First Chainlink ETF Sees Massive Investor Activity with $41M in Inflows on Launch

Highlights

- Grayscale's Chainlink ETF saw over $41 million in first-day inflows.

- GLNK reached $64 million in assets and also showed high trading volume.

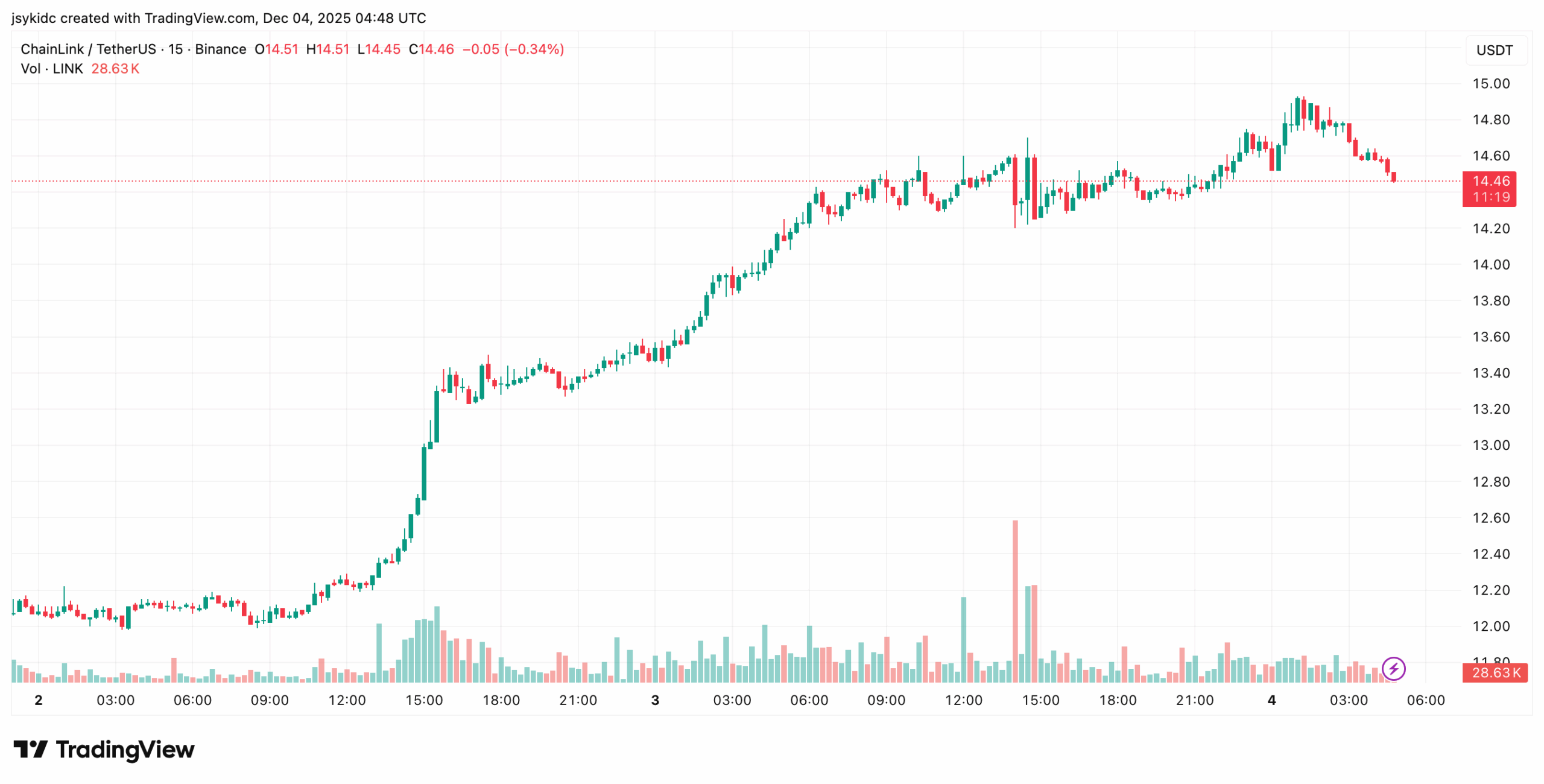

- LINK price surged over 6% in the past 24 hours.

Grayscale launched the first Chainlink ETF in the market yesterday. The fund saw massive investor activity for a first product, with inflows from investors amounting to over $41 million.

Chainlink ETF Records Strong Debut With $41M in First-Day Flows

The newly launched Grayscale product, traded under the ticker GLNK. It attracted nearly $42 million on day one. According to Bloomberg ETF analyst James Seyffart, that is a “very good opening for a new launch.” He also added that the Chainlink ETF reached $64 million in assets while showing strong trading volume.

So, $GLNK took in ~$42 million on day 1. Not "blockbuster" success but very good for a new launch. Volume was strong. The fund currently sits at $64 million in assets. Chainlink showing that longer tail assets can find success in the ETF wrapper too. https://t.co/CgVCxlykGr

— James Seyffart (@JSeyff) December 3, 2025

Seyffart said that the performance is all the more notable given the broader market downturn.

“Add in the fact that crypto hasn’t been performing well for the last month or two and it gets even more impressive,” he said.

Grayscale’s launch makes it the first U.S. exchange-traded product tied to Chainlink. This product gives investors exposure to Chainlink through an ETP structure instead of a traditional 40-Act ETF. This move is part of Grayscale’s plan to make it easier for people to access assets that are important for tokenization and data-oracle sectors.

While GLNK is now trading on NYSE Arca, attention also shifts to Bitwise’s Chainlink ETF. The product was listed on the DTCC under the ticker CLNK last month. The appearance on DTCC is an administrative step and not necessarily an approval.

GLNK directly holds Chainlink’s native token. This product lets investors access a project that is key in on-chain data infrastructure. However, the firm has warned that the product carries elevated risk and is not to be considered a traditional ETF.

Will LINK Price Continue Its Upward Move on ETF Launches?

While Investors wait for the launch of Bitwise’s fund, experts wonder how high the token could go once its live. For example, the token is up more than 6% in the 24 hours since the GLNK went live. Its trading volumes went up some 180% above average as market participants position around the new product.

Also, Bloomberg’s Eric Balchunas shared the sentiment of strong liquidity on the first sessions. He noted that GLNK posted about $13 million in day-one trading volume and was on pace to repeat the feat. “Another insta-hit,” he called it.

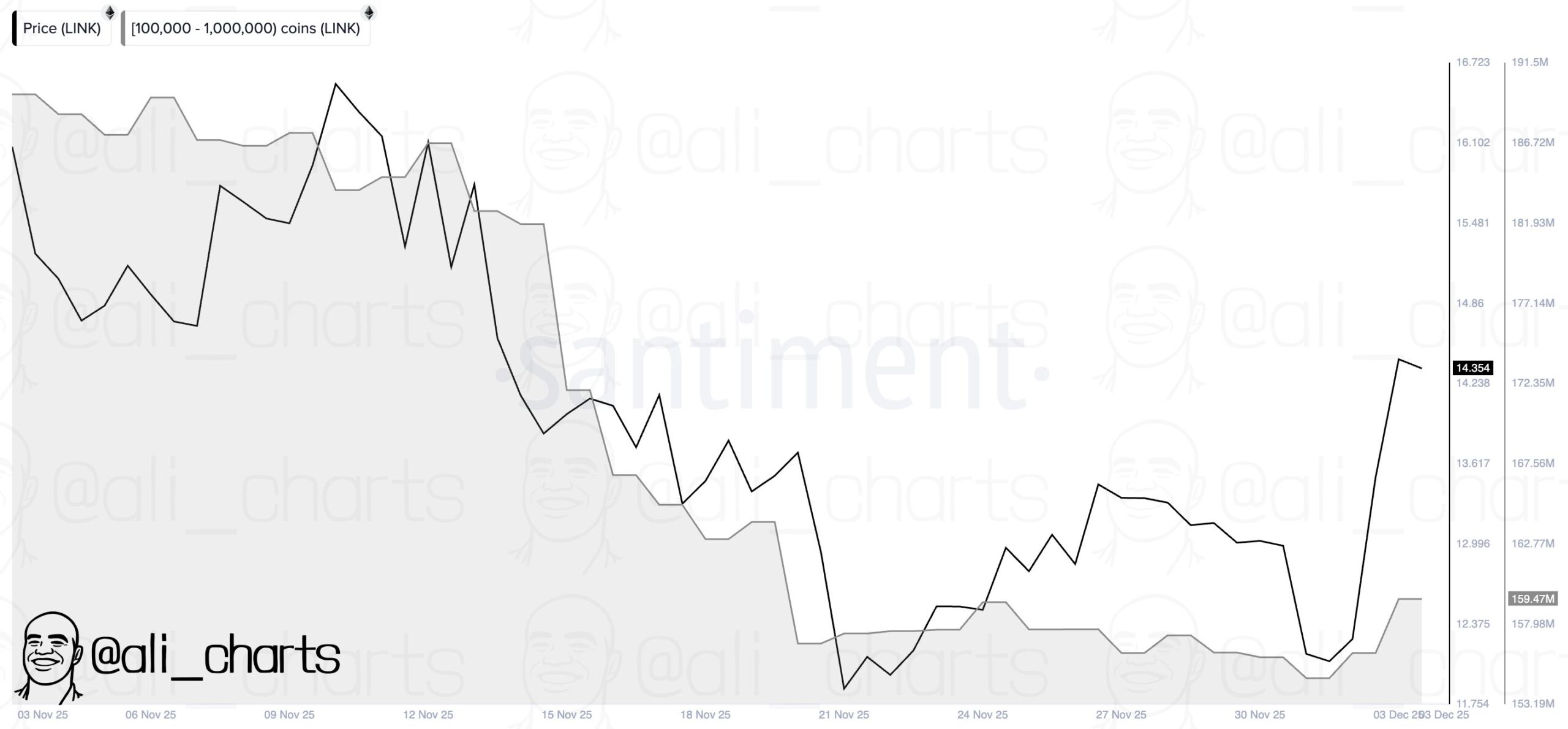

He also pointed out that the DOGE ETF is the only low performer among recent crypto ETF releases. To add, Analyst Ali Martinez reported that major investors bought 4.73 million LINK in just 48 hours.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs