Huobi Token, SushiSwap and Axie Infinity Price Analysis: 09 December

Huobi Group recently announced that their headquarters would operate out of Singapore right after the Chinese government imposed a crackdown on crypto trading. This development brought in changes in the token’s price action. At press time the token was priced at $9.93. Over the last 24 hours, HT recorded an 8.7% increase in prices, which could be tied to an increase in investments.

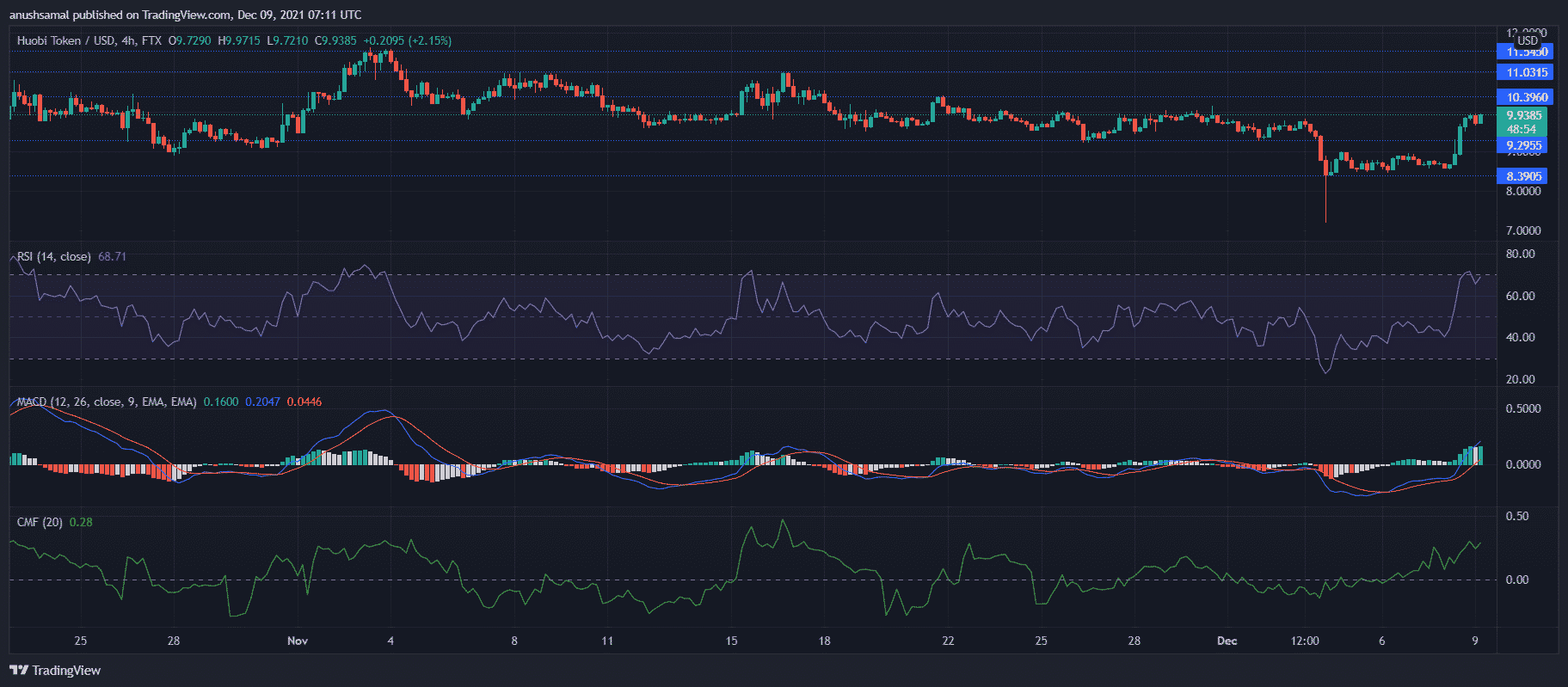

HT/USD Chart In The 4-hour Time Frame

The immediate price ceiling for HT was at $10.39, the token was trading below that mark for the past few weeks. Technicals pointed towards an uptrend of prices. Buying strength was on a multi-week high for Huobi Token as seen on the Relative Strength Index. The indicator hovered near the 80-mark which signified that HT was overbought at the time of writing.

In case Huobi Token manages to break above the $10.39 resistance mark, the other price ceilings rested at $11.03 and $11.54. On the Chaikin Money Flow, capital inflows were more than capital outflows as institutional interest grew owing to the recent news about Huobi picking its headquarters.

MACD also encountered a bullish crossover and flashed green histograms. In the event of the buying pressure dropping, HT’s prices could move to trade near its support level of $9.29 and then at $8.39.

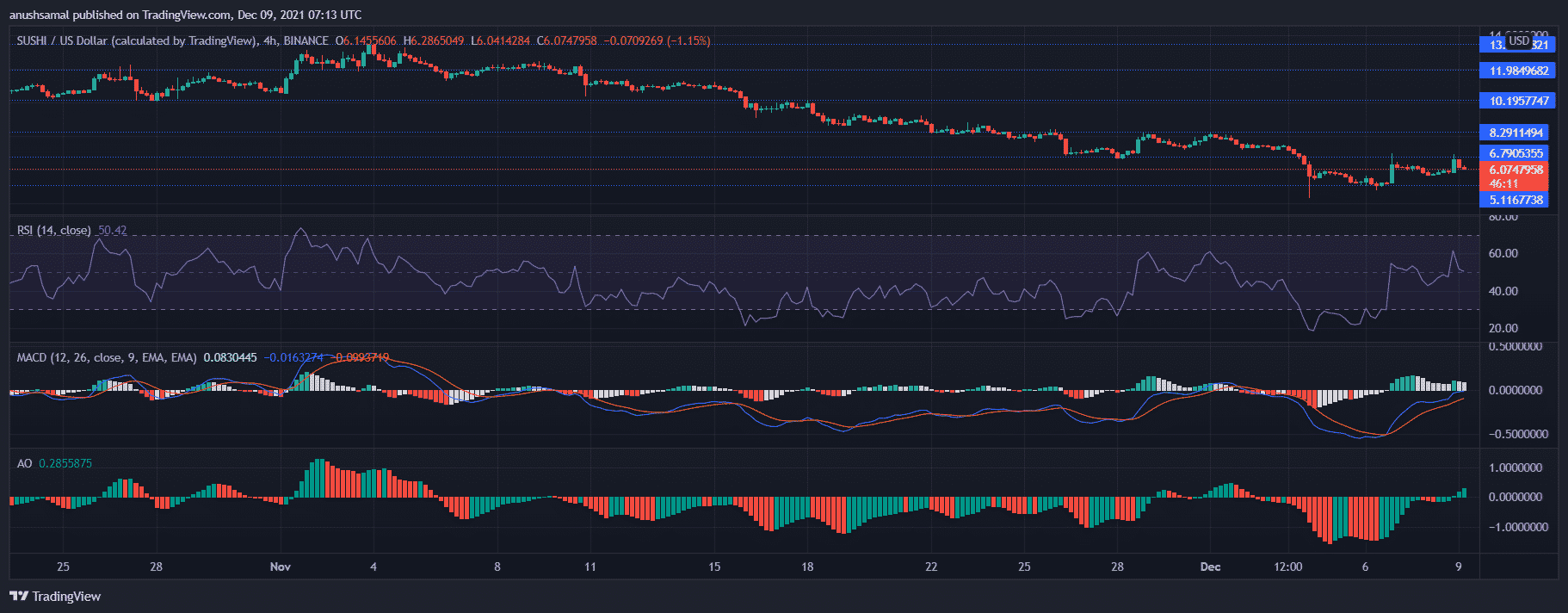

SUSHI/USD Chart In The 4-hour Time Frame

SushiSwap’s downtrend has remained consistent over the last couple of weeks, the altcoin lost almost 20.7% of its value in the last week. At press time, SUSHI was seen flashing signs of appreciation as the coin registered a 2% hike since the past day, it was priced at $6.07. The immediate support region for the coin was at $5.11.

MACD witnessed a bullish crossover and indicated some recovery over the last 24 hours. In accordance with the same, Awesome Oscillator also gave off green histograms.

Relative Strength Index although above the half-line, declined quite a bit, resulting in buyers exiting the market. If buying strength returns, SUSHI could attempt to breach the resistance mark of $6.79, moving past which SUSHI’s next target stood at $8.29. Additional price ceilings awaited the token at $10.19, $11.98 and $13.14.

In recent news, Joseph Delong, the Chief Technical Officer of SushiSwap resigned as a result of continuous friction and tension with the team.

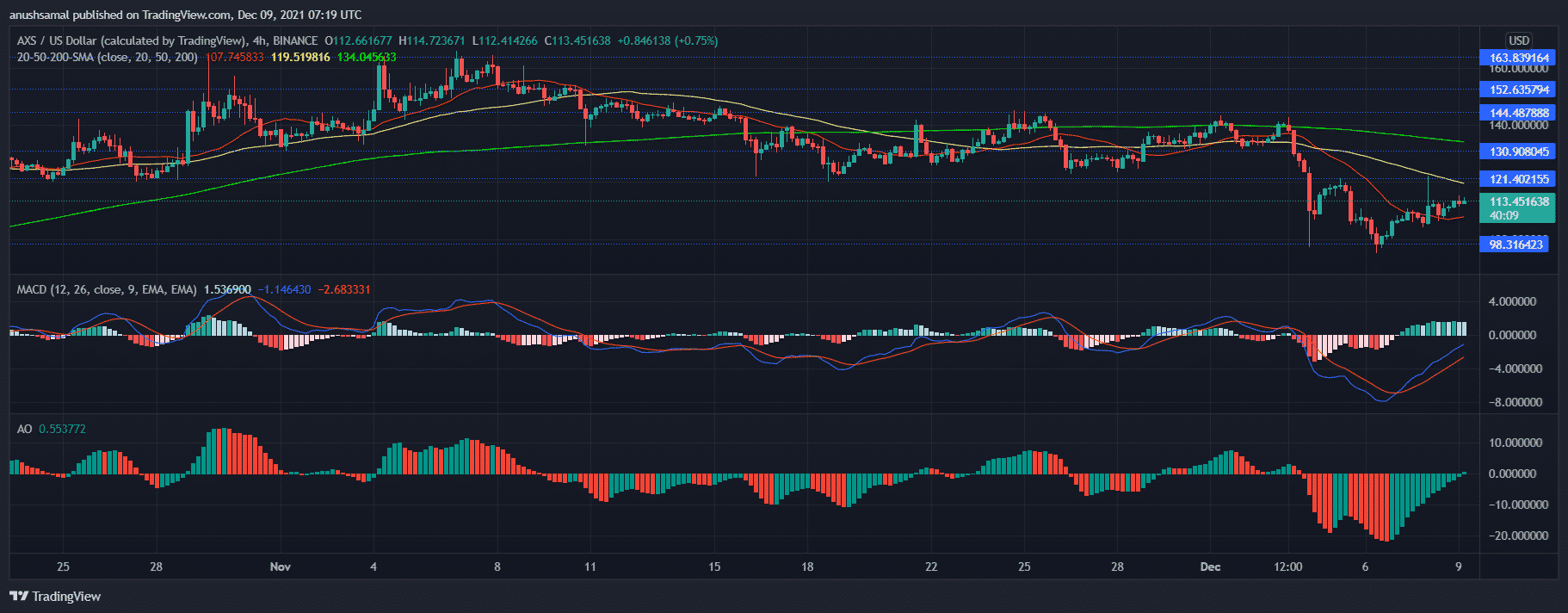

AVAX/USD Chart In The 4-hour Time Frame

Following the December crash, Axie has made slow progress. Over the past day, Axie recorded a 2.7% gain. The coin was trading for $113.45, if the bullish reversal strengthens, AXS could aim for the immediate price ceiling of $121.40 and then trade near $130.90. Breaking above these levels could push AXS to hover around its long holding price ceiling of $144.48, a mark it hasn’t broken in the past few weeks now.

Technical outlook emanated bullish signals. On the four hour chart, the price of AXS was above the 20-SMA line which meant that price momentum was in favour of buyers.

Additionally, MACD also displayed a bullish crossover and a positive price movement. Awesome Oscillator’s green histograms were visible highlighting that AXS was moving upwards on its charts.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs