FTX Seeks Settlement Agreement With Genesis For Just $176 Million

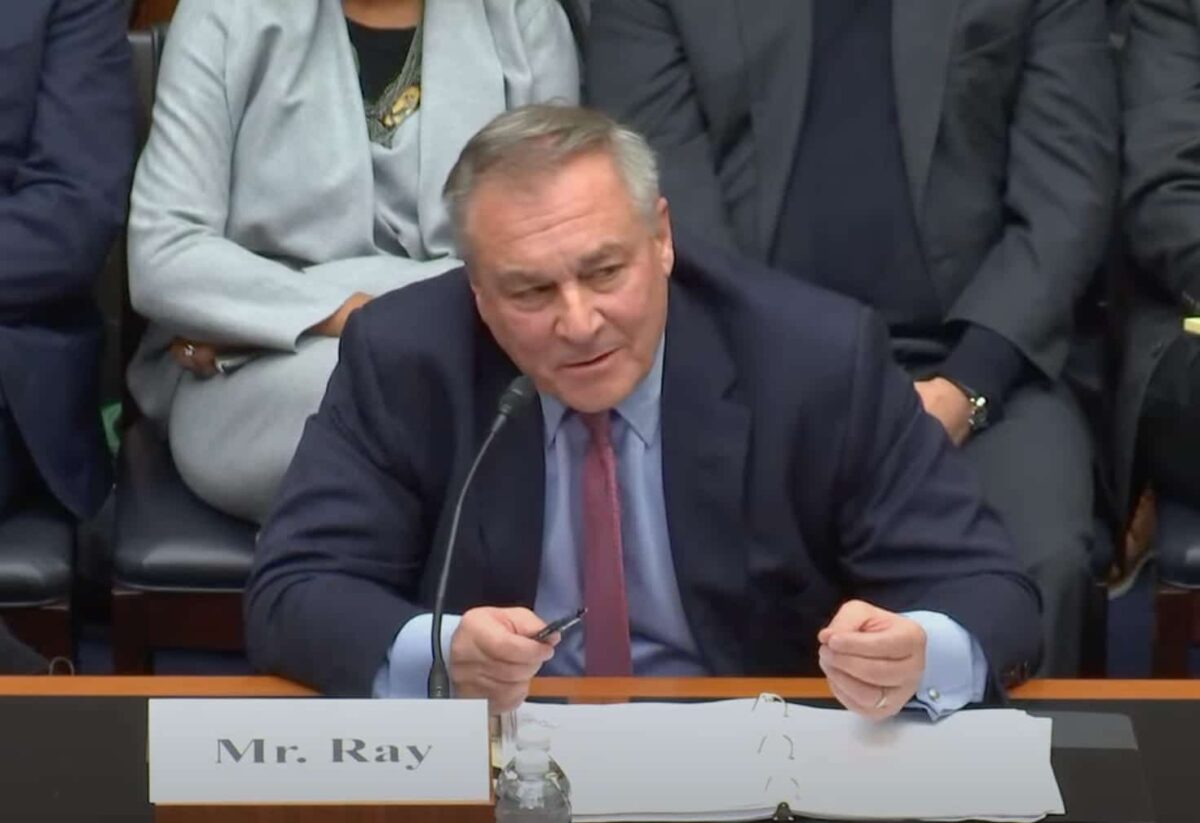

Beleaguered crypto exchange FTX and CEO John J. Ray III agree to settle with Genesis entities for $176 million. FTX creditors are disappointed with the plan and asking the Official Committee of Unsecured Creditors of FTX (UCC) to object to the settlement agreement as Alameda paid billions of FTX customer funds to Genesis in 2022.

FTX Motion For Settlement Agreement With Genesis

According to a court filing, FTX Trading and affiliated debtors submitted a motion for a court order to settle the dispute with Genesis entities for almost $176 million in claims.

Genesis entities have asserted claims against FTX and affiliates, which is approximately $176 million customer claim against FTX Trading.

“$140 million avoidance claim against Alameda, an approximately $40 million outstanding loan claim against Alameda, and, to the extent of any allowed FTX Claim, claims under section 502(h) of the Bankruptcy Code.”

FTX argues recoveries from the Genesis debtors and other Genesis entities are uncertain and settlement is the best possible way to prevent further disputes.

In addition, FTX CEO John Ray III also filed a declaration in support of the motion for a settlement agreement with Genesis and granting related relief.

FTX Creditors Oppose the Settlement

FTX 2.0 Coalition on August 17 said this is the worst deal by FTX, especially amid the DOJ investigation on DCG and Genesis.

“Genesis claims are currently worth more than FTX’s even as Genesis lender balances are inflated by the interest they earned from lending, among others, to Alameda.”

It expects the UCC to object to this settlement agreement as “Genesis was repaid by Alameda with billions of FTX customer funds in 2022.” These coins belong to FTX customers.

Also Read:

- Shibarium Stops Producing Blocks Again, Whales Dumping SHIB And BONE

- BinanceUS’ Protective Order Against US SEC Referred To Magistrate Judge, What’s Next?

- Crypto Exchange BIT Introduces XRP Options Trading Following Ripple’s Partial Victory

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?