Grayscale Strongly Claims Win Against US SEC, Is A Spot Bitcoin ETF Finally Coming?

Grayscale’s lawsuit against the U.S. Securities and Exchange Commission (SEC) for the denial of GBTC conversion to spot Bitcoin ETF picks pace as things have started to look in favor of Grayscale.

Crypto influencer Andrew in a tweet on February 21 shared that Grayscale’s chances to win the lawsuit against the SEC are currently in discussion in the crypto community. If Grayscale wins the lawsuit, the U.S. will get a proper spot Bitcoin ETF. The District of Columbia Court of Appeals will hear oral arguments on March 7.

“Legal minds believe their brief is powerful and the court may be prone to pushing back on regulatory overreach.”

While Grayscale is confident over its appeal against the SEC, a win could prove to be a major victory for the crypto industry. However, lawyers believe if Grayscale loses the case, they would take the case to the U.S. Supreme Court to have even better chances of winning.

Craig Salm, chief legal officer at Grayscale, shared a powerful line from the opening brief:

“At bottom, the Commission has arbitrarily rewarded bitcoin-futures ETPs for being vulnerable to two theoretical sources of fraud or manipulation—misconduct in the bitcoin futures market and misconduct in the spot bitcoin market—while arbitrarily penalizing spot-bitcoin ETPs for being exposed only to one…In ignoring that reality, the Commission has reached an unreasoned decision that unfairly discriminates between issuers in violation of the Exchange Act, see 15 U.S.C. § 78f(b)(5)—exactly what the APA forbids.”

Ripple supporter and attorney John Deaton also expressed that Grayscale could win the lawsuit against the SEC.

If the Court applies the law with these facts, @Grayscale will win. The denial of a #Bitcoin spot ETF – after allowing both futures and short #BTC ETFs – meets the very definition of arbitrary and capricious under the law. https://t.co/FY14EDtaJq

— John E Deaton (@JohnEDeaton1) February 20, 2023

Grayscale’s GBTC Trades At Discount Amid US SEC Lawsuit

In the context of the U.S. SEC-led crypto crackdown in the U.S., the case could prove to be crucial in driving market sentiment in favor of crypto.

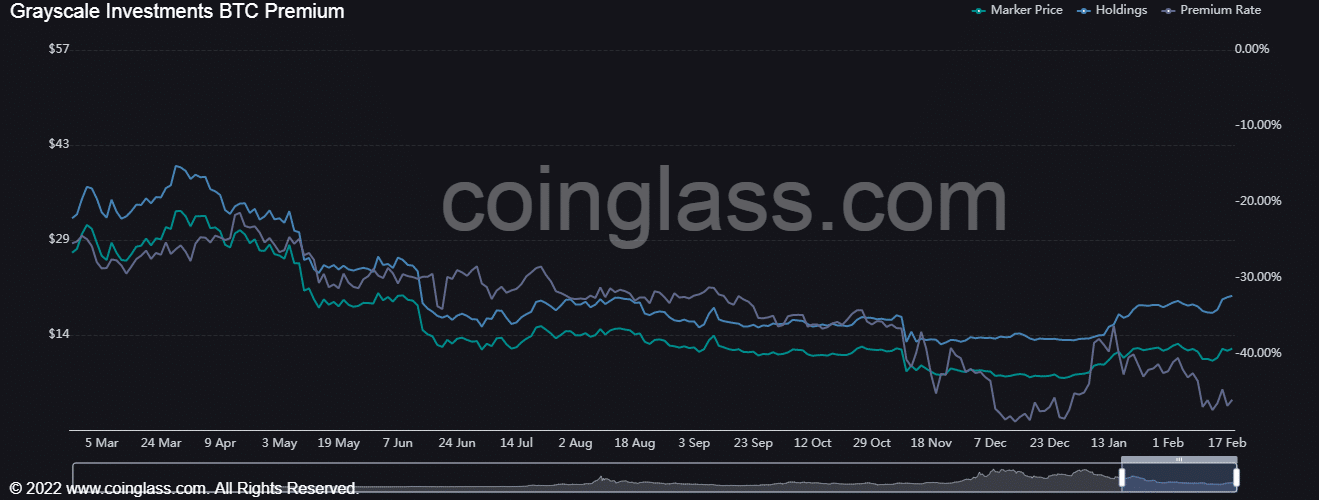

Grayscale’s GBTC currently has total holdings of $15.77 billion, with the price at $12.2. The GBTC continues to trade at a discount, with the premium rate at negative 46%. Meanwhile, Bitcoin price looks to cross the $25K psychological level.

Also Read: BlackRock Issues Metaverse Thematic ETF

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Is the Bitcoin Price Correction Really Over or Is This a Bear Market Trap?

- ‘Gambling Is Not Investing’: New Group Pushes Crackdown on Prediction Markets

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs