First North American Bitcoin ETF Acquire 1,032 BTC in a Day as BTC Price Rise Above $51K

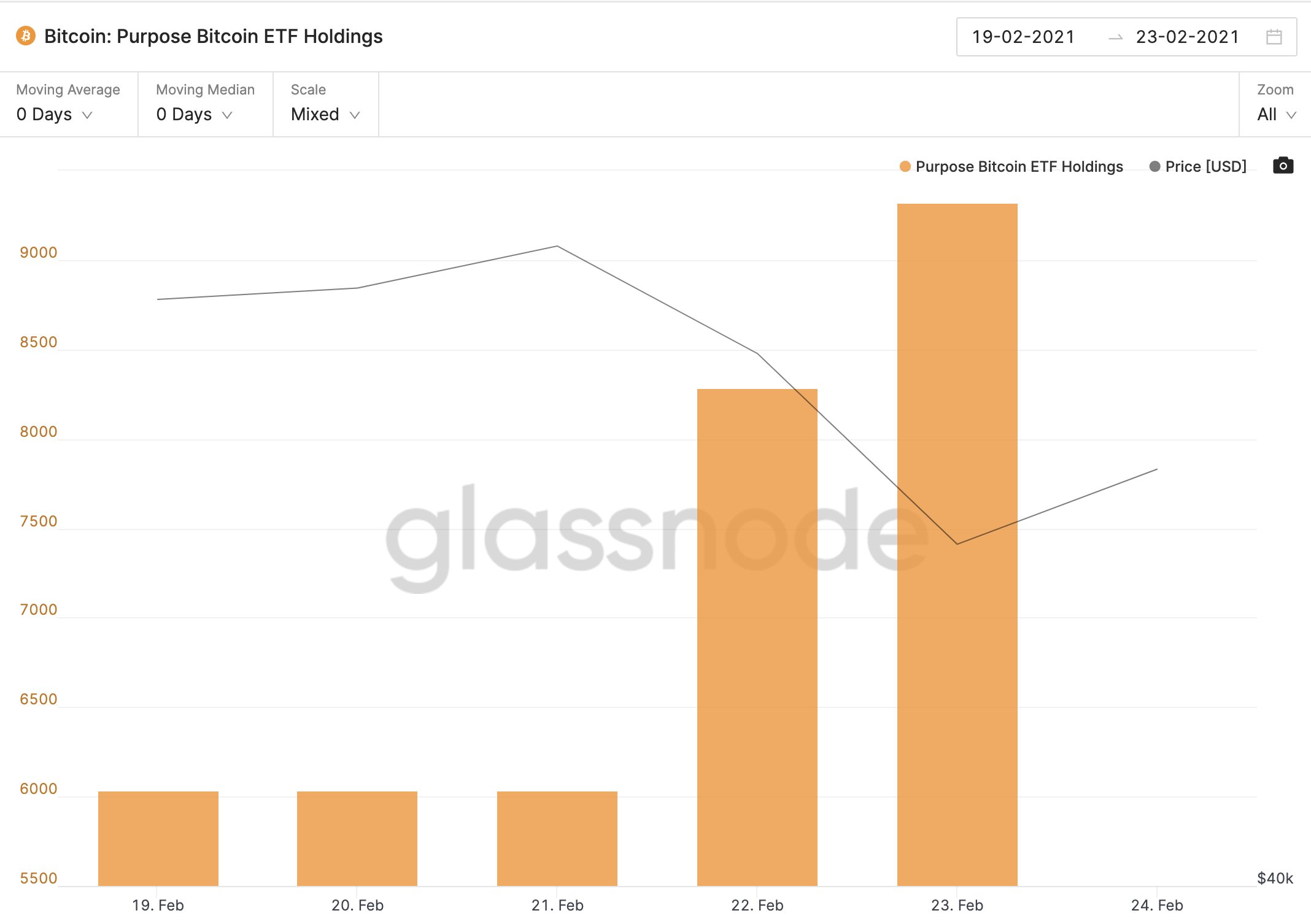

The first North American Bitcoin ETF launched by Purpose Group has seen tremendous growth over the past week, as the Canadain Bitcoin ETF now has 9320 BTC under its management within a week of its launch. Out of those 9320 BTC, nearly 1032 BTC came from the market yesterday which also saw the highest liquidation in crypto history worth $6 billion owing to the market crash that saw major cryptocurrencies lose nearly 20% of their market cap.

The Purpose Bitcoin ETF which was launched only last week had a phenomenal opening day as it traded nearly $180 million-plus worth of Bitcoin contracts on its very first day. The newly launched Bitcoin gathered stream on a day when most of the futures position was liquidated owing to a sharp price fall. The launch of the Purpose Bitcoin ETF has also heightened the demand for a similar bitcoin-focused exchange-traded fund in the US.

Purpose #Bitcoin ETF has acquired 9,320 BTC in 4 days since its launch. Yesterday alone, it added 1,032 BTC, bringing it's total AUM to $474M USD. pic.twitter.com/PrF5pv5zdq

— Bloqport (@Bloqport) February 24, 2021

The US regulators up until now have rejected all the Bitcoin ETF applications claiming the market is not big enough to launch an ETF as it may lead to market manipulation. However, a change of administration along with rising institutional adoption of Bitcoin could play a catalyst in approving the first Bitcoin ETF in the US.

The crypto market breathed a sigh of relief today as Bitcoin bounced above $50K to register a new daily high above $51,000. Ethereum that fell bel0w $1,400 briefly also managed to climb above $1,700 and other altcoins also showed signs of recovery after a two-day blood bath.

Bitcoin Futures Record New ATH

Bitcoin Futures market registered its highest daily trading volume yesterday as markets crashed to weekly lows. Not just the Futures market, even spot and options registered one of the most active days in months.

#bitcoin futures volume all-time-high yesterday pic.twitter.com/steg99xA58

— skew (@skewdotcom) February 24, 2021

CME Futures market also set a new record in terms of volume the day before yesterday when the market meltdown began.

CME ether futures logged a record volume day yesterday on new crypto market jitters pic.twitter.com/lsapnEw7mn

— skew (@skewdotcom) February 23, 2021

However, it is important to note that despite Bitcoin losing more than $10K within two days, the fall was only 20% which is quite astonishing to think given not even a year ago, Bitcoin was trading below $4,000 after March mayhem last year.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- What US SEC-CFTC Harmonization Means for the Crypto Market & Regulation?

- Breaking: Trump Declares Victory in Iran War, Vows to ‘Finish the Job’

- Ripple’s Valuation Tops $50B As Firm Begins $750M Share Buyback

- FDIC Proposes No Insurance for Stablecoins Under GENIUS Act Amid Banks’ ‘Deposit Flight’ Fears

- Ripple Joins Mastercard Crypto Partner Program to Advance On-Chain Payments

- XRP Price Outlook as Ripple to Acquire BC Payments Australia for Financial License

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200

- XRP Price Prediction as Goldman Sachs Becomes Biggest Holder of Ripple ETFs

- Circle (CRCL) Stock Price Prediction Ahead of CPI Data Release-Is 120 Next?

- Bitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week