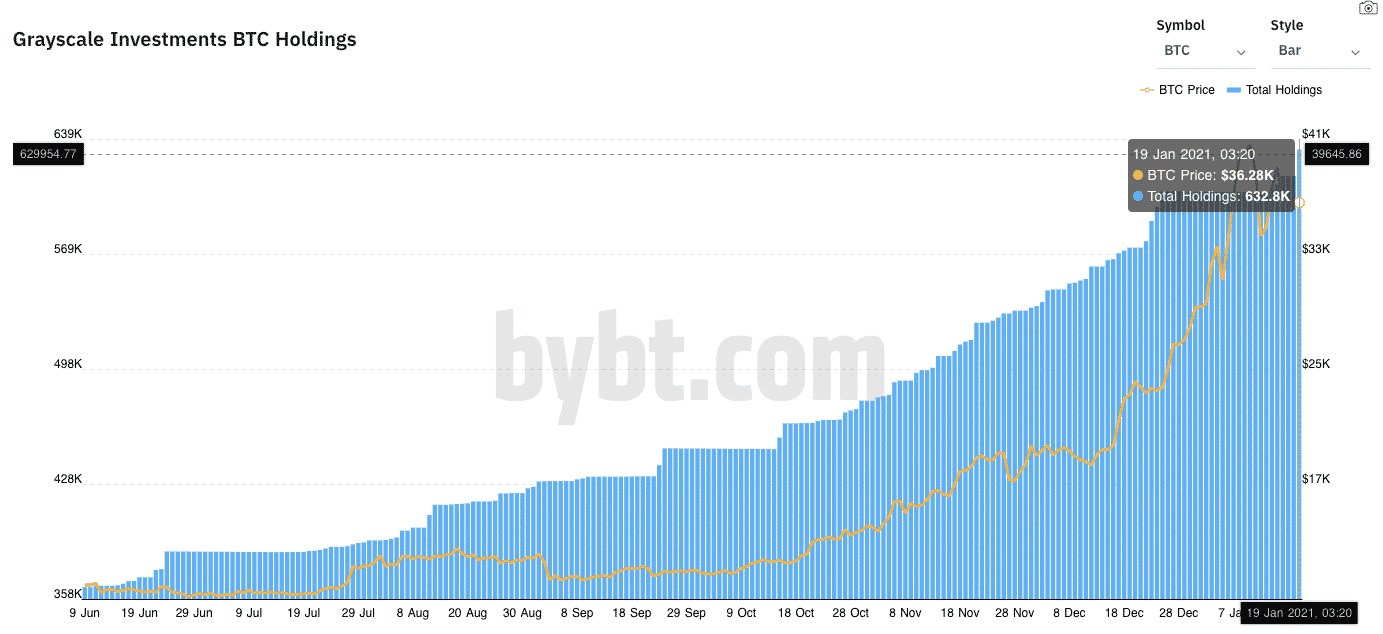

Institutional Buying, Grayscale Bitcoin Trust (GBTC) Buys Another 16,000 BTC Worth $590 Million

Amid the recent price volatility in Bitcoin (BTC), investors might be waiting on the sidelines for further correction. However, we might be reaching $40,000 levels once again sooner than expected. As per the data on Bybt.com, the Grayscale Bitcoin Trust (GBTC) has purchased another 16,000 Bitcoin in a single day taking its total BTC holdings above 632,000.

In the last 24-hours, Grayscale has poured another ~$600 million in Bitcoin purchases while gobbling more than 18 times the daily Bitcoin mined. Last week only, GBTC purchased around 10,000 Bitcoins (BTC) triggering a fresh buying spree. In less than a week, GBTC has added over 25,000 Bitcoins to its kitty.

This massive purchase coming from Grayscale suggests that institutions are still active and waiting to swallow every dip in the BTC price. Interestingly, the recent Bitcoin purchase comes just a day after JPMorgan said that inflows in the Grayscale Bitcoin Trust are essential for Bitcoin to surge and hold above $40,000 levels.

The digital asset manager Grayscale recently released its Q4 2020 report wherein reported net inflows of a massive $3.3 billion. Also, last week Grayscale CEO Michael Sonnenshein noted that his company raised a whopping $700 million in funds, in a single day.

1/15/2021 was also our largest single asset raise day, ever.

— Michael Sonnenshein (@Sonnenshein) January 16, 2021

Fresh Entry Opportunities In Bitcoin

While if you are wondering whether it’s the right time to make an entry in BTC, here’s what you need to know. On-chain data provider Santiment measures the overall daily ROI across all networks by calculating Bitcoin’s network realized profit/loss (NPL).

Santiment notes that major spikes in Bitcoin’s NPL suggest holders are selling, however, on the contrary, the strong dips suggest that investors are realizing losses amid the panic sell-offs. The on-chain data provider further adds:

“Historically, Bitcoin’s NPL has often surged during price rallies, pointing to regular profit taking and a healthy amount of investor fear about the coin’s short-term potential. Bitcoin’s price corrections, on the other hand, have sometimes coincided.

With a pronounced flattening of its Network Realized Profit/Loss, which suggests less profit taking on average and growing confidence by most BTC speculators. We’ve seen this pattern occur several times throughout the last year, including Bitcoin’s February and September.

As Bitcoin (BTC) continues to consolidate at $36,500 at press tie, we can reportedly see some fresh buying action in some time.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs