Breaking: Forward Industries Buys $1.58B in SOL to Launch Solana Treasury

Highlights

- The company bought over 6.8 million SOL tokens to kick off the Solana treasury.

- It bought these tokens at an average price of $232 per SOL.

- Helius also just announced $500 million in funding to launch its Solana treasury.

Forward Industries has kicked off its Solana treasury strategy following a successful raise last week to purchase SOL. This comes as Helius, another Nasdaq-listed company, has announced plans to launch its SOL treasury.

Forward Industries Kicks Off Solana Treasury With 6.8 Million SOL Buy

In a press release, the company announced that it has purchased 6.82 million SOL at an average of $232 per SOL and for a total cost of almost $1.58 billion. This makes the company the largest Solana treasury company, well ahead of second-placed Sharps Technology.

This development follows Forward Industries’ private placement last week, in which it raised $1.65 billion to kick off this strategy. As CoinGape reported, Galaxy Digital, Jump Crypto, and Multicoin Capital led the financing round.

The company stated that it acquired the SOL tokens through a combination of open market purchases and on-chain transactions, which marks the initial deployment of the $1.65 billion it raised last week for the Solana treasury.

The purchase includes a $1 million trade, which it executed through DFlow1, a decentralized exchange aggregator, routing this liquidity through SolFi, one of DFlow’s integrated providers.

Commenting on the SOL purchases, Kyle Samani, the Chairman of the Board, said that this development marks a significant milestone as Forward Industries begins executing its Solana treasury strategy. He added that they are looking to build a strategy that will both advance the Solana ecosystem and deliver long-term value for their shareholders.

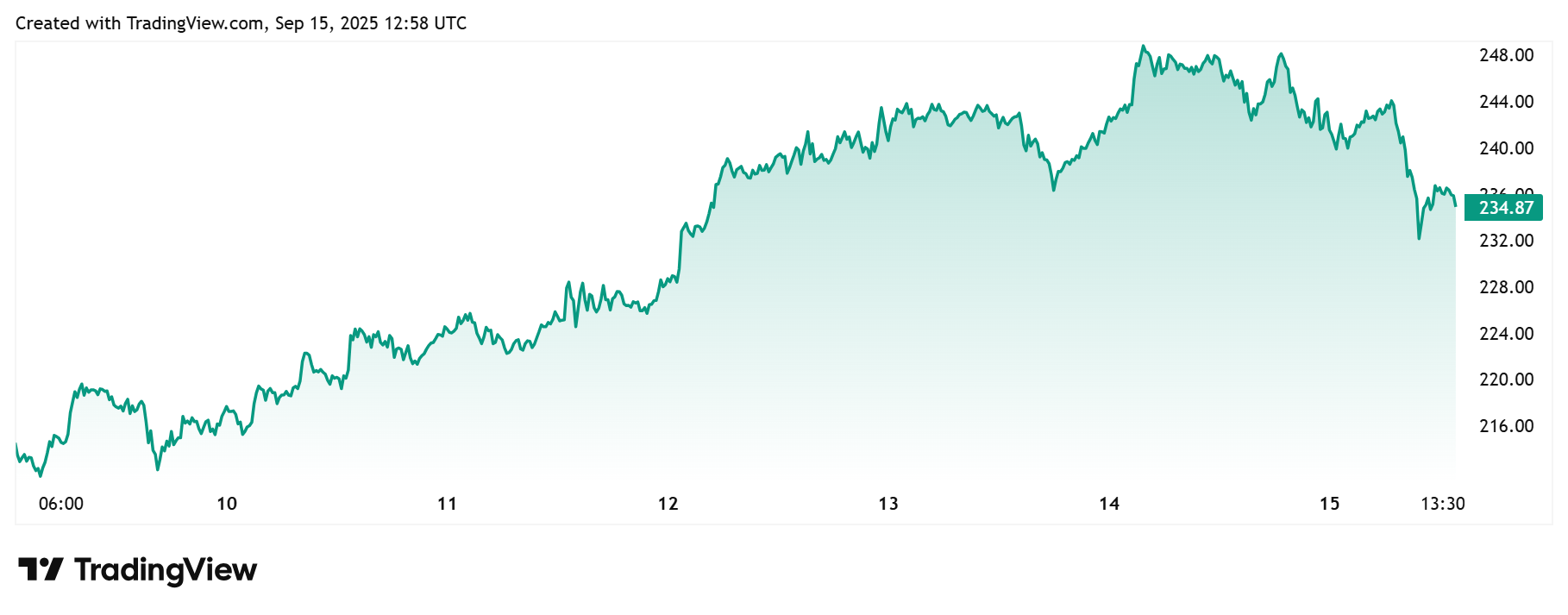

Notably, the Solana price had begun rising since last week following the completion of Forward Industries’ private placement. TradingView data shows that the token is up over 13% in the last week.

Another SOL Treasury Firm Emerges

In a press release, Helius Medical Technologies announced over $500 million in funding to launch its Solana treasury strategy. This public equity offering involves the purchase and sale of common stock at a purchase price of $6.881 and stapled warrants to purchase shares of common stock with an exercise price equal to $10.134 per stapled warrant.

Crypto-native investors Pantera Capital and Summer Capital are leading this funding round. Meanwhile, the closing of this offering is expected to occur on or about September 18. Helius plans to use the net proceeds of the offering to implement a digital asset treasury and acquire SOL.

As part of its Solana treasury strategy, the company plans to build an initial SOL position and significantly scale its holdings over the next 12 to 24 months through a “best-in-class capital markets program incorporating ATM sales and other proven strategies.”

Helius will also evaluate staking, lending, and other opportunities throughout the ecosystem to generate revenue from the SOL treasury while maintaining a “conservative risk profile.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs