Grayscale Didn’t Dump XRP, Instead They Bought 12 Million More XRP Token on New Year

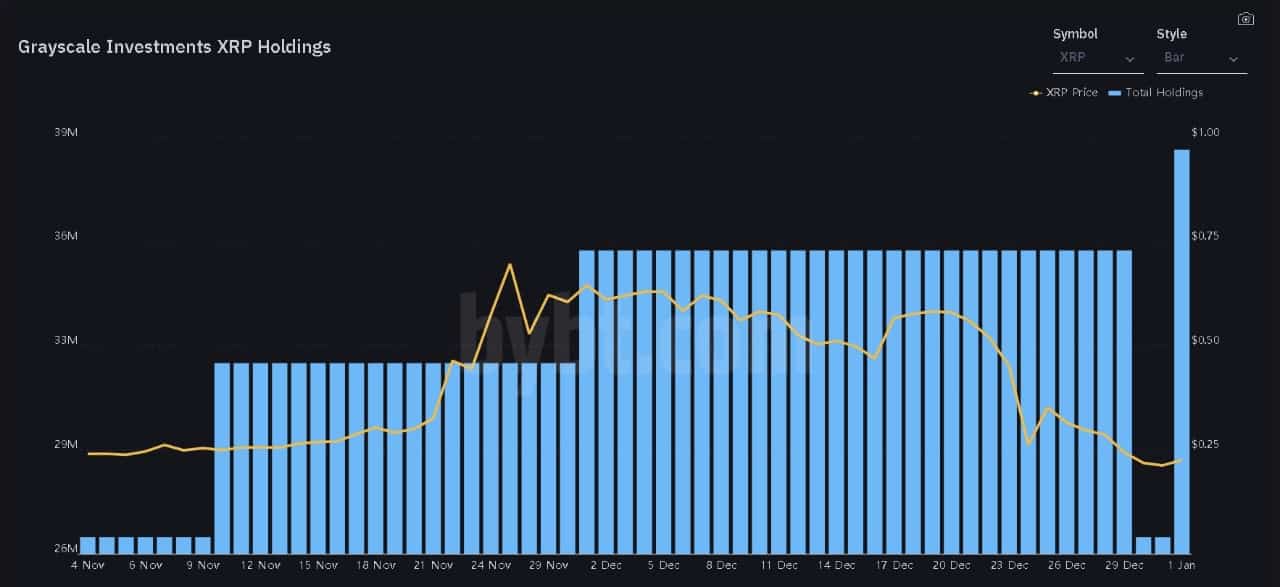

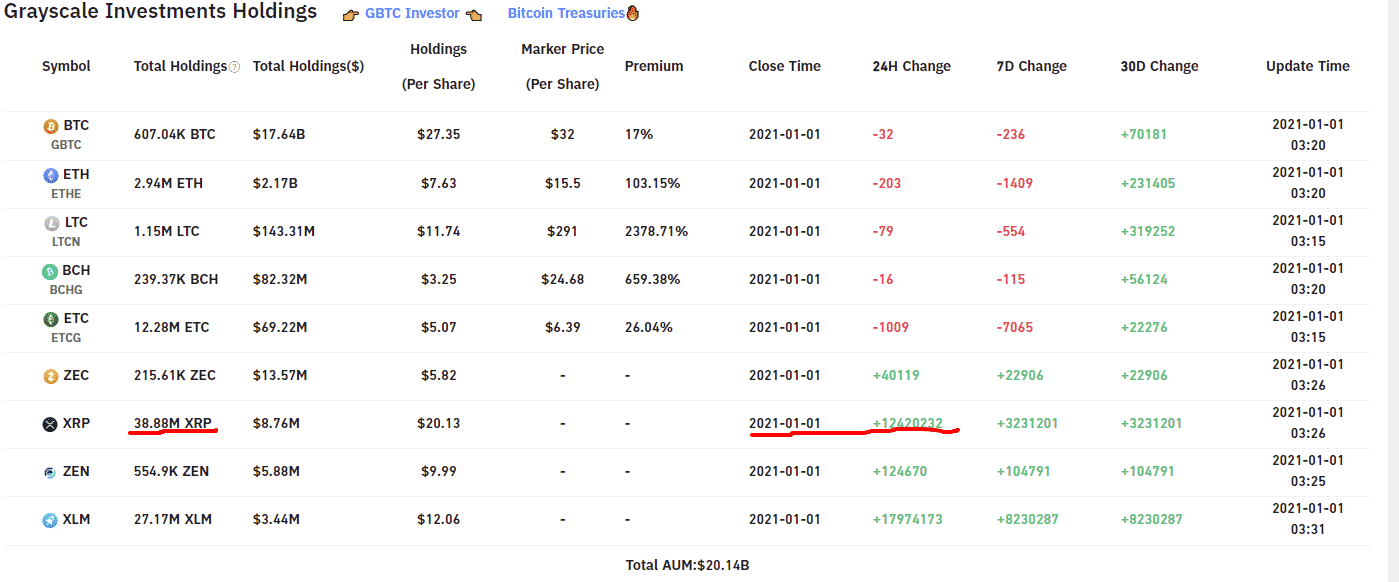

Grayscale dumping XRP was the headline of most media publications based on data from Bybt, however, a company spokesperson refuted all such claims. A quick look at the Grayscale Investment Holding now clarifies that no significant amount of XRP was liquidated in the past 7 days, however, earlier the chart did show mass liquidation of XRP token from the Grayscale trust.

A Grayscale spokesperson in an official statement said,

“Statements about large sales of underlying assets by any of our investment products are false and inaccurate. Any perceived large decrease in the USD value of Grayscale XRP Trust would have been a result of a decrease in the USD price of XRP.”

Grayscale went against the current trend where major crypto platforms, as well as asset managers, have started delisting XRP and the crypto asset manager bought more than 12 million units of XRP on 1st January.

Source: Grayscale

Mass Delisting Tanks XRP Token Price and Crypto Market

Ever since the SEC filed a lawsuit against Ripple and two of its executives on 21st December accusing them of selling $1.3 billion in unregistered security. The news led to a delisting spree where major crypto exchanges in the US as well as those outside serving the US customers started delisting XRP trading services to avoid SEC’s rathe.

The price of XRP token has lost more than 70% of its market cap as well as its long-held third-spot. Many Ripple strategic partners such as SBI Holdings have extended their support to the crypto firm and also suggested they need not worry as the majority of their market and remittance services are outside the US.

The first date for the pre-trial conference has been set for February 21 through a telephonic appearance mandatory for all the parties involved.

Mati Greenspan ex- eToro senior market analyst and founder Quantum economics said,

“The outgoing SEC Chairman’s actions were incredibly damaging but certainly not fatal. At this point the air is so cloudy that it’s really impossible to make any kind of accurate forecast. Once the air clears we’ll need to reassess”

Ripple in its defense claimed that SEC is merely targeting them as they have been operating for years while creating a core remittance business based on the XRP ledger, thus in the public interest and to protect thousands of XRP investors, SEC should not consider its token as a security. However, the SEC lawsuit claimed that Ripple and its executives were well aware of the fact that their offering qualifies as a security and they may be breaching federal security laws by offering XRP without registration.

Follow more updates on XRP here.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs