrency Bitcoin crossed the $48k barrier and is now eyeing for $49k and above. Additionally, the ultimate altcoin Ether (ETH) also managed to rise above $4,000 after stagnantly staying below, amid the short bear. At last, following the bull of these top two cryptocurrencies, the rest of the crypto market also marched towards a greener graph.

Earlier this week, Bitcoin’s price fell as low as $45,894. The consistent bear period was attributed to the shorting mentality regarding the FED meeting which was expected to announce the faster tapering of bond purchases, further triggering an upswing in inflation hedges like gold and Bitcoin.

Now that Gold has achieved the predicted success, the question arises whether Bitcoin is next in line? According to CoinGape’s reportage, Bitfinex crypto exchange’s limit order book also defined the current downturn in the crypto market as the perfect “Buy the News” scenario, where, right before the FOMC meeting, the market was looking at the ultimate investment opportunity for retail investors.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs