Hawkish Fed Rhetoric Pulls Down Bitcoin Price (BTC) By 4%, Does the Party End Sooner?

Earlier this week on Wednesday, February 15, the world’s largest cryptocurrency Bitcoin (BTC) jumped more than 12% inching closer to $25,000. This sparked a major euphoria in the crypto space that BTC could be heading to a further rally this year.

However, the macro indicators are flashing warnings and the hawkish fed rhetoric is a drag down. In the last 24 hours, the BTC price tanked by more than 4% and is currently trading at $23,797 with a market cap of $459 billion. Apart from this, some of the top altcoins have also retreated.

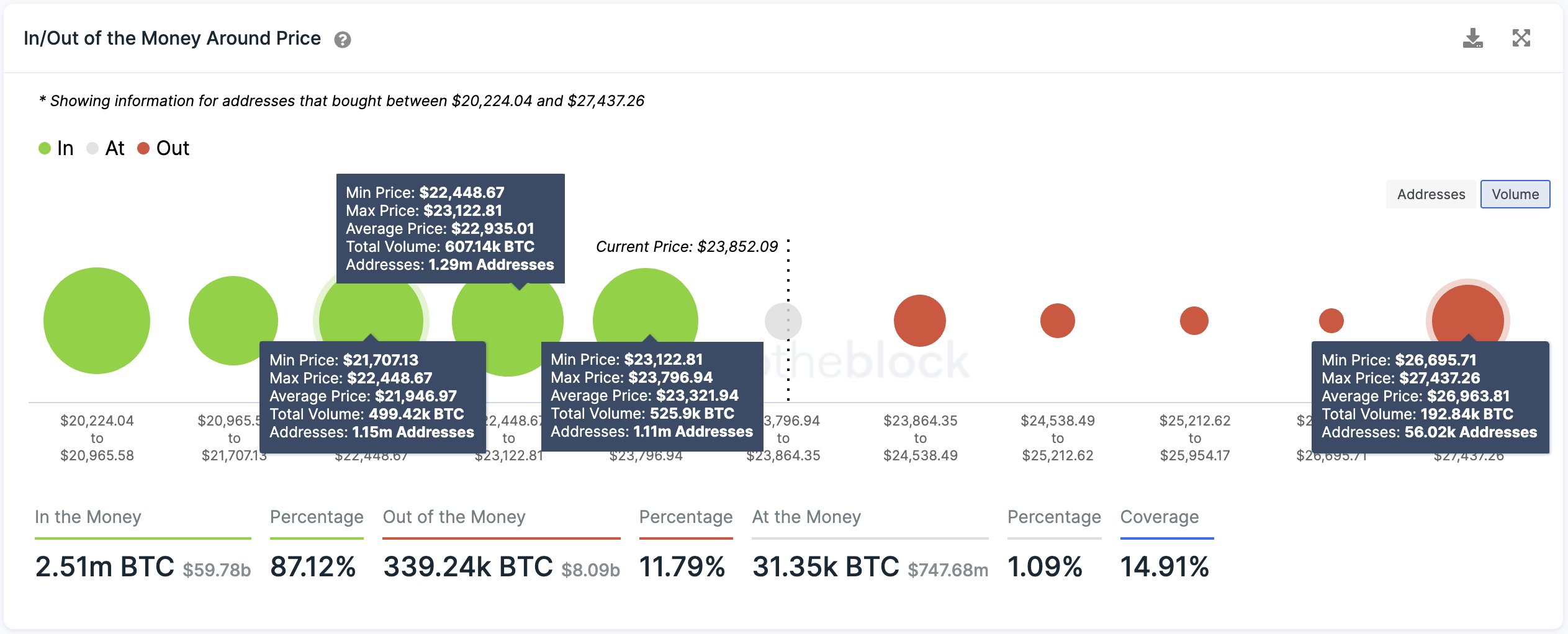

Investors are questioning what’s the next trajectory for Bitcoin (BTC) going ahead. Was yesterday’s price pump a dead cat bounce? On-chain indicators suggest that investors don’t need to worry yet. Citing data from IntoTheBlock, popular market analyst Ali Martinez noted:

Nothing to worry about yet! @intotheblock‘s IOMAP shows that Bitcoin built a vital support barrier between $21,700 and $23,700, where 1.60 million addresses bought over 1.32 million $BTC. If this demand wall can hold #BTC, notice that the next key resistance sits at $27,000.

As Bitcoin (BTC) posed 50% gains since the beginning of 2023, Bloomberg’s senior commodity strategist Mike McGlone explains the reason behind it. He said: “Bitcoin reached the steepest discount vs. its 200-week moving average at the end of 2022. This is a top reason for the 1Q snapback, but the global economic ebbing tide still looks unfavorable”.

Bitcoin and Equity Markets

Today’s drag down of the Bitcoin price comes with a correction on the top three Wall Street indices on Thursday. Bitcoin’s strongly correlated index Nasdaq Composite (INDEXNASDAQ: .IXIC) tanked by 1.78% ending at 11,855.

In order to tame the stick inflation, Fed officials are proposing larger rate hikes in the upcoming FOMC meetings. This is likely to draw away the interest from risk assets like Bitcoin.

In a note earlier this week, Goldman Sachs explained that “the fight against high inflation is still ongoing and there still remains more work for the Fed that has to be done”. It expects the growth stocks to face grater challenges going ahead.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs