Here’s Why You Should NOT Yet Buy the Bitcoin Dip, Miner Capitulation Ahead?

Well, the broader cryptocurrency has entered the second consecutive day of massive correction with Bitcoin bleeding deep red. Although Bitcoin has corrected a staggering 47% from its all-time high of $69,000, here’s why we think one should still wait and not jump in straight away to buy the dips.

Despite Bitcoin correcting heavily over the last week, the Bitcoin futures open interest continues to remain high. Historical trends suggest that unless the Bitcoin OI turns neutral or turns negative, we might not be done yet with the correction.

Crazy part is open interest still hasn't flushed pic.twitter.com/ivkPiYSTzQ

— Will Clemente (@WClementeIII) January 21, 2022

On the technical chart as well, Bitcoin has given a daily closing under $36,5000 levels. This is the lowest daily close since July 25, 2021. Twitter handle BTC Ninja writes that Bitcoin has given a close under 0.789 FIB. Thus, we can expect more pain with Bitcoin going to $33K and even lower.

#Bitcoin closed the daily at $36,456. Lowest daily close since July 25th, 2021. It closed below the .786, therefore, a higher probability that we might see the .886 at $33k. #BTC $BTC pic.twitter.com/IHBA7Bj2xw

— ₿TC Ninja ⚡ (@mario80503) January 22, 2022

Bitcoin Miner Capitulation Coming?

Bitcoin miners have been accumulating heavily so far in this recent correction. Data shows that miners have accumulated more than 6000 BTC in the last two weeks as BTC corrected from $45,000 to $38,000.

Data from @cryptoquant_com shows that #Bitcoin miners have added more than 6,000 $BTC to their wallets in the past two weeks while #BTC went from $45,000 to $38,000. pic.twitter.com/VOkihaybpe

— Ali Martinez (@ali_charts) January 21, 2022

But we are now very much close to the BTC miner production cost of $34,000. Now, if the BTC price continues to correct further, we can see heavy selling and capitulation coming from Bitcoin miners. Last week when BTC was trading around $42,00, verified crypto analyst @venturefounder wrote:

The worst dumps #Bitcoin ever had were due to miners capitulation (Dec 2018, Mar 2020), when Bitcoin fell below production costs, it is at risk for miner capitulation BTC was at risk for miner capitulation at $30k in May. The current production cost is $34k, 20% below current price.

Bitcoin’s Co-relation With Nasdaq Hits New All-Time High

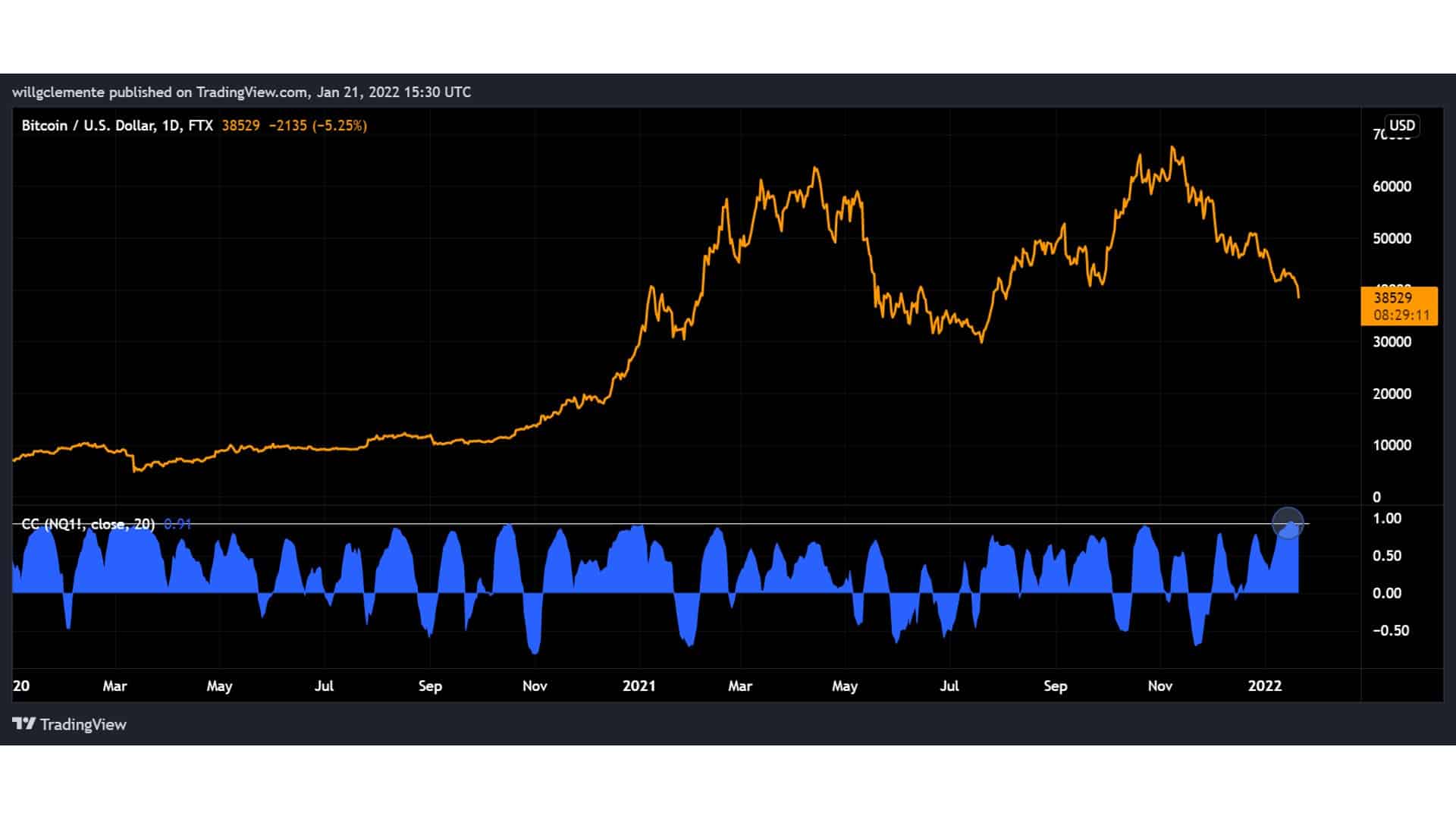

We know that the current correction in crypto has been following the broader sell-off in the U.S. equity market. Popular market analyst Will Clemente writes:

This week Bitcoin’s correlation to the Nasdaq reached an all-time high. With no catalyst to cause idiosyncratic flows to BTC, for the time being, it is just following risk-off behavior from equities with a high beta.

On the other hand, the S&P 500 has broken below its 200-DMA. Well, it can result in more liquidations in the crypto space, thereby creating a possible Ripple effect in the crypto market as well. Along with Bitcoin, altcoins too have entered a brutal correction.

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- XRP Seller Susquehanna Confirms Long-Term Commitment to Bitcoin ETF and GBTC

- Vitalik Buterin Offloads $3.67M in ETH Amid Ethereum Price Decline

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards