Breaking: Grayscale Sui Staking ETF to Start Trading on NYSE Arca Today

Highlights

- Grayscale Sui Staking ETF (GSUI) gains auto-effective approval to trade on NYSE Arca.

- The issuer has announced a management fee of 0.35%, along with fee waiver period.

- SUI price wavers as analyst predicted a rally.

Grayscale has announced that its Sui Staking ETF will begin trading on the NYSE Arca under the ticker GSUI on Wednesday. This marks a groundbreaking development for the Sui blockchain. Will the SUI token see a massive price rally today?

Grayscale Sui Staking ETF to Trade Under GSUI Ticker on NYSE Arca

Grayscale Sui Staking ETF becomes auto-effective with 8-A filing with the US Securities and Exchange Commission (SEC). Crypto asset manager Grayscale Investments also submitted a CERT filing, indicating approval from NYSE Arca for the listing and trading of Sui ETF shares.

The issuer confirmed Grayscale Sui Staking ETF will begin trading on February 18. It is set to trade under the ticker GSUI on NYSE Arca.

The Sui ETF has a management fee of 0.35%. Grayscale Investments Sponsors LLC has waived the entire fee for a 3-month period or until assets under management (AUM) reaches $1 billion. The spot ETF will offer regulated exposure to SUI token, with generating yield rewards for its investors by staking SUI.

Jane Street Capital, LLC and Virtu Americas LLC have agreed to act as authorized participants. In addition, JSCT, Virtu Financial Singapore, Galaxy Digital Trading Cayman, and Flowdesk are liquidity providers.

As CoinGape reported earlier, Bank of New York Mellon will serve as the transfer agent and the administrator of the Grayscale Sui Staking ETF. Meanwhile, Coinbase is the prime broker and Coinbase Custody Trust Company is the custodian of the trust.

Will SUI Price Rally?

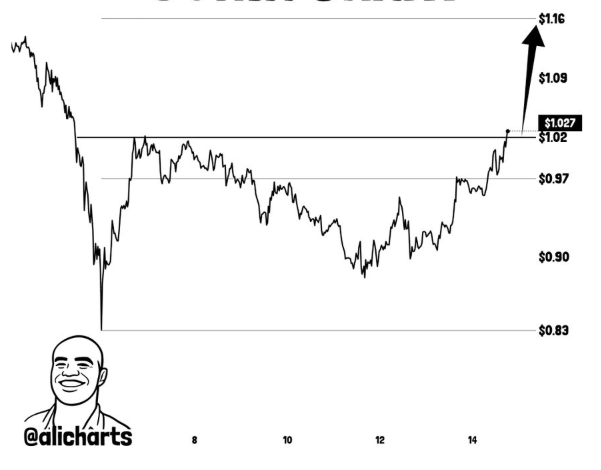

The last time Grayscale amended its Sui ETF, the price jumped more than 7%. At the time of writing, SUI price is trading 0.88% lower at $0.968. The 24-hour low and high are $0.954 and 0.987, respectively.

Trading volume has dropped 22% amid rising uncertainty in the broader crypto market ahead of macroeconomic data releases, including the FOMC Minutes.

The derivatives market revealed mixed sentiment, according to CoinGlass data. The total SUI futures open interest jumped almost 1% to $509.07 million in the past 24 hours. At the time of writing, 4-hour SUI futures OI fell by almost 0.35%. However, 4-hour futures open interest jumped nearly 0.22% on Binance, 0.62% on OKX, and 0.35% on Bybit.

Analyst Ali Martinez predicted a 15% rally towards $1.16. He claims the token is breaking out of an Adam & Eve pattern for upside momentum.

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- Bitwise, Granitshares Eyes $63B Sector With New Prediction Markets ETF Filing

- Prediction Market Lawsuit: Nevada Targets Kalshi in Court After Action Against Polymarket

- Robinhood to Raise $1B IPO to Open Private Markets to Retail Investors

- Elemental Royalty Becomes First to Pay Dividends in Tether’s Tokenized Gold XAUT

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k