Breaking: Grayscale Solana ETF (GSOL) to Trade with 0.35% Fee

Highlights

- Grayscale Solana ETF (GSOL) announces 0.35% fee.

- Grayscale Solana Trust ETF to list and trade on NYSE Arca after the U.S. SEC approval.

- Bitwise currently leads in fee war with 0.20%.

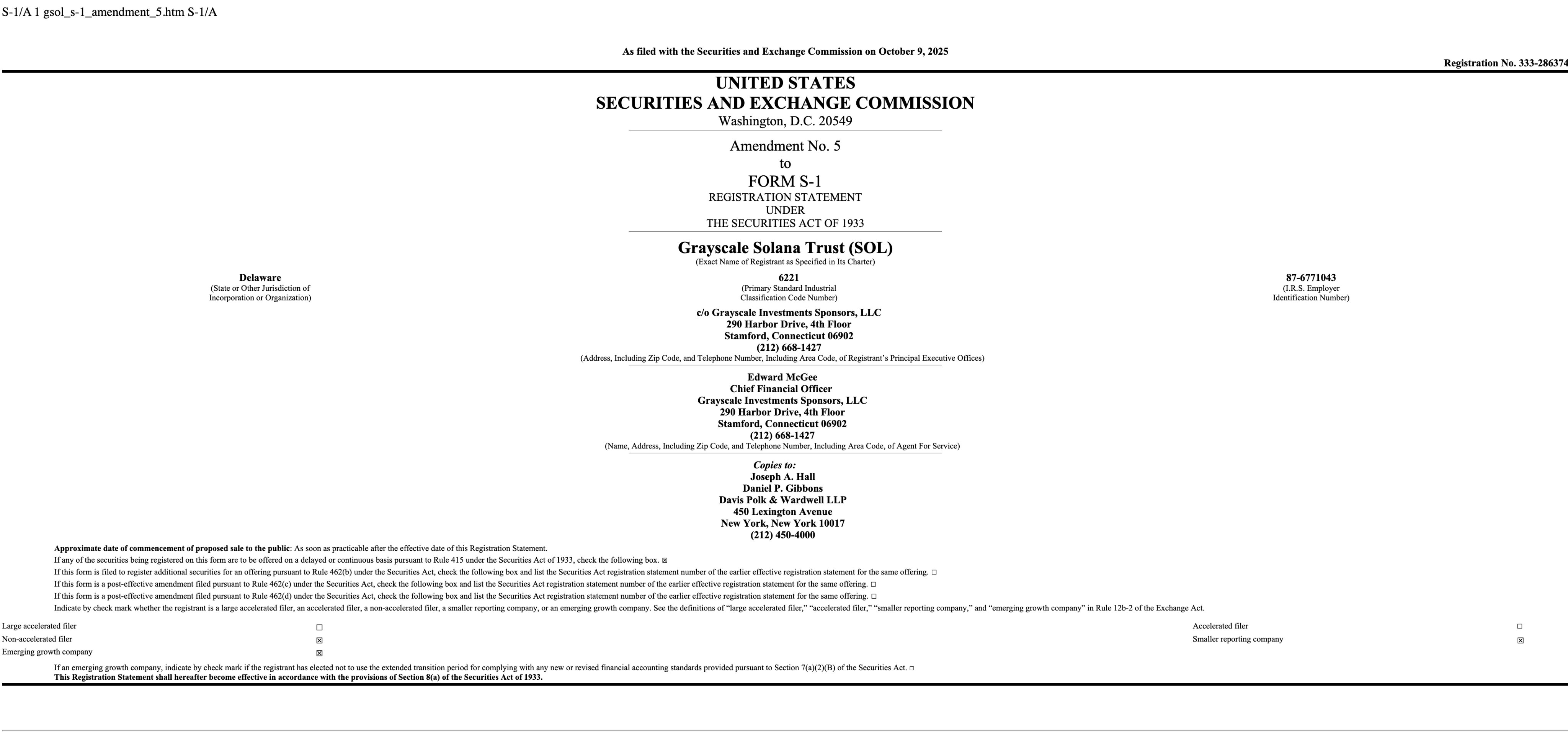

With the U.S. Securities and Exchange Commission’s (SEC) final decision on Grayscale Solana ETF (GSOL) approval due today, the crypto asset manager has filed to announce a 0.35% management fee. The firm awaits regulatory approval to list GSOL on NYSE Arca, which is currently delayed due to the U.S. government shutdown.

Grayscale Files to List Solana ETF with 0.35% Fee

According to a US SEC filing dated October 9, Grayscale Solana Trust submitted an S-1 form to announce a 0.35% fee for the Solana ETF. The sponsor fee is payable in SOL, with mention of temporarily waiving it. Currently, the asset manager will not intend to do so.

The trust has updated language and risk factors related to staking, while raising concerns on the feature, stating “Validators may suffer losses due to staking, or staking may prove unattractive to validators, which could adversely affect the Solana Network.”

Recently, Grayscale activated staking on Solana Trust, giving investors access to SOL staking through a traditional brokerage account. With pending regulatory approval of GSOL as an ETF by the SEC, it is expected to become one of the first spot Solana ETPs with staking.

Grayscale Solana Trust ETF to list and trade on NYSE Arca after the US SEC approval, currently delayed due to the government shutdown.

Other details disclosed in the filings include Davis Polk & Wardwell as tax counsel, consent from accounting firms KPMG and Marcum, and Foreside Fund Services as marketing agent. Also, Coinbase Custody is the primary custodian and Anchorage Digital Bank is an additional custodian.

Bitwise Solana ETF (BSOL) Currently Leads in Fee War

On Wednesday, Bitwise announced a fee of 0.20%, currently the lowest among other Solana ETFs. Bloomberg senior ETF analyst Eric Balchunas quoted the low fees as “Bitwise not playing around” as they seek to lead in inflows.

It has waived fees for the first three months or until assets under management reach the first $1 billion. Also, Bitwise Solana ETF (BSOL) changed its name to Bitwise Solana Staking ETF.

SOL price is trading more than 2% lower in the past 24 hours, with the price currently trading at $222.10. The 24-hour low and high are $217.20 and $228.63, respectively. Trading volume has climbed by 5% in the last 24 hours, indicating buy-the-dip sentiment.

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling