FOMC Meeting: Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps

Highlights

- The Fed has cut interest rates by 25 bps in line with expectations.

- Attention will now turn to Powell's speech to seek guidance on whether the Fed is currently dovish or hawkish.

- Powell's speech will provide insights into the whether there will be further rate cuts this year.

The Federal Reserve has made its first Fed rate cut this year following today’s FOMC meeting, lowering interest rates by 25 basis points (bps). This comes in line with expectations, while the crypto market awaits Fed Chair Jerome Powell’s speech for guidance on the committee’s stance moving forward.

FOMC Makes First Fed Rate Cut This Year With 25 Bps Cut

In a press release, the committee announced that it has decided to lower the target range for the federal funds rate by 25 bps from between 4.25% and 4.5% to 4% and 4.25%. This comes in line with expectations as market participants were pricing in a 25 bps cut, as against a 50 bps cut.

This marks the first Fed rate cut this year, with the last cut before this coming last year in December. Notably, the Fed also made the first cut last year in September, although it was a 50 bps cut back then. All Fed officials voted in favor of a 25 bps cut except Stephen Miran, who dissented in favor of a 50 bps cut.

This rate cut decision comes amid concerns that the labor market may be softening, with recent U.S. jobs data pointing to a weak labor market. The committee noted in the release that job gains have slowed, and that the unemployment rate has edged up but remains low. They added that inflation has moved up and remains somewhat elevated.

Fed Chair Jerome Powell had also already signaled at the Jackson Hole Conference that they were likely to lower interest rates with the downside risk in the labor market rising. The committee reiterated this in the release that downside risks to employment have risen.

Before the Fed rate cut decision, experts weighed in on whether the FOMC should make a 25 bps cut or a 50 bps cut. U.S. President Donald Trump had urged Powell to make a higher Fed rate cut, which hasn’t happened. Now, attention will turn to the Fed Chair’s speech as market participants seek guidance on whether the committee is open to making more rate cuts by year-end.

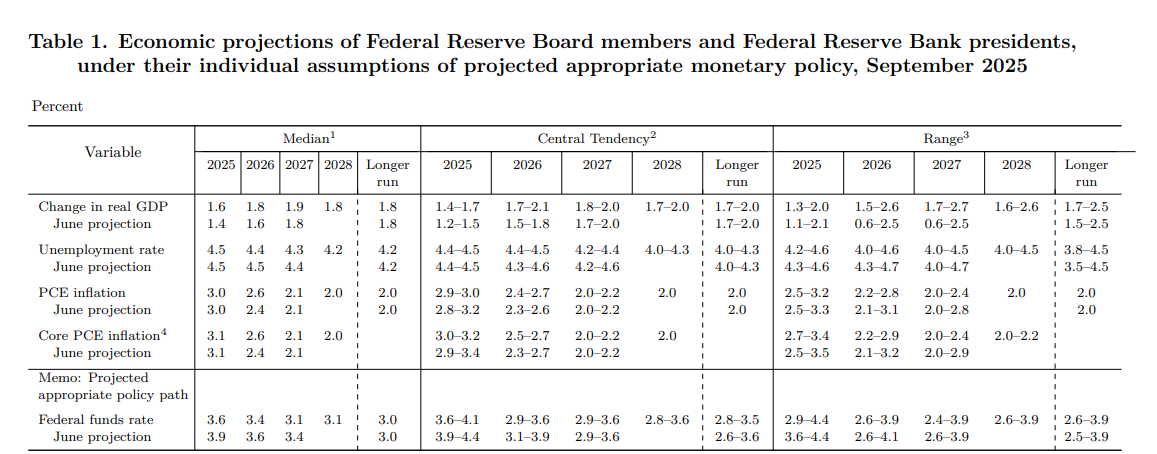

More Cuts To Come This Year

Based on the Federal Reserve’s median economic projections, there is likely to be an additional 50 bps Fed rate cut this year. This means that interest rates could still drop to as low as 3.6%.

CME FedWatch data also shows that the Fed is likely to make additional cuts this year. There is currently a 93.2% chance that the Fed will lower interest rates by 25 bps at the October FOMC meeting, bringing the benchmark rate to 3.75% and 4%. Meanwhile, there is a 92.7% chance that the Fed will cut rates again by 25 bps at the December meeting.

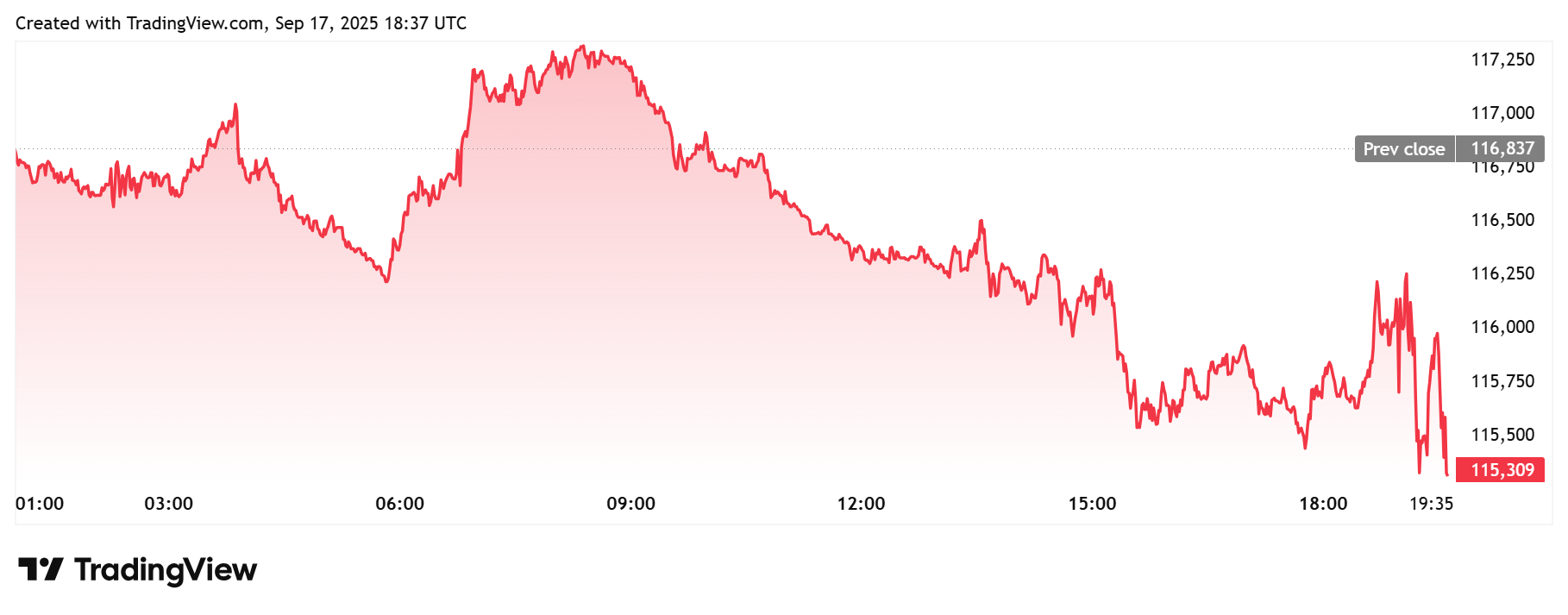

The Bitcoin price sharply dropped following the Fed rate cut decision. TradingView data shows that the flagship crypto dropped from around $116,000 and is currently trading at around $115,500.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs