FOMC Meeting: Fed Expected to Approve Rate Cut on Dec. 10

Highlights

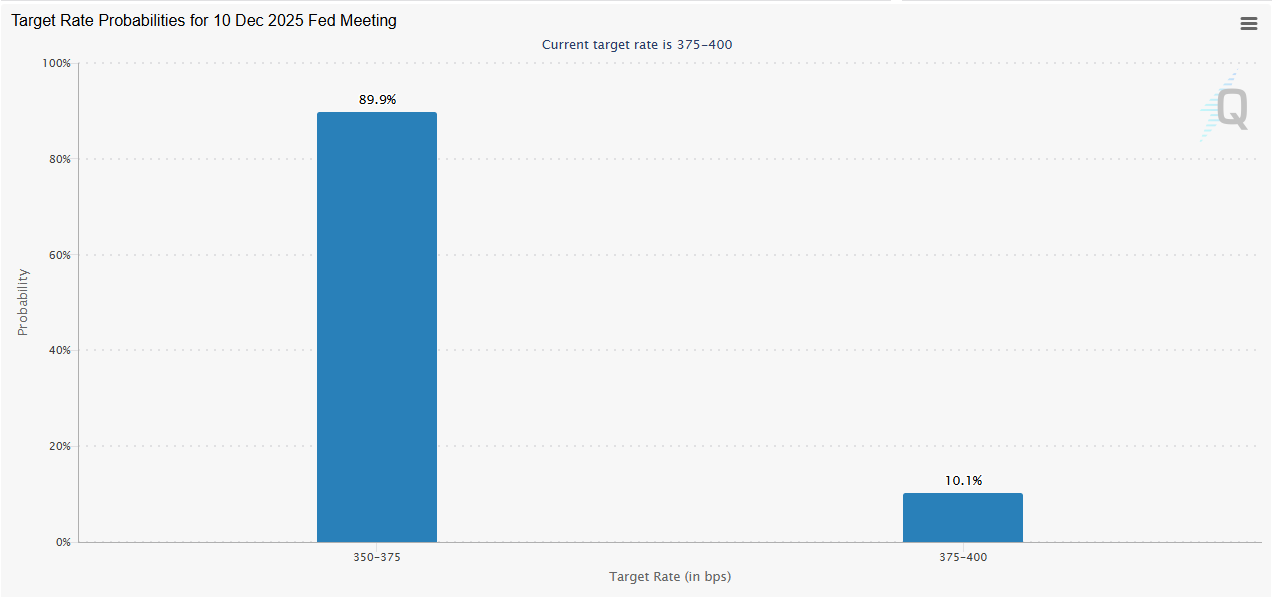

- There is a 90% chance that the Fed will a third rate cut of the year at this week's FOMC meeting.

- Bitcoin had bounced above $90,000 as market participants anticipate this rate cut.

- Based on historical trends, the flagship crypto is at risk of falling after the Fed meeting.

The December FOMC meeting is holding this week, with market participants betting on the committee making a third rate cut of the year. Notably, the Bitcoin price and broader crypto market have rebounded in anticipation of a cut, though historical trends suggest a crash following the meeting this Wednesday.

Fed To Make Third Rate Cut Of The Year At This Week’s FOMC Meeting

CME FedWatch data shows a 90% chance the Fed will cut rates again by 25 basis points at this week’s meeting on December 10. This potential cut will mark the third rate cut of the year, after the committee lowered rates in September and October.

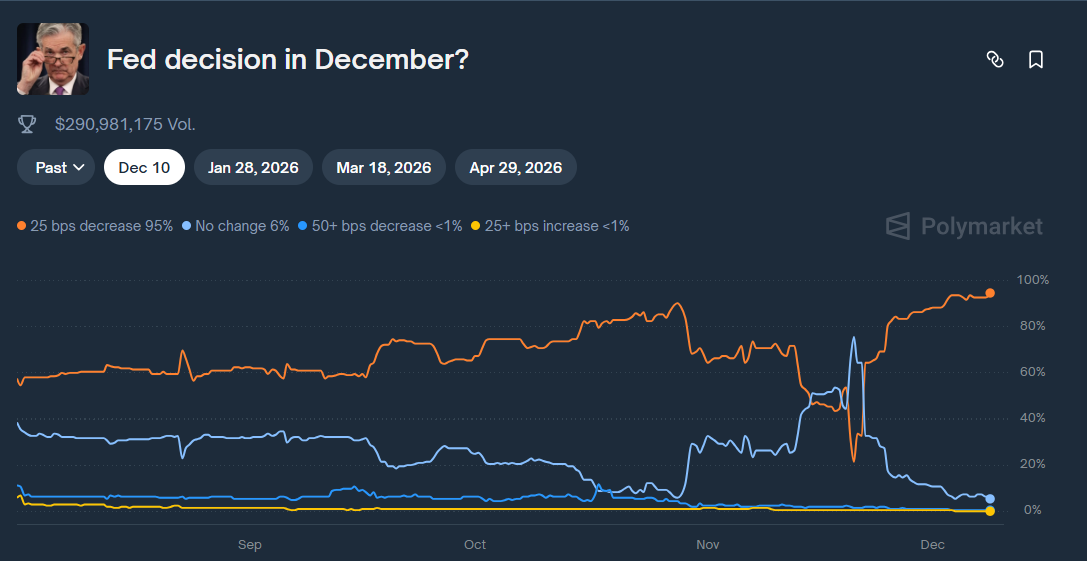

Crypto traders are also betting on the Fed lowering rates at this week’s FOMC meeting. Polymarket data shows a 95% chance that the committee will make a third rate cut this year at the December 10 meeting.

The odds of a rate cut increased following the release of several macroeconomic data last week, including the September U.S. PCE inflation. The core PCE came in below expectations year-over-year, suggesting that inflation isn’t rising sharply as some Fed officials fear.

During a CNBC interview today, prospective Fed Chair Kevin Hassett also advocated for a 25 basis points rate cut ahead of the December 10 FOMC meeting. However, he stated that they should continue to review the incoming data for upcoming rate-cut decisions.

As CoinGape reported, Hassett has emerged as the favorite to replace Fed Chair Jerome Powell, with Trump recently calling him the “potential Fed chair.” His potential emergence as the next Fed chair is expected to give the U.S. president more control over the Fed even as he continues to advocate for lower interest rates.

How Will BTC React Following The Meeting?

Based on the trend throughout the year, Bitcoin and the broader crypto market are at risk of a significant decline following this week’s FOMC meeting. Crypto analyst Ali Martinez recently pointed out the flagship crypto’s price action following the seven meetings that have been held this year.

The BTC price has heavily corrected following six out of the seven meetings this year. The flagship crypto dropped by 19% following the October meeting, when the Fed made the second cut this year. The largest drop came during the January meeting, when it declined by 25%. On average, Bitcoin has declined by 15% after each meeting this year.

In line with this, Martinez urged market participants to stay cautious. With another rate cut already priced in, the focus will be on Jerome Powell’s press conference after the FOMC meeting, which could provide insights into the Fed’s stance on monetary policy heading into 2026.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs