Huobi Executive Takes A Dig at Binance’s Recently Acquired Crypto Aggregator

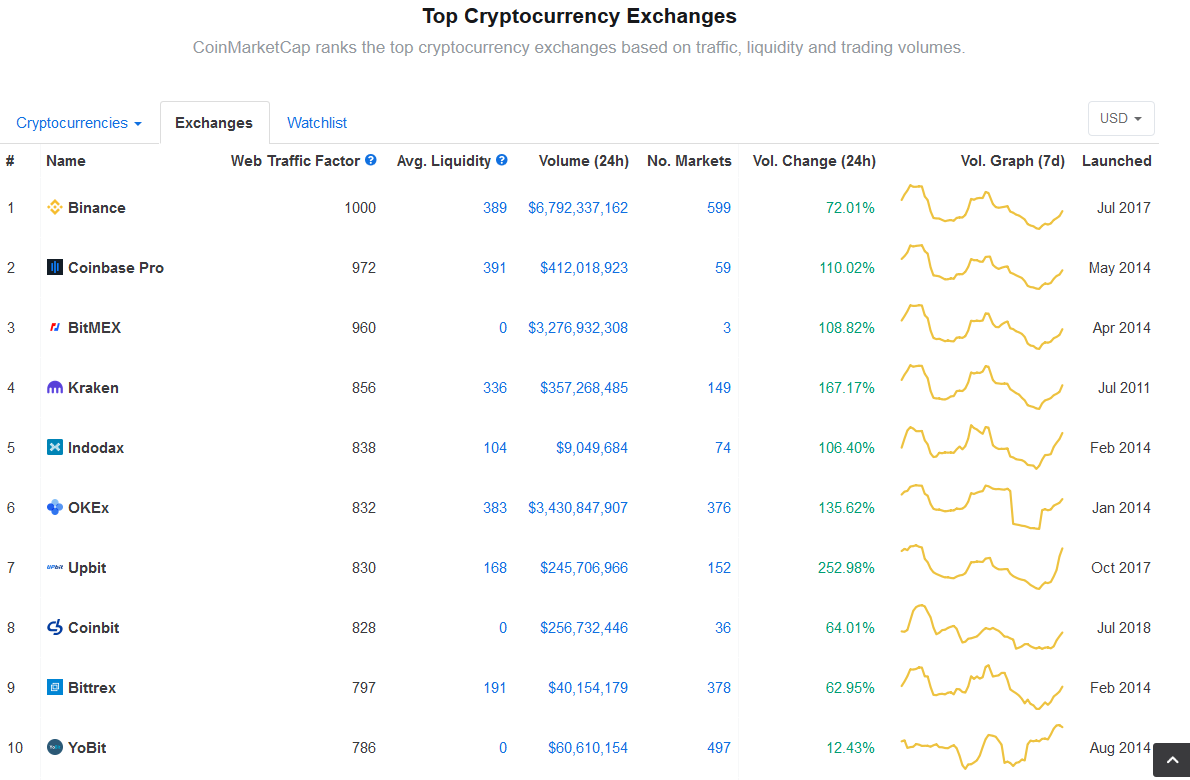

According to Ciara Sun, the Vice President and the Head of Global Business and Markets, more institutional traders are pouring into cryptocurrency. However, in her analysis, CoinMarketCap (CMC), an aggregator, has fallen short of expectations following the recent tweak of their ranking system which prioritized web traffic and unique visitors over traditional gauges like trading volumes and liquidity.

Taking to Twitter, she said:

“Institutional trading volume grew by 128.25% in Q1 2020 vs. Q4 2019. From Fidelity, nearly half of institutional investors using metrics see digital assets within their portfolios. Yet CoinMarketCap is now using web page views and unique visits. Look forward, not back.”

Institutional trading volume grew by 128.25% in Q1 2020 vs Q4 2019.

From Fidelity, nearly half of institutional investors using metrics see digital assets within their portfolios.

Yet @CoinMarketCap is now using web page views and unique visits.

Look forward, not back.

— Ciara Sun (@CiaraHuobi) May 18, 2020

Responding to the concern Spencer Yang, VP of Operations & growth at Coinmarketcap, accepted the incompleteness of data and assured that CoinMarketcap team is working and will be adding more holistic data points soon.

Indeed! The Web Traffic Factor we've just released aims to help users in the meantime to discern what others are using. Not perfect and we will release more holistic data points soon: https://t.co/F9U4EQOdVb

— Spencer Yang (@spenceryang) May 18, 2020

Is CoinMarketCap Operating Independently?

Binance, according to the new CMC rankings, is coincidentally without blemish.

Roughly a month after Binance shelled out a reported $400 million to take full control of the aggregator, the aggressive exchange now has the best ranking scores placing it ahead of competitors.

The exchange scores above both Coinbase Pro and Huobi Global—which is at distant 18th, with better trading volumes, liquidity and unique visitor count over the last 24 hours.

Expectedly, this new format didn’t lie well with Huobi and even other coin aggregators. Questions of CMC’s independence has undoubtedly been raised and whether the new ranking system will be reliable over the long haul will only depend on the reaction from the community.

Responding to Ciara’s tweet, Bobby Ang of Coingecko said it was time for his platform to be relied on.

Others from Crypto twitter said Binance was bent on “ruining” stuff.

Binance Making New Algorithm Improvements

Still, Binance and Changpeng Zhao—who remains active on Twitter, is keen on improving the space and part of that means CMC will maintain its independence.

At the same time, they will continue to incorporate views from the community to make their ranking algorithms even better. It is imperative that they do. CMC was one of the first aggregators and receives over 29 million unique page views every month.

We listened. @coinmarketcap updated exchange rankings by incorporating web traffic factor. Checkout the update rankings at URL below and let us know what you think.https://t.co/00jEVwiC6c https://t.co/WGmyM0MkCj

— CZ Binance ??? (@cz_binance) May 14, 2020

Part of their objective will be to repair the damaged CMC has received over the months for their accusations of listing exchanges which have been accused of wash trading and other trading volume manipulation tactics.

In a blog post, Binance said the ranking algorithm will factor in special metrics as order book depth for streamlining purposes. Consequently, on May 29, a new algorithm will be rolled out to detect outliers in reported volumes.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- BitMine’s Tom Lee Bets on ‘March Turnaround’ to Spark Crypto Market Recovery

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs