Institutional Investors Sell Bitcoin, Ethereum Worth $690M, Buys XRP

Highlights

- Institutional investors saw Solana (SOL) and XRP as better alternatives to Bitcoin and Ethereum amid market crash.

- Crypto asset investment products recorded $584 million outflow in a week, with Bitcoin seeing a $630 million in outflows.

- Solana, XRP, Litecoin and Polygon recorded buying activity.

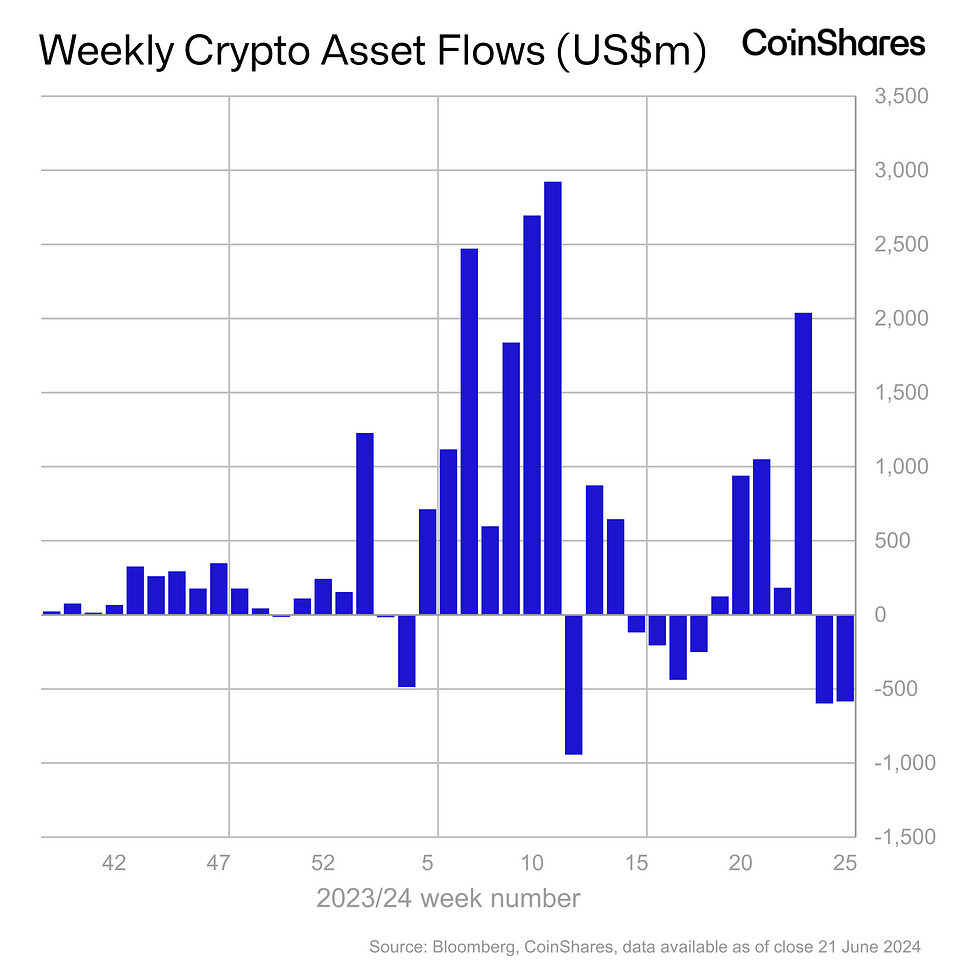

At a time when institutional investors are bearish on Bitcoin (BTC) and Ethereum (ETH), altcoins such as Solana (SOL) and XRP are seen as better alternatives. CoinShares claims further outflows from digital assets funds globally indicate a “true correction” is underway. Digital asset investment products have recorded $1.2 billion in outflows in two weeks.

Hedge funds are expected to exit Bitcoin and remain short on crypto stocks such as MicroStrategy, which could risk further selloff in Bitcoin.

Crypto Assets Saw Second Consecutive Week Of Selloff

The $1.2 billion outflow from digital asset investment globally reflects pessimism amongst institutional investors for interest rate cuts by the US FED this year. Digital asset investment products recorded $584 million outflow in a week, according to a CoinShares report on June 24.

James Butterfill, head of research at CoinShares, said “Bitcoin was the primary focus, seeing US$630m in outflows, but recent negative sentiment has not seen investors add to short positions. Multi-asset products saw US$98m inflows, suggest investors seen the weakness in the altcoin market as a buying opportunity.”

The selloff mostly came from investors in the United States and Canada, accounting for $475 million and $109 million, respectively. They are followed by Germany, Hong Kong, and Sweden. Interestingly, Switzerland and Brazil defied the selloff and saw inflows of $39 million and $48.5 million, respectively.

Also Read: Crypto Market Crash — Here’s Why Bitcoin, Ethereum, XRP, SHIB Are Falling Today

Solana and XRP Recorded Buying

Altcoins such as Solana, XRP, Litecoin and Polygon saw inflows as Bitcoin, Ethereum and Cardano remained under selling pressure. Bitcoin price fell under $59k, a recording a dip of 5% in the past 24 hours.

Solana recorded $2.7 million in buying by investors in a week. SOL price currently trades at $137.36, up 9% today after buying from the recent dip witnessed by altcoins. The 24-hour low and high are $125.90 and $136.73, respectively.

Meanwhile, XRP saw $0.7 million in investments in a week. XRP price jumped 0.34% in the past 24 hours, with the price currently trading at $0.475. The 24-hour low and high are $0.469 and $0.482, respectively. Furthermore, the trading volume has increased by 5% in the last 24 hours.

Also Read: Political Memecoins Might Be Biggest Winner In Trump Vs Biden Debate

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

Buy $GGs

Buy $GGs