Grayscale Transfers $900M in BTC Amid ETF Speculation

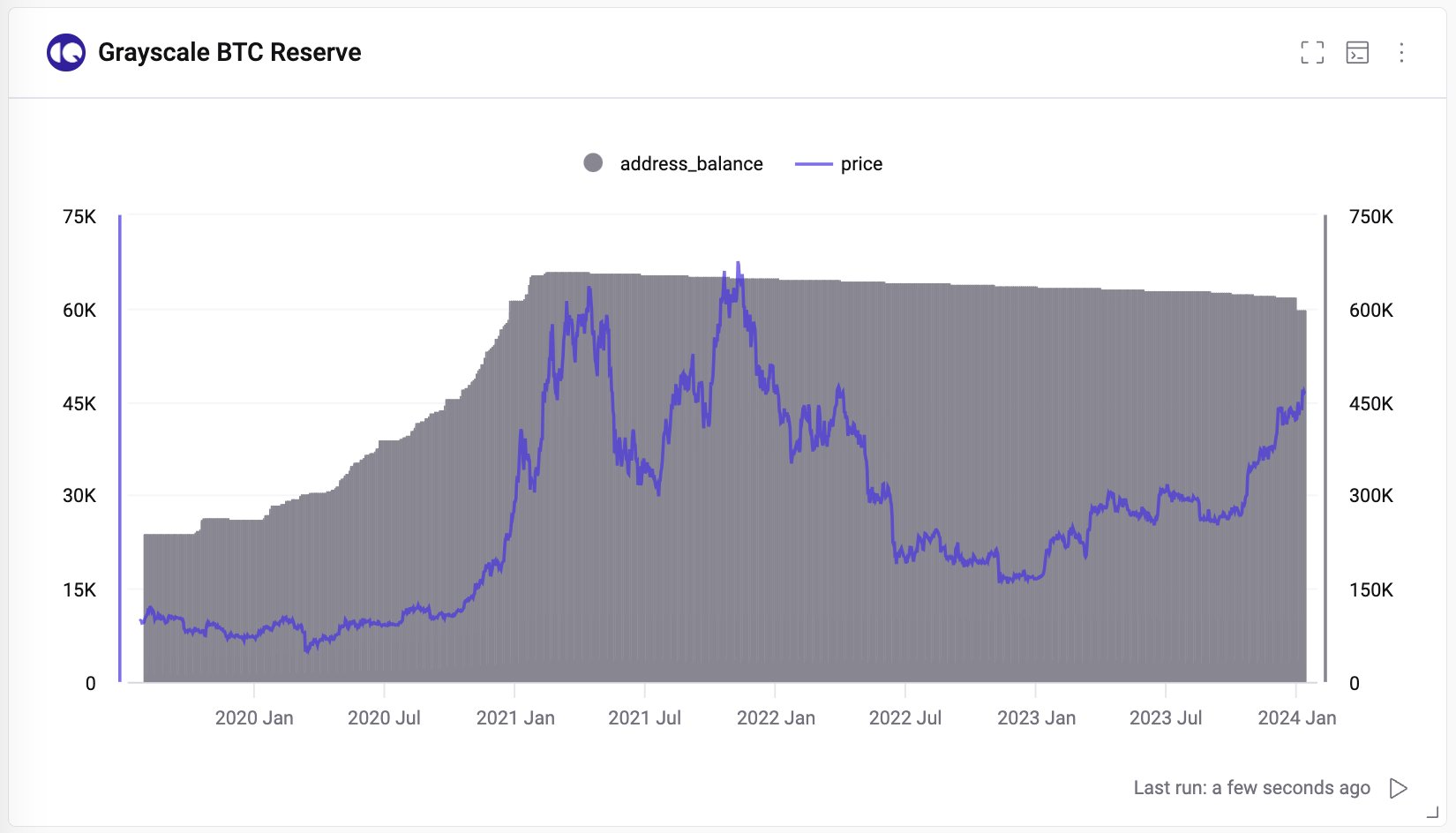

After the U.S. Securities and Exchange Commission (SEC) approved all 11 Spot Bitcoin ETFs at the same time, SEC Chair Gary Gensler admitted that Grayscale’s court victory was the key reason behind approving spot Bitcoin ETFs. However, Grayscale has been moving Bitcoin to multiple addresses including crypto exchanges in the last 30 days.

Grayscale Dumping Bitcoin During Spot Bitcoin ETF Speculation

The first day of spot Bitcoin ETF was strong in terms of $4.6 billion in total trading volume. However, experts believe the Bitcoin inflows were much lower than expected, with GBTC recording $95 million of outflow. The total net flow for the day into the new ETFs was $625.8 million.

BitMEX Research data showed that on the second day of listing of the spot Bitcoin ETF, GBTC outflows were $484 million, and the total GBTC outflows in the previous two days were $579 million.

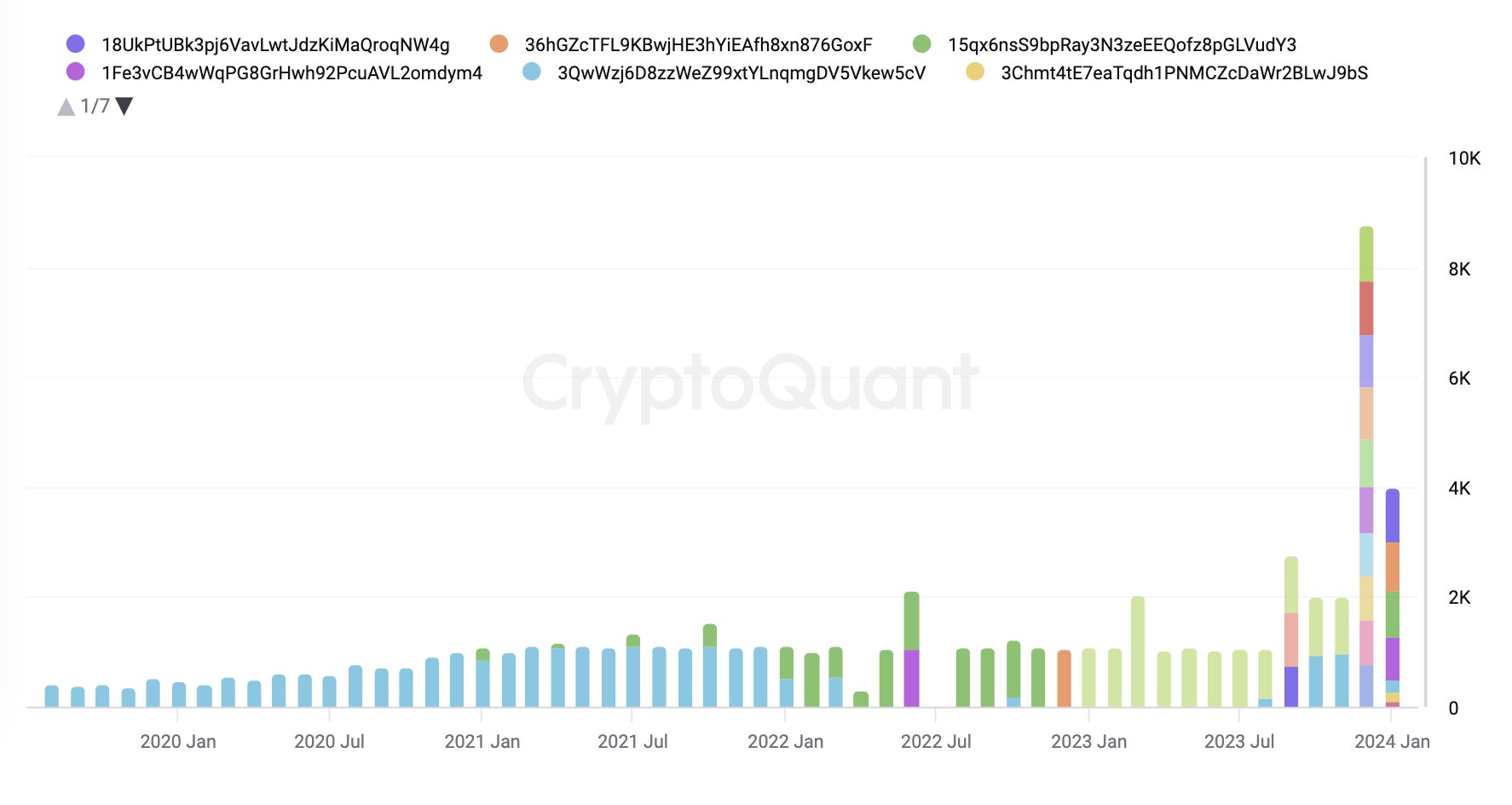

CryptoQuant founder and CEO Ki Young Ju in a post on January 13 revealed that Grayscale moved 21,400 BTCs worth over 900 million in the last 30 days. Grayscale sent bitcoins to multiple addresses including Coinbase, which indicates holders are selling as spot Bitcoin ETF approval came near.

Moreover, a breakdown of outflows from Grayscale wallets shows that the Grayscale BTC reserve wallet balance changed most recently. Grayscale sent 4,000 BTC worth $183 million to a Coinbase Prime deposit address yesterday. This could be due to investors switching their assets to other spot Bitcoin ETFs as it has the highest fee of 1.5%.

BTC price tumbled over 6% in the past 24 hours, with the price currently trading at $42,846. The 24-hour low and high are $0.643 and $0.664, respectively. Furthermore, the trading volume has decreased in the last 24 hours, indicating a decline in the interest of traders.

Also Read:

- Bitcoin (BTC) Price Tanks Another 8%, Scaramucci Blames Grayscale/FTX For This Rout

- Vanguard Escalates Fight Against Bitcoin ETFs, Here’s What Happening

- MicroStrategy’s Michael Saylor Sells More Stocks For Investing Into Bitcoin

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise