Gold Price Today: Precious Metal’s Price In US, Dubai, India, Singapore

Gold Price Today: Gold rate ticked higher in the early morning trading session on Monday amidst mixed global cues as the weaker dollar made bullion relatively less expensive for international buyers. Noticeably, today’s gain in Gold prices was limited by the prospects of further interest rate hikes by the Federal Reserve the next year. Last week, the U.S. central bank increased interest rates by 50 basis points, making it the seventh rate hike in 2022. Fed has indicated that it will continue with its rate hike spree to bring down inflation to the target range.

Gold prices in the U.S., December 19:

Spot gold was up 0.1% at $1,794.60 per ounce as of 0226 GMT. U.S. gold futures jumped 0.2% at $1,804.00. The dollar index slipped 0.1%.

Gold, perceived as a safe-haven asset, is usually considered a hedge against inflation as well as economic uncertainties. However, rising interest rates tend to dent bullion’s appeal as the precious metal pays zero interest. There have been instances where prices appear detached from the safe-haven status when factors like Fed policies come into the picture.

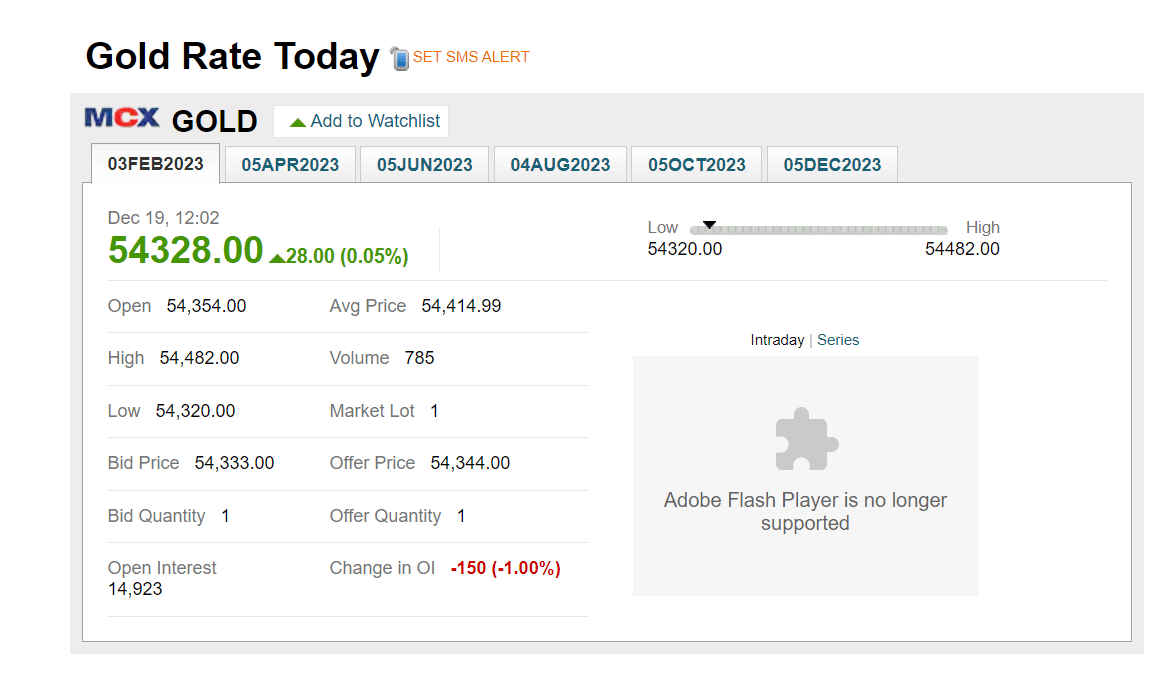

Gold price in India:

Gold was trading on the higher side on the first day of this week when the Multi Commodity Exchange (MCX) opened. As of 11:21 AM on Monday, Gold February futures jumped 0.12 % at 54365.00 per 10 grams.

Gold price in India depends on several factors, like the value of Indian currency against the dollar and global demand for the precious metal.

Source: Money Control

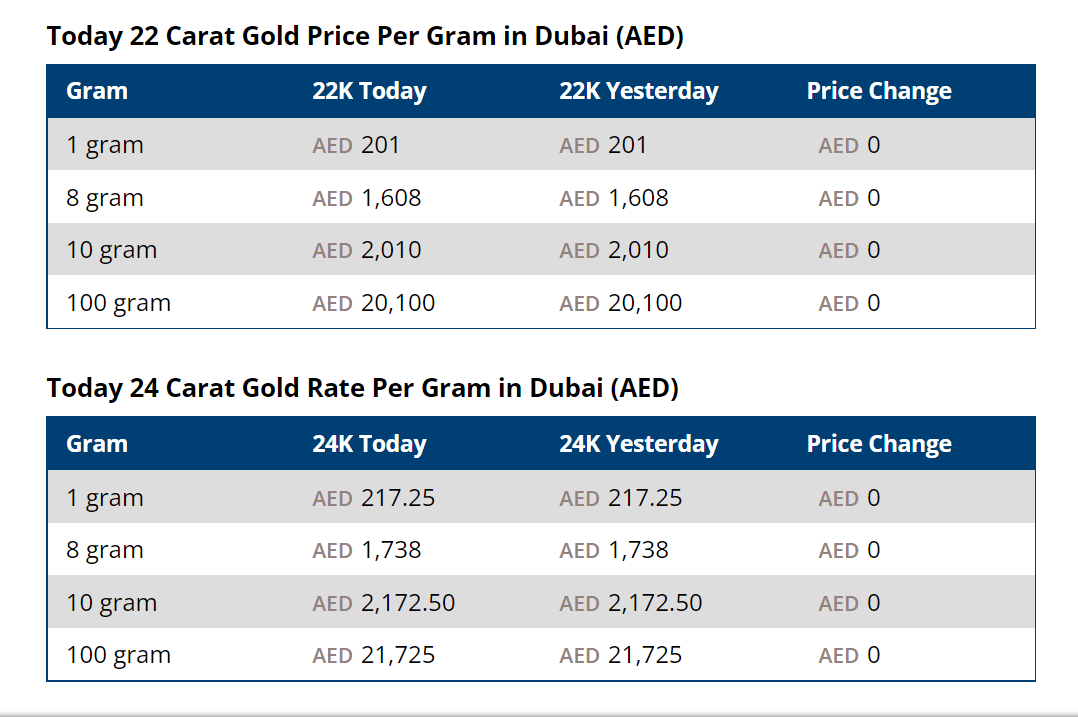

Gold Rate in Dubai, December 19:

The rate of 24 Carat/gram in Dubai is 217.25 AED.

The gold rate (22 Carat/gram) is 201 AED.

Source: Goodreturns

Gold Rate in Singapore:

Today, in Singapore, each gram of 24K gold is priced at 84.30 SGD (a jump of 0.20 SGD compared to yesterday’s price). Meanwhile, 22K gold per gram costs 75.80 SGD (0% change from the previous price).

Gold Price Prediction 2023:

Gold Price Forecast: According to Reuters, Gold is expected to average $1,745 in 2023. There are speculations that the dollar will remain strong or strengthen more in the initial half of 2023. Besides, if interest rates are lowered, and the dollar loses its strength, gold prices will be pushed higher in the year’s remaining months.

In 2023 the gold price will have a few significant drivers for traders to watch for. These include the geopolitical situations, the firmness of the U.S. dollar, and inflation & interest rates. How these factors evolve in 2023 will impact the gold price to a great extent.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs