FOMC Minutes: Most Fed Officials Say Further Rate Cuts Are ‘Appropriate’ If Inflation Declines

Highlights

- Most Fed officials said that further rate cuts would likely be appropriate if inflation declines over time.

- Some stated that based on their economic outlooks, it would be best to keep interest rates unchanged for some time.

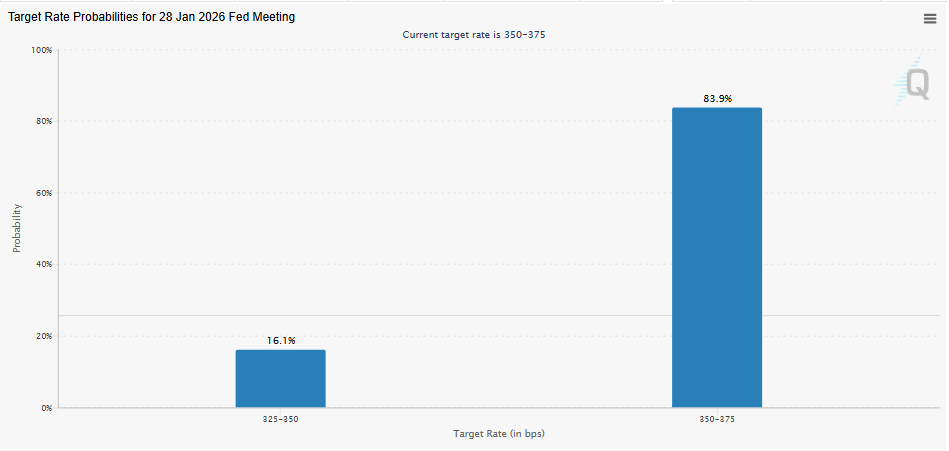

- There is currently an 84% chance that the Fed will leave rates unchanged in January.

The FOMC minutes have revealed where the Fed officials currently stand on further rate cuts heading into the new year. Meanwhile, some Fed officials said it might be best to leave rates unchanged for a while after the committee made three rate cuts this year to support the weakening labor market.

FOMC Minutes Show Most Fed Officials In Support Of Further Rate Cuts

According to the minutes of the December FOMC meeting, most participants judged that it would likely be appropriate to make further downward adjustments to the federal funds rate if inflation declined over time, as they expect. Meanwhile, regarding the extent and timing of additional cuts, some participants suggested that under the economic outlook, it would likely be appropriate to keep the interest rate unchanged for some time.

This followed the December 10 FOMC meeting, in which the Fed lowered rates by 25 basis points (bps) for the third time this year. The FOMC minutes stated that a few participants observed that keeping rates unchanged for a while would allow them to assess the lagged effects on the labor market.

These Fed officials also observed that such a move would allow them to assess the economic activity of the committee’s recent moves towards a more neutral policy stance while also giving policymakers time to acquire more confidence about inflation returning to their 2% target.

As CoinGape reported, the November CPI came in at 2.7% year-over-year (YoY), below expectations of 3%, while the core CPI came in at 2.6%, also below estimates of 3%. However, New York Fed President John Williams warned that there were likely distortions due to the U.S. government shutdown.

Monetary Policy Not On A Preset Course

Meanwhile, the FOMC minutes stated that all participants agreed that monetary policy was not on a preset course and would be informed by a wide range of incoming data, the evolving economic outlook, and the balance of risks.

Fed officials, such as Fed Governor Chris Waller, have suggested that the labor market should remain their top concern heading into 2026. This came as he said he doesn’t expect inflation to reaccelerate, but that the labor market is signaling they should make more cuts.

Market participants are currently betting that the Fed will keep interest rates unchanged at the January FOMC meeting. CME FedWatch data shows that there is currently an 84% chance that interest rates will remain unchanged.

Crypto traders are also betting that the Fed will keep rates unchanged. Polymarket shows an 865 chance that the Fed will leave interest rates unchanged at the January meeting, while there is only a 14% chance that the Fed will lower rates by 25 bps.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Arthur Hayes Sees 5x HYPE Token Rally as Oil Perps Pump on Hyperliquid Amid U.S.–Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs